Thukten Zangpo

Goods and services have become costlier by 12.78 percent since the pay revision of civil servants in July 2019.

This means consumers today pay 12.8 percent more on the purchase of the same basket of goods and services.

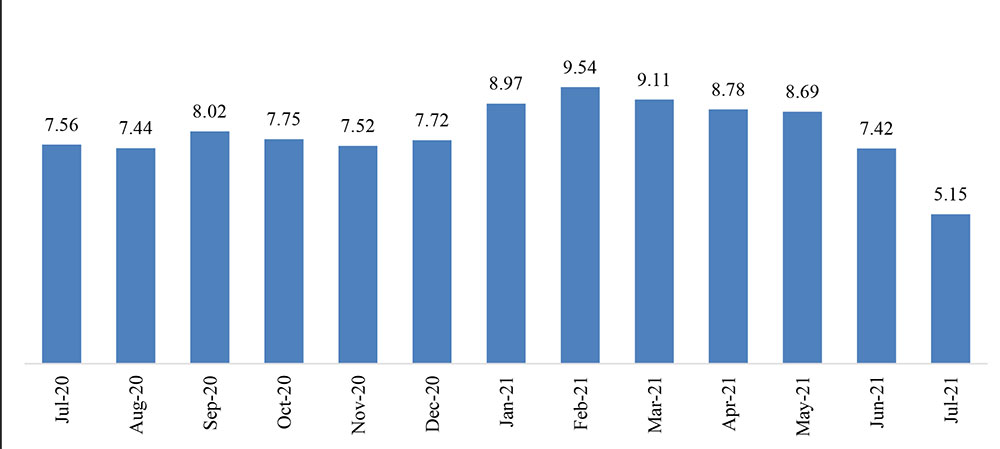

The average inflation rate measured in Consumer Price Index (CPI) was 8.24 percent as of July this year, 5.63 percent in 2020 and 2.73 percent in 2019, according to the National Statistics Bureau (NSB).

CPI is a measure of average price changes in the basket of goods and services purchased by households over time.

NSB’s Statistical Officer Penjor Gyeltshen said, “Increase in the prices of goods and services was primarily driven by Covid-19 situation and the restrictions that lead to a shortage of supply of goods and services.”

The Pay Revision Act 2019 entitled civil servants 2 percent lump sum annual increment as an adjustment to the rising cost of goods and services.

With two times annual increment for civil servants at the rate of four percent, the costs of goods and services increased by 8.78 percent.

On the other hand, most of the private employees did not get their salary increment at that time. About 50,000 people lost their jobs due to the pandemic.

The goods and services in July this year were 5.14 percent more expensive compared to July last year, according to NSB.

Similarly, the price of goods and services rose 7.56 percent in July last year compared to July 2019.

The rise in the price of food and non-alcoholic beverages rose by 3.52 percent was the main contributor with a 20.2 percent increase in the price of oils and fats and cereals and bread by 6.77 percent in July this year.

The alcohol and beverages became costlier by 16.96 percent due to an increase in betel nuts by 26.74 percent.

According to NSB, the price of rice has become costlier by 5 percent, meat by 6.9 percent, fish by 3 percent, cheese, and eggs by 3.12 percent. Additionally, fruits become 6 percent costlier, however, the vegetable price dropped by 6 percent and alcohol and beverages by 8.05 percent.

Penjor Gyeltshen said the change in the price of rice would have more impact as it is consumed daily.

Additionally, he said the price of the vegetables fluctuates and the price goes up in the month of April and it gradually decreases and goes up again during the off-season.

The clothing and footwear became costlier by 9.86 percent while housing, electricity and gas (LPG) prices increased by 6.49 percent.

Transport (cost of vehicles, fuel prices, and maintenance) increased by 7.62 percent mainly due to a 33 percent rise in fuel prices.

Penjor Gyeltshen said the price of the fuel was low last year in July at Nu 54.71 per litre because of the low demand and travel restrictions. The current price is Nu 74.65. However, the cost of communications dropped by 10.92 percent in the past year, due to a reduction in call and data charges.

“The price of goods and services will drop if the situation becomes normal,” said Penjor Gyeltshen.

An importer said that the rise in the price of goods was due to price increases at factories, which could not operate at their full capacity.

He attributed the price hike to the increase in transportation and labour costs at the mini-dry port in Phuentsholing. “If the labour costs come down and we can import regularly, the costs of the goods would come down by 2 percent to 3 percent.”

According to the Bhutan Living Standard Survey 2017, the average monthly household expenditure is Nu 33, 542 (Nu 45, 508 in the urban areas, and Nu 26, 937 in the rural areas).

The average monthly per capita household expenditure is Nu 7,939 and the monthly per capita household expenditure of Nu 11, 452 in the urban areas is 85 percent higher than that in rural areas (Nu 6, 174).

More than 65 percent of households live in rental units in urban areas where the majority of available rental housing costs more than 30 percent of household income, according to National Housing Policy 2020.

Edited by Tshering Palden