MB Subba

The Royal Monetary Authority (RMA) has recorded a significant increase in mobile payments during the second lockdown as compared to the records of the first lockdown, indicating an increasing preference for digital payments.

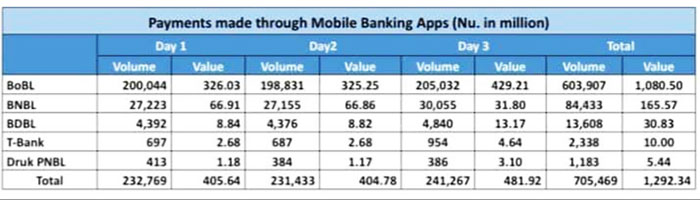

RMA officials said that figures are still being compiled. But during the first three days of lockdown (December 20 to 22), mobile payments saw a substantial surge with 783,617 transactions amounting to Nu 1.3715 billion (B), according to a report compiled by the central bank.

The number of transactions increased by 175,613 in the first three days of the ongoing lockdown in comparison with the first three days of the first lockdown. Correspondingly, the value of the transactions increased by Nu 910.55 million (M).

The use of mobile wallets also increased by of 13,775 transactions amounting to Nu 4.09M.

Director of the Department of Payment and Settlement Systems, Tshering Wangmo, said the latest figures were being compiled. She also said the cybersecurity is given importance and that no digital fraud was reported during the lockdown.

Similarly, Bhutan QR code and the payment gateway recorded 61,033 transactions amounting to Nu 73.29M and 3,340 transactions amounting to Nu 1.8M, respectively, in the first three days of the lockdown.

The growth in digital payments space is expected to further accelerate both in terms of transaction volume and value, the RMA report states. This, according to the central bank, suggests that more people can be brought into the online payment ecosystem with proper infrastructure and awareness.

Digital payments avoid physical cash and ATM withdrawals which has a higher risk of Covid-19 transmission. Since the first lockdown, the numbers of customers switching to mobile banking payments and mobile wallets have drastically increased, according to the RMA.

Overall, a total of 821,816 domestic transactions amounting to more than Nu 2.263B were recorded through various channels of digital payment, including mobile payments, during the first three days of the second lockdown. About 61 percent (Nu 1.3715B) of the overall total value of digital transactions accounted for mobile payments.

According to the RMA, a total of 62,600 new mobile banking subscribers, including 14,923 new e-wallet subscribers, have been registered by the banks and telecoms since the start of the first lockdown.

“The growth in the mobile and internet payments are expected to accelerate in the current situation, as consumers are expected to prefer to make payments of essential services through this medium to adhere to social distancing norms,” the RMA report states.

It adds that the current uncertainty may have triggered the need to hoard cash to manage unforeseen circumstances and hence, huge withdrawal from ATMs on the first day of lockdown. “However, going forward, the use of ATMs and PoS (point of sale) are expected to decline owing to the risks of transmission of the virus through the exchange of currency notes and also due to limited access to physical ATMs and PoS terminals.”

To ensure an uninterrupted flow of essential financial services during the second lockdown, the RMA has activated the 24/7 Command Call Centre (CMCC), for addressing public inquiries in terms of uninterrupted provision of financial services delivery to the general public. Accordingly, the Financial Service Providers (FSPs) were notified to activate their support centres and also to ensure that their digital financial services remain accessible and available round-the-clock during lockdown.