Tshering Palden

Bhutan Development Bank Ltd (BDBL) having incurred more than half a billion ngultrums in losses between 2014 and 2018 is faced with sustainability issues, a Royal Audit Authority’s performance report stated.

BDBL lost Nu 580.22 million (M) during the audit period.

The audit report released this week shows that BDBL sustained huge overall losses in 2016 and 2017. In 2017 the loss figures were substantial amounting to Nu 880M. The management told auditors it was due to migration from Ascend Banking system to Finacle core banking system in May 2017. The loss was incurred due to deterioration of non-performing loans (NPL) and the requirement of huge provision for impairment of loans and advances, the audit report stated.

There were issues such as erroneous ageing of loans, inability to capture interest accrual, repayment and prepayments in the new system. Further, analysis of the branch-wise profit and loss statements revealed that BDBL’s operations were not much a profitable venture in some of the branches.

Between 2014 and 2018, BDBL sustained overall losses in 13 branches, the head office in Thimphu sustained the highest loss of Nu 1.468 billion.

Some of the reasons cited were lack of clientele population, state of the local economy, increase in the cost of operation and funds.

Another issue was despite clear procedures for writing off loans the data of some clients as old as more than three years are still reflected in the system as active. According to BDBL management, these loan clients were untraceable.

It was revealed 99 loan accounts with a total outstanding of Nu 14.09M were outstanding for an average of 6,487 days. It is apparently because of inadequate follow-up mechanisms in place and non-implementation of the provisions of the BDBL write off manual.

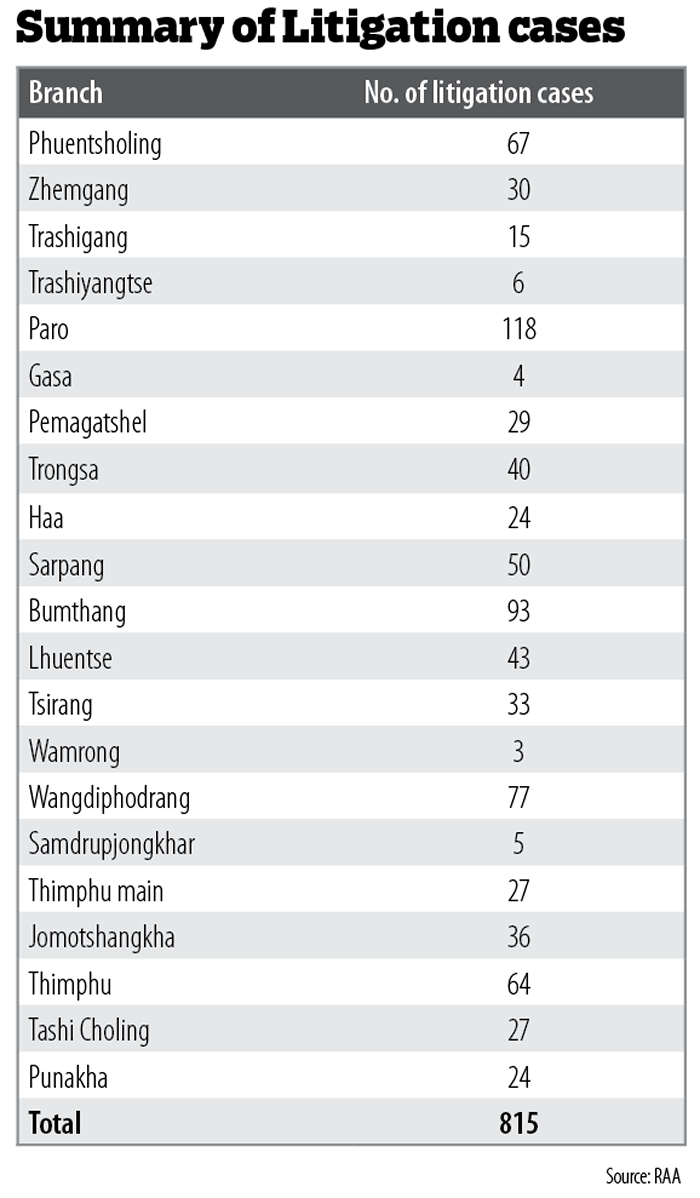

The bank also has many litigation cases as a result of high NPL. As of December 2018, there were 815 cases under litigation spread across 21 branch offices. “While the primary purpose of microcredit is to meet the financial needs of the clients and promote economic activities, it often does not result in intended outcomes,” the auditors stated.

Auditors said that these issues cannot be directly linked to any particular cause but most of them could be traced to non-monitoring of the projects based on its initial need for financing. “Generally, there was a lack of evidence of monitoring of projects or they are not on record.”

The report also stated: “The scenario is a cause for concern since litigations will further discourage people from availing credit facilities. Instead of facilitating growth and development, the clients will be pushed further into poverty and impoverishment.”

The high instance of NPL and litigations culminated into the seizure of land and properties mortgaged. BDBL auctioned 248.97 acres of land in 16 dzongkhags including five houses last year.

“Through the loan default cases, redistribution of land is taking place. The modus operandi of redistribution defeats the very purpose of granting land by various schemes to the landless,” the auditors reported. The land and property seizure on account of loan has a disruptive impact on the socio-economic prospects of the people, the RAA report stated.

Auditors also found bank officials applied old interest rates which resulted in undue implication on the clients. Review of loan data revealed that the BDBL imposed rates of interest other than the revised rate for loans sanctioned after the effective date. The revised interest rate for Agriculture and Livestock loans is 10.25 percent if the tenure is below five years and 10.5 percent if the tenure is between 5 to 10 years, for loans sanctioned after the effective date of April 4, 2017.

The auditors found various instances of imposing rate of interest other than the revised rate. There were instances of application of rates lower than the revised rate and higher than the revised rate. Altogether, there were 204 loans applied rates other than the revised rate in agriculture and livestock loan category. “This issue is possible in other loan categories as well.” Auditors said that it was due to lack of due diligence when entering the data into the system.

The same issue was raised by RAA in the report on the IT audit of Core Banking System (CBS) of BDBL in 2019.

“Due to this lapse, there was an undue burden on the clients as a result of the application of higher interest rates and similarly, there is loss to the bank by application of lower interest rates.” Auditors warned if this was not corrected in time, it could further lead to avoidable loss to the bank and the clients.

As of December 2018, it was noted that about 21,125 clients were still repaying old rates of interest.

BDBL management responded saying that it is the obligation of the clients to update their loans once the information is disseminated. “However, BDBL’s clients are rural people with less access to media communication platforms and mostly illiterate,” the auditors stated.