In the wake of the increasing cost of building hydropower projects and huge deviation from initial estimation, the power tariff of Bhutanese electricity is bound to increase.

This will impact both domestic users and importers on the Indian side.

Power tariff is determined on cost plus modality, which means all costs incurred during the construction of hydropower including its financing costs, operation and maintenance charges, and depreciation are taken into account. In addition, a return on equity is provisioned.

According to a journal published by the Center for Bhutan Studies titled ‘Export price of electricity in Bhutan,’ taking the case of Mangdechhu Project, the journal pointed out that electricity should be priced at a competitive rate in order to secure a comparative advantage and for the economy to gain.

The study also stated that local industries, especially power-intensive industries, who are already paying higher than the export tariff, may barely break even while a few may even run at a loss if domestic price runs high.

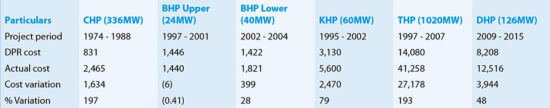

Cost escalation of hydropower is a cause of concern, among policymakers in Bhutan. The first mega hydropower plant, Chhukha (336 MW) suffered a cost escalation of 197 percent, an increase from Nu 831 million (M) in 1974 to about Nu 2.5 billion (B) in 1988. The 1,020MW Tala has also experienced a cost escalation of 193 percent, an increase of almost Nu 27 billion. However, the tariff for these two plants is still the lowest in the region giving Bhutanese electricity a competitive edge in the Indian market.

On the other hand, the two projects of Punatshangchhu I and II have already crossed 100 percent cost overrun as of 2017. The Bhutan Electricity Authority (BEA), in its review of cost overruns of hydropower projects, explained that cost overruns and delays are largely on account of inflation is not considered in the initial cost estimates to get the project approved, geological surprises, design changes, increase in installed capacity and construction of additional infrastructures such as roads, hospitals and other amenities which is, in turn, accounted into the tariff.

It is estimated that the final export tariff for Punatshangchhu II will cross Nu 6 a unit of electricity in consideration of the existing cost of construction. It is also projected that the total cost will increase by at least 13M for each day of delay. Consequently, the tariff is likely to increase further.

Comparing that to the power tariff in the Indian market, it is relatively higher. Power tariff in India is falling due to the addition of solar and wind renewables, but the baseload demand has to be continued to be met by conventional forms of energy like coal.

According to the recent energy trading data available from Power Trading Corporation of India, renewables like wind and solar are the cheapest forms of power available priced at INR 3 per unit on average. Even thermal plants such as Jindal India Thermal Power Limited sell at INR 4.2 a unit, which is only slightly higher than Mangdechhu. However, power from hydro projects in Himachal is priced between INR 3 to 6 a unit.

The case in point is that as the generation cost from the Bhutanese projects increase, it will become unviable for both India and Bhutan to invest in bigger projects. Thus, other modalities of building hydropower projects must be explored to bring down the cost. As such the Joint Venture and Public Private Partnership models are being pursued and the question of cost escalation remains to be answered.

While the Domestic Tariff Determination Policy states that the domestic load has to be met from the plants with the lowest generation cost, domestic demand has to be completed from plants with higher generation costs if the domestic load increases as projected. This can potentially impact the domestic tariff as well. For instance, in the last tariff revision, three percent of power from Mangdechu was provisioned for domestic use.

Another impact of cost escalation is on the country’s debt. Hydropower debt constituted 73 percent of the total external debt at Nu 162.48B as of December 2021.

Although the Bhutanese government has been stressing that hydropower debts are self-liquidating, the Royal Audit Authority pointed out various risks associated with repayment of the loans due to susceptibility to time and cost overruns. This results in revenue loss and a mounting debt burden. There are also hydrological risks associated with hydropower projects.

It was also noted that the terms of financing from the Indian government changed over time with a reduction in grants and an increase in the loan component.

Contributed by

Tshering Dorji

The story is being covered by the Institute of Happiness for a research conducted on the effects of cross-border energy trade.