Every pandemic is an outcome of its time. Simply look at how technology has evolved over time. So, will the pathogens and diseases. But advancement in technology has better equipped men to deal with new diseases. Malaria, Tuberculosis and plague, for instance had wiped out close to a quarter of human race when it first emerged. These diseases are not life threatening anymore. Pandemics like Covid-19 are also undesired outcomes of globalization, which is bound to surface.

The unlimited speed and multifarious network of global connectivity has enriched the global economy. This, however, has also made the world more vulnerable to pandemics to spread at an exponential rate. It remains to be seen how the world combats this invisible epidemic in form of a pathogen.

This is why a bit of global perspective is essential to set a context.

So, the disease is going to cripple the global economy. We have two simultaneous battles to fight-eliminating the disease and preventing a devastating economic recession. With the US anticipating a major recession since 9/11 attack, most European economy at standstill and China perched at epicenter of the pandemic, it is apparent that global economy is headed downward. The race has already begun. The faster the world contains the disease, the softer will be its impact.

The Asian Development Bank has estimated that developing Asia (excluding China) would experience a loss of $22 billion or 0.24% of its GDP under the moderate-case scenario (assuming that the pandemic would result in restrictions lasting up to three months).

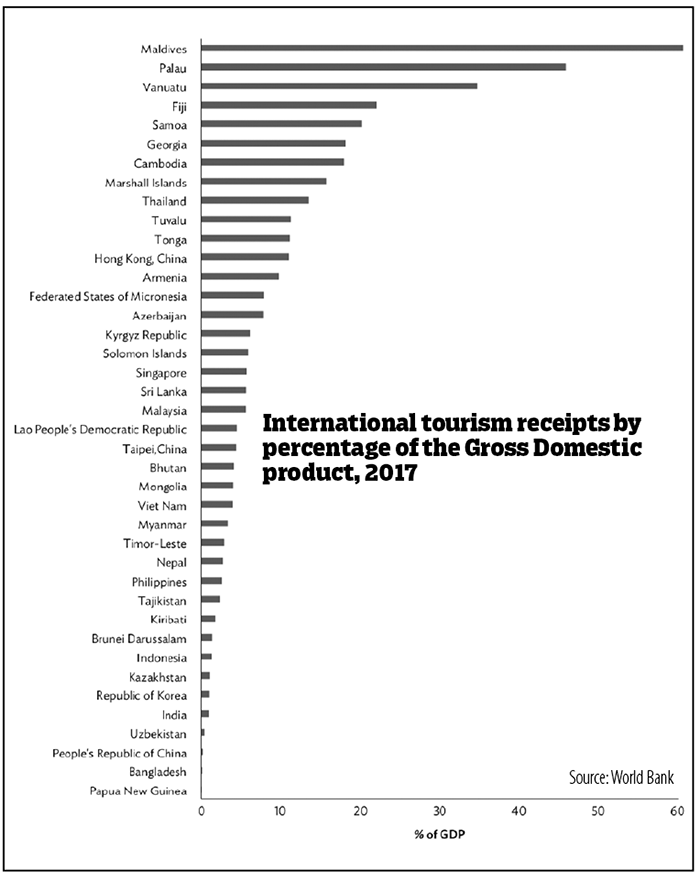

From a layman’s point, there is going to be a sharp decline in domestic consumption and investment across the globe as a result of restrictions on movement, hitting the tourism sector, which is the primary revenue source or economic stimulators in most Asian countries. Consequently, this will ripple down to supply-side disruptions, impacting trade and production linkages in other sectors.

The rest of developing Asia is expected to experience a loss of $22B or 0.24% of its GDP from tourism alone, under the moderate-case scenario.

Saudi Arabia and Russia are already engaged in oil price war after they refused to cut the supply to stabilize price in reciprocation to demand suppression in the aftermath of the Covid-19 outbreak, which led to closure of factories and declining movement of both surface and air transport. In China alone, automobile sales have plunged 80% and passenger traffic is down 85%. This trend will repeat in other economies under lockdown.

The worst impact could be the loss of job and wages, looming from the financial market. Some economies have initiated rate cuts and deferment of mortgage payments but it is all contingent on the how fast can the world contain the virus and how long would it take.

Most visibly, governments across the globe will divert their budget and (or) external funding into the health sector at the cost of production and job creation. This is the need of the hour, albeit the impact aftermath could possibly be on foreign aid flow from developed world and international organizations to the developing world.

What about Bhutan?

Bhutan’s economy is modest both in terms of size and substance. Yet it is complicated enough to replicate the global practices because of its uniqueness.

Hydropower is the main source of government revenue and India, the single largest market. While the Covid-19 is not likely to hit the power generation, it should be concerned about the declining demand for energy. For instance, plummeting demand for fuel has sparked a price war between the OPEC countries.

The export market for Bhutan, however remains cushioned by the bilateral power purchase agreement between Bhutan and GoI, which guarantees that India will buy all the surplus power at a pre-fixed tariff.

Domestic market will be hit in the worst-case-scenario or in case the factories had to be shut. Hotels and institutions, classified as LV bulk consumers will be paying trivial utility bills with inoccupancy extending indefinitely. This will directly cost the government coffer as domestic sales of power plunge.

The recently commissioned Mangdechhu is estimated to bring in an additional revenue of Nu 7B annually. However, bulk of the revenue has already been appropriated for pay hike of public servants, leaving behind a slender fiscal space to re-appropriate the national budget for emergency situation such as this pandemic. The ministry of Finance has already estimated a fiscal deficit of Nu 28 in the 12th Plan.

The government is also planning to divert the planned budget to fight Covid-19 and in doing so, it may have to pull out money from capital works because current expenditure comprises of salaries and allowances. If capital works are squeezed, construction sector, which already heave an NPL of Nu 4B and victimized by restriction on labor import, may be subjected to a big blow. The spillover will hit the financial market and slow down the construction of hydropower projects.

Tourism, the country’s largest source for convertible currency is currently at standstill. According to tourism monitor report, Bhutan received 274,097 visitors in 2018, which is an increase of 7.61% over 2017. Of the total arrivals, there were 71,807 international and 202,290 regional arrivals. Total tourism receipt from the international leisure segment was USD 85.41M.

A total of 271 TCB certified tourist accommodation facilities in the country comprising of 136 star hotels (3, 4- and 5-star accommodation) and 135 Village Home Stays (VHS) remains affected, going by the 2018 figures. There are over 2,300 tour operators and over 1,500 guides.

The year would have proven lucrative for tourism after the Lonely Planet ranked Bhutan as top destination early this year, had Covid-19 not turned the tables.

The ADB has estimated that Bhutan’s tourism revenue could decline by USD 0.7M, if the travel restrictions prolong up to six months. This is not considering the indirect benefits. “Tourism arrivals and receipts in many developing Asian economies are expected to decline sharply, as a result of numerous travel bans as well as precautionary behaviour,” according to the ADB’s study on economic impact due to Covid-19.

These demand shocks can spill over to other sectors and economies via trade and production linkages. For instance, travel restriction has already hit two airlines, hotels and restaurants. The ripple effect will be on the grocery stores, retailers, handicrafts, farmers and other service providers like transport industry. In all these chain reactions, loss of jobs and wages should be the biggest concern because most of these establishments are private firms associated with job insecurity.

“There have been substantial production disruptions as a result of forced business closures and the inability of workers to get to work, as well as disruptions to trade and business as a result of border closures, travel bans, and other restrictions on the movement of goods, people, and capital,” according to the ADB.

The NPL in service sector, mainly construction and tourism has ballooned to 30 percent of the portfolio last year and it could prove troublesome for the banks if the sector is further exposed to the Covid-19 shocks. Hoteliers, alone feed the financial institutions Nu 329m in monthly EMI. Stretched over a three-month period, it could cross Nu 1B and cross Nu 2B in worst-case scenario.

For Bhutan, the disturbing factor is credit and import driven consumption, which has already skewed current account balance. Notwithstanding the fact the India is the country’s import destination for more than 80 percent of goods and that third country imports also land on Indian port, Bhutan could face serious blockade if Covid-19 explodes in India forcing the Indian government to take lockdown measures. This will be a testing time for Bhutan-India friendship.

While there are views on deferment of loan repayments or rate cuts, the Bhutanese banking system is not equipped with sophisticated products to cushion the impact. A rate cut on loans may accompany with rate cuts on deposits, particularly the corporate deposits which forms a major share of funds for the banks. Any laxity in payment deferrals and rate cuts could also result in misappropriation, as the hospitality sector is already a beneficiary of host of other fiscal incentives including tax holiday. It is imperative for the authorities to study the balance sheets of private establishments before announcing a rate cut or defer repayment.

FDI is likely to take back seat for quite some time because the financial contagion spreading across the globe transpired by market loss, movements in exchange rates, stock prices, sovereign spreads, and capital flows will take some time to recover.

As the global economy comes at standstill, Bhutanese working abroad could either lose their jobs or return home. Consequently, inward remittance could also plunge.

In pressing times, people can find solace in the country’s farsighted Constitution, which mentions that the country must maintain a minimum foreign currency reserve enough to meet 12 months of essential imports.

Opportunities

While short-term fiscal and monetary tools are available to confront immediate impacts, focus should be on long-term measures because there is an opportunity to transform the economy from the pandemic.

Bhutan achieved egg self-sufficiency after bird flu scare. The ban on chilies resulted in locally grown jitshi ema. In times of corona, can our farmers and CSI’s spot a big opportunity?

AWP has taken the lead to manufacture sanitisers and it could well capture the Indian market along the border if production scales beyond the domestic demand. Big business names across the globe are already doing their risk assessment and identifying new opportunities to explore.

For Bhutan, it would be appropriate to kick start two flagships that have the potential to transform the economy while tourism is put to rest- the CSI flagship and digital Drukyul.

CSIs, because there is a pressing need to boost local production, particularly the agri-business. The better we substitute imports with locally sourced products, the more immune we become to global food shortage should the pandemic persist longer than expected. Probably, there is also an opportunity for the government to lobby for shift in dietary habits.

Hoarding will be inevitable should the situation worsen, but for a dependent economy like Bhutan, traders and suppliers across border stand to gain the most. The government should not only monitor prices of goods in its territory but also use its diplomatic channel to calm unsubstantiated inflation across the border.

We must give entrepreneurs a chance to find solutions that would sustain post pandemic and possibly transform the economy.

Most of the solutions in times of crisis and worst-case scenario rest with Digital Drukyul. It will ensure undisrupted public service delivery, smooth functioning of the government agencies and business firms.

At the same time, it is also wise to capitalize on what is already there. Schools have started to use Google classroom and other social media channels. Banking transactions are made easier with apps but more could be done with fintech tools, which are already there in the market. Bhutan telecom has made it easier to avail services via online forms. There is already an app that delivers food from various restaurants in the capital. LPG delivery is also made possible with a phone call. Bus tickets and taxis can be booked via mobile apps. G2C is already supervising host of public services.

These are examples of services that are possible to avail through an online platform. Lessons from the advanced economy elucidate that these kinds of services proved most beneficial under lockdown.

Covid-19 could permanently shift working patterns as companies across the globe are forced to embrace remote working. The IMF has also sent its employees to work from home, for instance.

Startups such as Slack and Zoom and established giants including Google and Microsoft are offering their tools for free, in the hope that people who start using them in a crisis may carry on once normality returns.

Studies also show that this kind of distributed work evolution has increased the company’s efficiency while providing flexi time to their employees.

Meanwhile, hand washing and sanitization drive has never been this effective. Even the Global handwashing day, observed across the country didn’t bring much impact. Banks, offices, shops and restaurants among others kept sanitizing their facilities and sanitisers for public use. This is a good initiative but it should not end with the pandemic. We have just found a reason to lead a hygienic life amid the pandemic.

Contributed by

Tshering Dorji

He is a former business and economic journalist with Kuensel