Thukten Zangpo

The Royal Monetary Authority (RMA) has directed the National Cottage and Small Industries Development Bank (NCSIDB) to temporarily freeze loans from May 12, this year.

CSI bank’s non-performing loans reached 5.23 percent of the total loans last year, which is higher than the RMA’s required NPL of 5 percent.

It includes loans availed by the clients from its start in February 2020.

In 2020, about nine percent of the clients did not pay the loans.

A loan becomes NPL when the borrower does not make interest payments or principal within 90 days.

According to the RMA report 2020-21, as of June 2021, the CSI bank provided a total loan amounting to Nu 1.34B, of which loans to the agriculture sector accounted for 84.1 percent.

The CSI bank’s overall NPL ratio accounted for 12.6 percent, as of June 2021 as compared to 40 percent in June 2020.

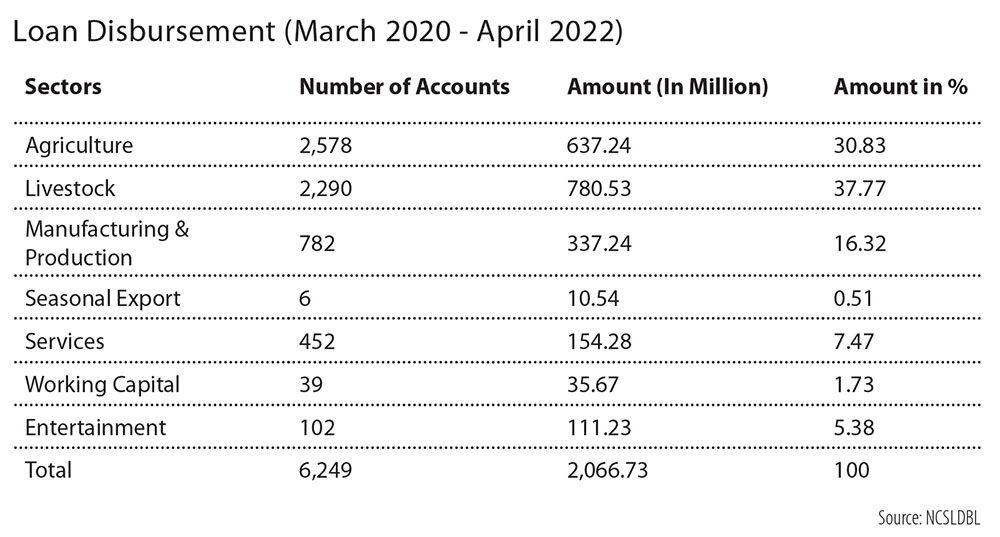

As of April, this year, CSI bank has disbursed loans amounting to Nu 2.06 billion to 6,249 clients.

The majority of the loans were in agriculture and livestock sectors, which is 68.6 percent of the total loans amounting to about Nu 1.42B.

The highest NPL was recorded in the agriculture sector.

An official said that the loans could be lifted once there is a strong NPL regulation and modality to work. He added that the clients are faced with challenges in availing labour, capital, and procuring raw materials.

Meanwhile, observers say that it is not good to freeze the loans from CSI bank when the economy is recovering.

An official also said that when the CSI bank took over the then Rural Enterprise Development Corporation Limited (REDCL), NPL was at an alarming 58 percent under the revolving fund (RF-I) and 18 percent under the revolving fund (RF-II).

This means, of the total outstanding loan, more than half of the loan availed from REDCL defaulted.

An official said that when the REDCL loans become good, it is included in CSI bank’s loan portfolio. “Bad loans from REDCL was not taken when the CSI bank was started.”

The government injected Nu 5B as an Economic Stimulus Plan from foreign aid when the 11th Five Year Plan was started in 2013.

From the total of Nu 5B, Nu 2.1B was allocated as subordinate debt to the banks and the government still receives interest from the banks.

Remaining Nu 1.9B was allocated to the then Business Opportunity and Information Centre (BOiC) with the introduction of the revolving fund (RF-I) and revolving fund (RF-II).

However, BOiC was discontinued due to legality issues. The government then set up REDCL to carry out micro-lending activities for non-formal economic activities in the rural areas with Nu 400 million (M) as RF-II.

Meanwhile, Nu 1.5B under RF-I was injected into the Bhutan Development Bank Limited to finance cottage and small industries through a special window. The REDCL was upgraded to NCSIDB as a fully-fledged non-deposit-taking bank in February 2020.