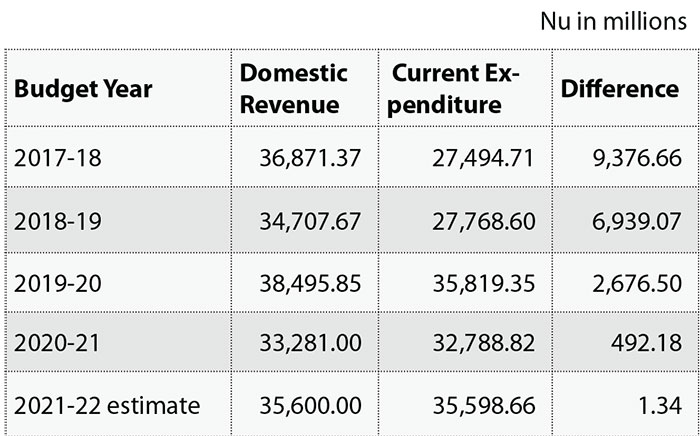

In the past five years, the current expenditure has been increasing faster than the domestic revenue.

The projected domestic revenue and recurrent expenditure in the fiscal year 2021-22 are Nu 35.6 billion (B) and 35.598B, respectively. This means that only Nu 1.3 million (M) will be available from the government’s revenue for disposal in the capital expenditure.

The situation will not only widen the fiscal deficit but also increase the debt burden on the country, as almost all the capital expenditure must be financed through borrowings and grants.

The surplus between the capital and recurrent expenditures in the fiscal year 2017-18 was Nu 9.376B, which means that the difference has narrowed drastically.

Commenting on the annual budget 2021-22, the National Council’s economic affairs committee (EAC) yesterday stated that the constitutional requirement of meeting all the recurrent expenditures from the domestic revenue could be breached if the trend continued.

“As current expenditures will continue to rise to keep up with the rising cost of wages, salaries, maintenance and inflation among other factors, it is important to rationalise expenditure and raise domestic revenues,” the EAC’s deputy chairperson, Ugyen Tshering, said.

Amid the slow increase in revenue, the fiscal deficit, which signifies the gap between the government’s total revenue and expenditure, has been increasing significantly over the years.

The deficit is estimated at Nu 17.153B in the fiscal year 2021-22.

The EAC also stated that the fiscal deficit for the new fiscal year had exceeded the projection made by the government in the current fiscal year’s budget, which was Nu 10.082B. The fiscal deficit has consistently exceeded the fiscal deficit threshold and shows a rising trend.

The government has set a fiscal policy target to contain fiscal deficit below 3-5 percent of GDP. But the deficit has increased from 1.96 percent of GDP in 2018-19 to 8.59 percent (estimated) of GDP in 2021-22.

The EAC deputy chairperson said that the situation was understandable as the Covid-19 had invariably impacted the overall economic performance and commended the government for taking various measures to contain expenditures. But the committee’s report added that the pandemic alone was not responsible for the reduction in revenues.

It highlighted that the government’s decision to reduce the corporate income tax (CIT) for private companies from 30 to 25 percent in 2020, increase the personal income tax (PIT) exemption ceiling and fiscal incentives among other measures.

The fiscal deficit situation has been aggravated by non-realisation of revenue sources due to delays in major sources of revenues such as Punatsangchhu I.

The committee reiterated that the failure to realise the full revenue potential of Mangdechhu Hydro Project had led to losses amounting to about Nu 1.37B from 2019 to the end of 2020. “With the restoration unlikely to be completed before the monsoon of 2021, the project is expected to accrue additional revenue loss of Nu 1.85B in 2021.”

The committee also expressed concerns about the repeated delays and cost escalation of Punatsangchhu I, the cost of which increased from Nu 35B to Nu 94B.

The committee stated that continued dependence on grants would undermine the country’s goal of economic self-reliance and reliance on loans would in debt the future generations. “The best option is to contain expenditure and raise domestic revenues.”

The EAC also expressed its concerns about the steady increase in total public debt. The government has been saying that the hydropower debts (70 percent of the total public debts) are self-liquidating. But the issue is that the non-hydro debt has increased from 30 percent of GDP in 2019 to 32.7 percent of GDP in 2021, it highlighted.

The government’s debt management policy states that the non-hydro debt should be maintained within 35 percent of GDP. The non-hydro debt has not breached the policy.

The total public debt has increased from Nu 182B in 2019 to more than Nu 224.9B in 2021, which is 120.5 percent of the GDP.

The main risks arising from non-hydro external debt include the rising debt burden due to the steady depreciation of the Ngultrum against the US dollar.

Highlighting the EAC’s concerns, Ugyen Tshering said that the overall national goal of achieving economic self-reliance, which is a vital pillar to uphold national security and sovereignty, should be upheld.

Members supported the committee’s observations on the economy and the annual budget. The House will vote on the committee’s report today.

By MB Subba

Edited by Tashi Dema