Transactions go digital amid Covid-19 pandemic and digital drive

MB Subba

Digital payment transactions have seen a significant jump amid the Covid-19 pandemic, according to the Royal Monetary Authority’s (RMA) report on the Covid-19 impact on Payments in Bhutan.

The economy recorded 29.5 million (M) domestic retail payment transactions from January to June 2020 amounting to Nu 80.66 billion (B). The average number of recorded transactions increased to 4.9M per month as compared to 3.1M in 2019.

The share of digital payments in the total recorded domestic payment transactions rose to more than 85 percent in the first quarter of 2020 from 77.47 percent in 2019. Out of that, the monthly average growth in mobile payments increased from 5.18 percent in 2019 to 8.29 percent in 2020.

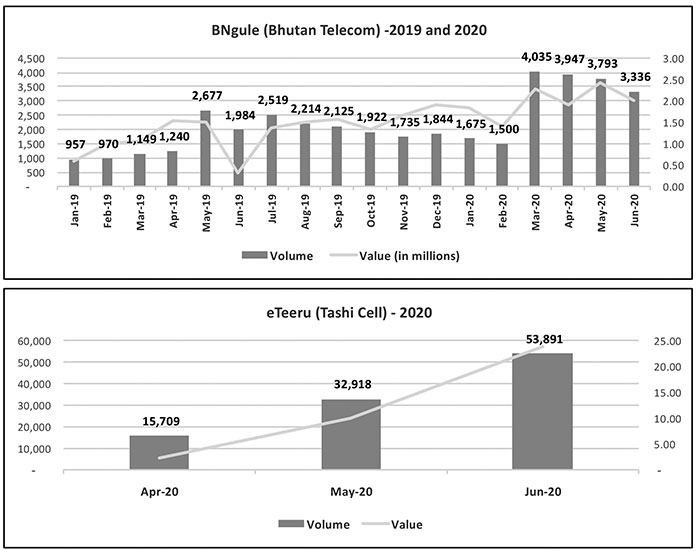

Similarly, mobile wallets saw an increase in the volume of transactions processed, especially with effect from March 2020, with the launch of eTeeru of Tashi InfoComm. The increase is also attributed to policy changes made by the central bank in April 2020 to allow merchant payment and enhance transaction limits.

However, the RMA states that it was not only the Covid-19 pandemic that encouraged more people to switch to the digital payment system.

The RMA’s director of Department of Payment and Settlement Systems, Tshering Wangmo, said that the increase in digital payments was also a result of the RMA and banks’ rigorous digital initiatives. She said digital payments have gained popularity and trust and that the central bank would further promote cashless payments.

The digital payment system, she said, would be more relevant and crucial if the country goes into the Covid-19 red-zone. “The recent launch of Bhutan Quick Response (QR) Code for payment is also expected to further benefit customers,” she said.

Launched on July 17, QR Code facilitates customers to make payments by scanning QR codes of different banks directly from their accounts without the need for POS (point of sale) terminals. However, there are complaints that transections are not smooth as expected. Money getting deducted but not getting credited is the main complain among users.

The RMA also reported that payments through the Global Interchange for Financial Transaction (GIFT), an electronic system that enables individuals and business entities to claim the payments online from the government, also increased significantly.

The GIFT has three payment components—BITS (deferred interbank fund transfer below Nu 1M), RTGS (real time large value fund transfer above Nu 1M) and BULK (real time retail payments with no amount ceilings).

The transaction volume through BITS increased significantly this year. As of June this year, the economy recorded a total of 8,925 transactions amounting to more than Nu 1,366M through BITS.

Through BULK, a total of 23,469 transactions valued at Nu 2.52B were processed as of June. The system is also used for bulk disbursement of funds such as salaries, loan and pension by government agencies, corporates and private institutions from one bank to another.

The Druk Gyalpo’s Relief Kidu is also being disbursed through BULK, according to the RMA.

As of June, a total of 2,215 transactions worth more than Nu 30.323B were recorded. The average number of such transactions per month increased to 176 this year as compared to 128 last year.

Through RTGS and cheques, transactions worth Nu 155.16B took place as of June 2020. Compared with pervious years, a majority of large value transactions were channeled digitally instead of using cheques.

Cash withdrawal from ATMs saw a drop in 2020 as more people chose digital transactions.

The withdrawals from ATMs saw a negative growth of 2.74 percent from an average growth of 12.55 percent. As of June, a total of 12.54 M transactions amounting to Nu 44.86B was made through ATMs.

The report includes data from January 2019 to June 2020 and broadly categorised payments into retail and large value payments and further based on payment instruments such as card, mobile and internet, cheques, and cash.