Thukten Zangpo

External debt servicing could cost Bhutan Nu 9.34 billion (B) in the fiscal year 2022-23, according to the finance ministry. This is including principal and interest repayment.

What this means is that the country’s debt servicing would increase by Nu 128.67 million (M) from 2021-22 fiscal year.

The debt service ratio is the ratio of debt service payments, principal, and interest of a country to that of its export earnings. This means that the lower the ratio, the healthier the economy because the low ratio is derived from the expansion of export earnings or less amount of loan repayment.

External debt service for exports of goods and services or debt service ratio was projected to decrease to 14.3 percent in the current fiscal year from the previous fiscal year’s 15.1 percent with expected growth of export of goods and services at Nu 65.41B from Nu 61.21B.

The debt service ratio of 14.3 percent is lower than the annual external debt service ratio of 25 percent set by the public debt policy. The ratio was 11.5 percent in 2020-21.

Bhutan’s domestic revenue is projected at Nu 41.28B in the current fiscal year, up by over 5 percent compared to the previous fiscal year.

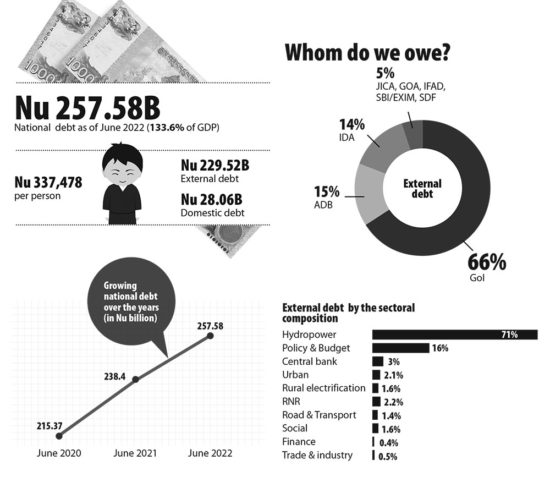

As of June this year, the total external debt was Nu 229.52B, an increase of 3.3 percent or equivalent to Nu 7.4B from March this year because of the disbursement under programme borrowings from World Bank, Japan International Cooperation Agency (JICA), and hydropower loans.

Similarly, domestic debt was Nu 28.06B, an increase of 9.7 percent or Nu 2.49B from March this year. The domestic debt increased because of the new issuance of government bonds for deficit-financing.

So an increase in both external and domestic debt pushed the national debt to Nu 257.58B, accounting for 133.6 percent of the fiscal year 2021-22’s gross domestic product (GDP) estimate of Nu 192.82B. It saw an increase by Nu 9.9B.

The hydropower debt was reported at Nu 163.04B, 71 percent of the total external debt. The hydro-debt comprised the debt stock of six hydropower projects of Mangdechhu hydro-project authority, Puna-I, Puna-II, Nikachhu, Dagachhu, and Bashochhu.

Non-hydro debt stood at Nu 66.48B, which is 29 percent of the total external debt and 34.5 percent of the estimated GDP.

According to the ministry, the non-hydro debt to GDP ratio of 34.5 percent is within the 35 percent prescribed by the Public Debt Policy 2016.

Indian Rupee (INR) debt accounted for 67.7 percent of total external debt, of which 95.5 percent was hydropower debt at Nu 148.4B. The INR denominated debt, in June this year, increased marginally by INR 439.51M from March owing to disbursement for Puna-I.

At the same time, convertible currency debt (CC) stock stood at USD 937.65M, equivalent to Nu 74.12B, which accounts for 32.3 percent of the total external debt. The Ngultrum value of CC debt stock increased by Nu 6.86B from the total CC debt stock of Nu 67.2B (USD 884.19M) in March this year. The increase was mainly because of budgetary support loan disbursement from the World Bank and JICA and ongoing project loan disbursement.

Despite the rise in the national debt, the finance ministry said that the overall risk is manageable. External debt distress is considered moderate providing 91.5 percent of the debt is denominated in INR with no exchange rate risks.