Thukten Zangpo

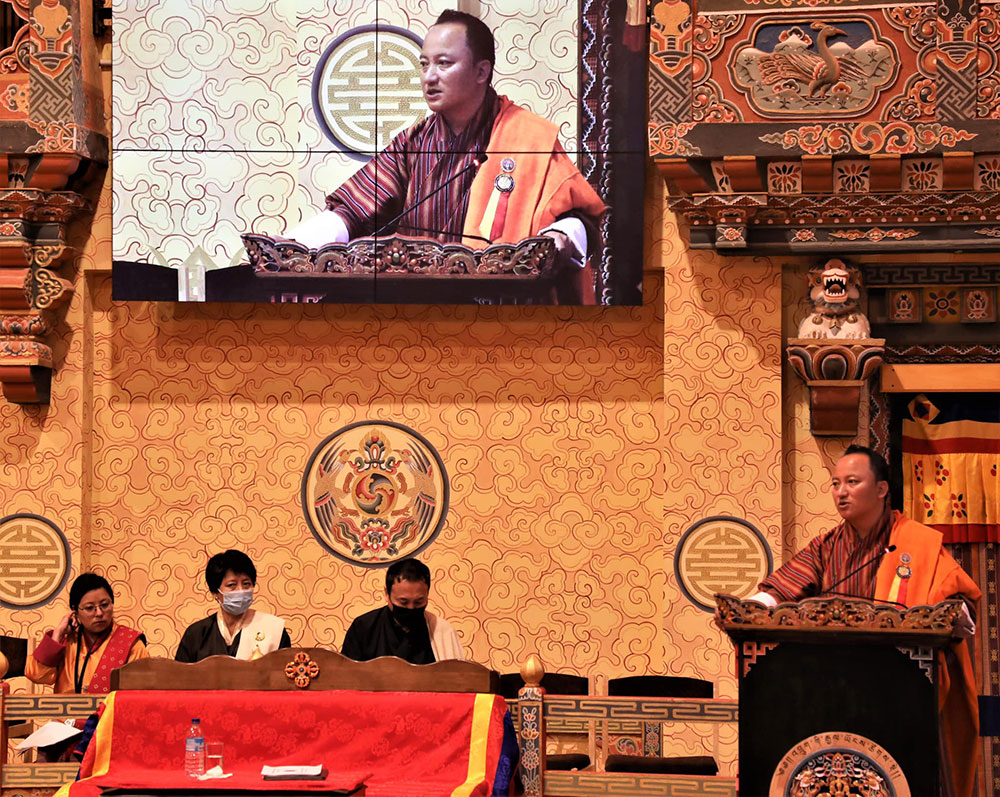

The finance minister introduced the Pay Structure Reform Bill 2022 at the National Council yesterday after the National Assembly passed it as money Bill.

Introducing the Bill, the Finance Minister Namgay Tshering said that the Bill was about re-structuring the existing pay and allowances and not about increasing. “This will address the fundamental structural issues in the pay revision in future.”

Lyonpo Namgay Tshering said that the 5th Pay Commission considered budget neutrality while re-structuring the pay and whether the domestic revenue would be adequate to meet the expenditure on salary and allowances.

He said that the existing pay system had 30 different types of allowances that were not reflected in the pay slip and lacked transparency.

However, Lyonpo said that an additional Nu 1.2 billion (B) for the one-off 5 percent indexation to curb the rising costs of goods and one-off fixed payment is included in the pay reform. “No one would be worse-off.”

The civil servants at P1 to P4, P5 to S4, and S5 levels and below will get a lump sum one-off fixed payment of Nu 1,000, Nu 1,500, and Nu 2,000 per month on basic pay to mitigate hardships.

In case the country’s domestic revenue falls beyond the recurrent expenditure, the government can withdraw one of these allowances.

Lyonpo said the country needed capping or upper ceiling on the costs of salary and allowances to the domestic revenue unlike other countries.

“Other countries have capped 35 percent of the domestic revenue for the salary and allowances. However, in Bhutan it incurs 58 to 60 percent of the country’s domestic revenue,” he said, adding that tax collection has never gone above 12 percent of the gross domestic product.

In 2021-22, tax, the highest contributor to the domestic revenue, contributed Nu 22 billion (B) of the Nu 36B total domestic revenue. For the salary and allowances, it incurred Nu 19.9B in the same year.

Trashigang NC, Lhatu, asked the minister about the clean wage system being followed by other countries apart from Singapore and what would be the benefit of the clean wage system. He also asked whether the ministry looked into pegging the salary to the private sector employees.

Lyonpo Namgay Tshering responded that the clean wage system is similar to that of Singapore.

On pegging salary revision for the private sector, Lyonpo informed the House that if the pay were not at par, it would bring fiscal instability. He said that the clean wage system has not made a huge difference in the salary revision but helps create a basic foundation.

Lyonpo said that the existing Bhutanese pay structure was following the rank in person system (gets promotion and grade after every five years) which now has to be revised to performance-based rank in the job system.

Chukha NC, Sangay Dorji, also said that there were meritorious promotions and training earlier and asked how the Performance-based Incentives (PBI) would be effective.

Lyonpo answered that the PBI would promote competency, meritocracy and dynamism in public service. He added that the PBI could be up to 100 percent of the basic civil servant’s pay and that the Royal Civil Service Commission is working on the performance management system framework.

Lyonpo said that non-monetary incentives like meritorious promotions, offering medals were helpful. However, the civil servants, he said, should be provided with the monetary incentives for social security. “The PBI has worked well in other countries.”

On the discontinuation of allowances, Lyonpo said that the vehicle quota system was practised from 1980s when there was not much vehicle to improve mobility.

Not supporting the designated vehicles for MPs as endorsed in NA, Lyonpo asked the NC to review and provide recommendations.

He added that the designated vehicles for prime minister, cabinet ministers and equivalent positions, speaker of the NA, chairperson of the NC and 58 MPs could incur cost of Nu 203 million (M) yearly.

He said that this would require additional 58 drivers whose monthly pay of Nu 18,000 worked out to Nu 12.5M and fuel and maintenance expenditure of Nu 10M yearly.

He said an MP gets Nu 20,000 monthly currently as allowance for fuel, maintenance, and driver’s salary. Expenditure comes to Nu 13.9M. Additionally, MPs get a one-time lump sum vehicle allowance of Nu 1M, which is Nu 58M for 58 MPs.

“If the designated vehicles can be used for 10 years, there is still an excess of Nu 97M,” Lyonpo said.

Gasa NC Dorji Khandu asked the minister on the government’s decision to discontinue the pool vehicles. “There are about 2,000 pool vehicles in the country, a pool vehicle for every 10 civil servants, and fuel and maintenance costs of Nu 1B yearly.”

Lyonpo Namgay Tshering said that the existing designated vehicles have to convert into pool vehicles to be used as and when required by the officials.