Thukten Zangpo

The all-time record high cost of fuel, especially diesel, is already creating a ripple effect at all levels and in all sectors. From cost of essentials, housing, construction to service and industry every other sector will bear the brunt of the increase.

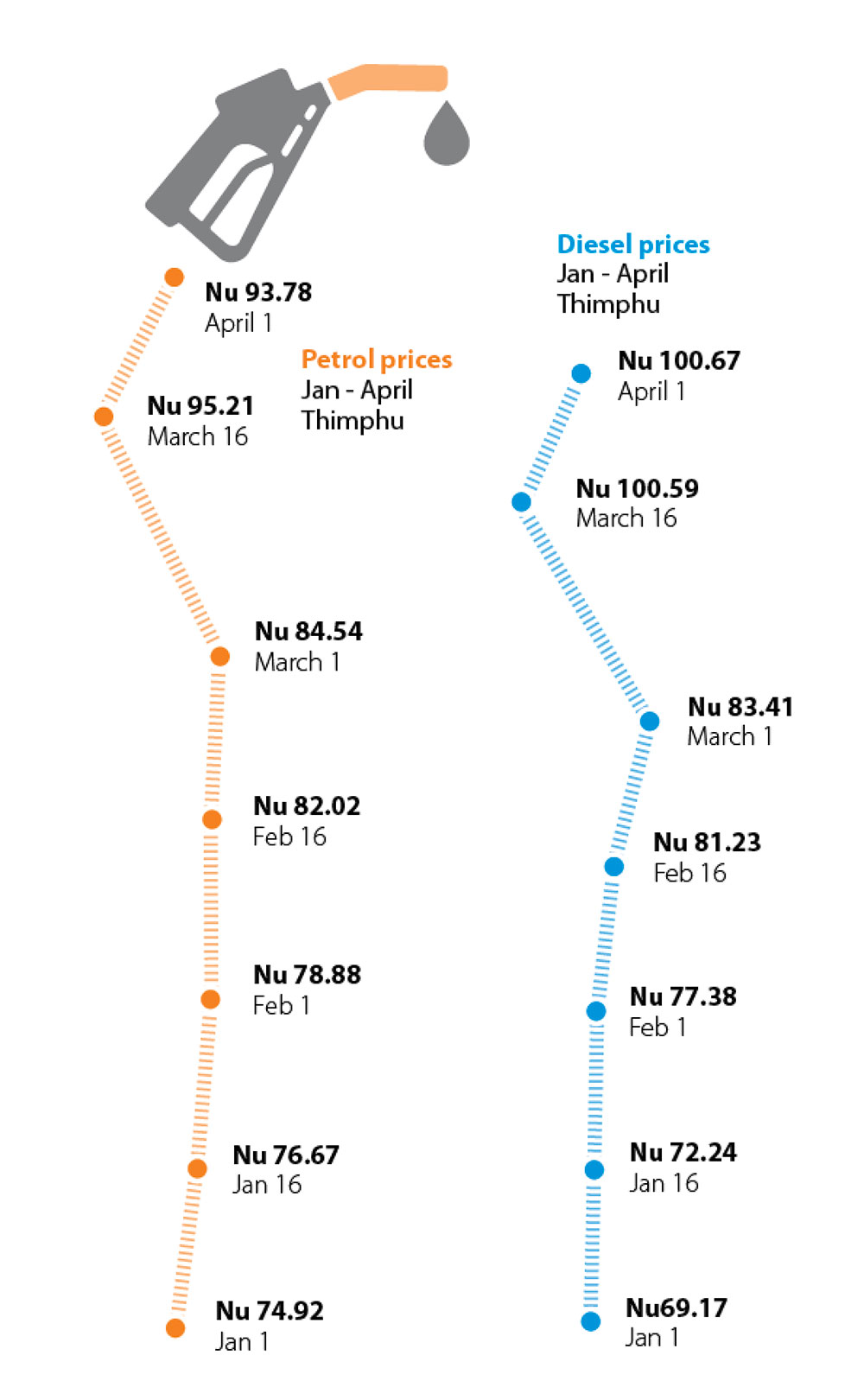

Diesel touched Nu 100.67 and petrol at Nu 93.78 in Thimphu today. Diesel saw an increase of Nu 17.26 (20.69 percent) and petrol Nu 9.24 (10.9 percent) since March 17 this year.

Compared with 2019, pre-pandemic level, fuel price has increased by about 57.6 percent. For reference, a litre of diesel in March 2019 was Nu 61.93, and a litre and petrol Nu 61.41.

The impact is already being felt. A Thimphu civil servant said that Nu 2,500 was enough to fuel his Alto car for a month a few months ago. It cost him Nu 3,300 after the revision. This is about 12. 6 percent of an officer-level civil servant earning a monthly salary of Nu 26,274. The monthly fuel budget of Nu 2,100 in March 2019 has increased by about Nu 1, 200 for the same quantity.

Spending a larger portion of income on fuel translates to less consumer spending. Professor of economics with the Royal Thimphu College, Sanjeev Mehta in a recent interview said higher fuel prices affect those who do not own cars.

“At the micro-level, reallocation of household budgets to manage the impact of rising fuel and overall prices, contribute to a welfare loss. Household savings also fall during this time. The poor and lower-and middle class are the worst hit,” Sanjeev Mehta said.

He added that the higher cost of living tends to cut into the real income while unemployment and poverty rate rises.

According to the National Accounts Statistics, 2021, private household final consumption expenditure for food and non-alcoholic beverages fell by about 12.32 percent in 2020 among others compared to the previous year.

In an earlier interview, the economic affairs minister, Loknath Sharma said that a fuel price hike would increase the price of goods since it constitutes 25 percent of the consumer price index.

A Royal Monetary Authority’s study on the impact of fuel prices on inflation in 2021 found that an increase in fuel prices by 10 percent would increase monthly inflation by 3.6 percent within a month and further push inflation by 1.3 percent after three months.

“If fuel prices increase by 10 percent, other factors remain constant, the total increase in inflation will be 4.9 percent after three months from now,” it added.

With the increase in fuel price by 15.8 percent since March this year, it could increase monthly inflation by about 5.7 percent within a month and further push inflation by 7.7 percent after three months.

A wholesaler said the recent fuel hike drove freight charges by Nu 2,000 to Nu 3,000 negating the benefit of removing the driving switching mode, which was attributed for driving transportation cost.

However, he said that the costs of the goods are expected to increase soon with most of the goods arriving with new prices and maximum retail prices. This is because of increase in price of goods at source driven by cost of fuel besides other factors.

With the service sector consuming the maximum fuel at 33 percent, the sector will bear the heaviest brunt. The agriculture sector consumes almost 22 percent, the industrial sector at about 20 percent, and the household sector accounting for almost 19 percent in 2020.

Construction Industry

Cost of construction materials has gone up by 30 percent from the pre-pandemic level. The recent fuel hike will make it worse, according to Construction Association of Bhutan’s executive director, Tshering Younten.

A contractor said that the cost of construction raw materials could have gone up by 50 percent with the recent fuel hike pushing production and transportation costs.

For instance, he said that a metal rod that cost Nu 52 per kilogram earlier is Nu 80 now transported from Phuentsholing to Thimphu.

Similarly, a bag of cement cost Nu 355 from Nu 325 and a truckload (10-wheeler truck) of sand that cost Nu 12, 000 now costs Nu 18,000. A bag of cement from retailers in Thimphu cost Nu 520 a bag weighing 50 kgs.

“Buildings under construction will reassess the cost and this will have an impact on housing as the cost will be passed down to tenants since landlords would have to pay increased equated monthly installments,” he added.

Dungsum Cement Corporation Limited’s (DCCL) interim chief executive officer, Tshering Tenzin said cement price was revised by Nu 5 a bag because of the fuel revision.

The ex-factory price for Ordinary Portland Cement is Nu 305 a bag and Nu 295 for Portland Pozzolona Cement.

However, Tshering Tenzin said price of cement would increase depending on locations.

Industry

In an earlier interview, the economic affairs minister Loknath Sharma said the rise in fuel prices will affect the competitiveness of manufacturing industries as it impacts the supply chain and logistics cost of raw materials during imports and export of finished goods or materials.

Fuel price would increase price of raw materials because of the huge volume import on-road transportation, an official from the Association of Bhutanese Industries said. “This will drive cost of export making it not competitive in the international market.”

DCCL’s interim chief executive officer, Tshering Tenzin said export of cement to India would become less competitive if the fuel price increases mainly on the increased freight charges for coal which is the main raw material. About 15 to 20 truckloads are ferried from State Mining Corporation Limited (SMCL) for the plant’s daily operation.

Eighty percent of demand for coal (high ash) is met from SMCL and 20 percent of coal (low ash) is imported from India. Tshering Tenzin said low ash coal is necessary for the plant.

Lyonpo also said that if global prices persistently remain high, India may increase the use of coal for power generation and this will further accentuate the coal import difficulties for our industries. India uses 29.55 percent of fuel to generate electricity to meet domestic demand.

Tshering Tenzin said that if India resorts to coal for power generation, this will further accentuate the coal import difficulties for DCCL. Bhutan imports 50,000 metric tonnes of coal in a year.

According to the National Statistics Bureau, the recent producer price index (PPI) saw an increase of 12.53 percent in the third quarter (July to September), 2021 from the previous year. PPI is a measure of the average price change of goods and services over time from the producer’s perspective.

Passenger fare

Fares for public transport will see an increase too as cost of fuel determines fare charged.

Road Safety and Transport Authority’s chief transport officer, Sithar Dorji said that the authority recently revised the taxi and bus fares effective from March 1 this year.

Passenger fares are revised twice a year, on February 1 and August 1. “The recent hike in fuel price would be taken care of when the fare revision takes place from August this year,” said the chief.

The revised fare for a 30-seater coaster bus for a one-way trip from Thimphu to Bumthang is Nu 554. It was Nu 296 in August 2020 and Nu 344 in August last year. Similarly, a taxi fare from Thimphu to Bumthang costs Nu 1,4 69 now.