Nu 17.8B raised from bonds in last three years

Thukten Zangpo

To meet its growing fiscal deficit, the government had raised Nu 17.8 billion (B) from the issuance of bonds in less than three years.

Fiscal deficit arises when government expenditure is more than the revenue generated in a fiscal year.

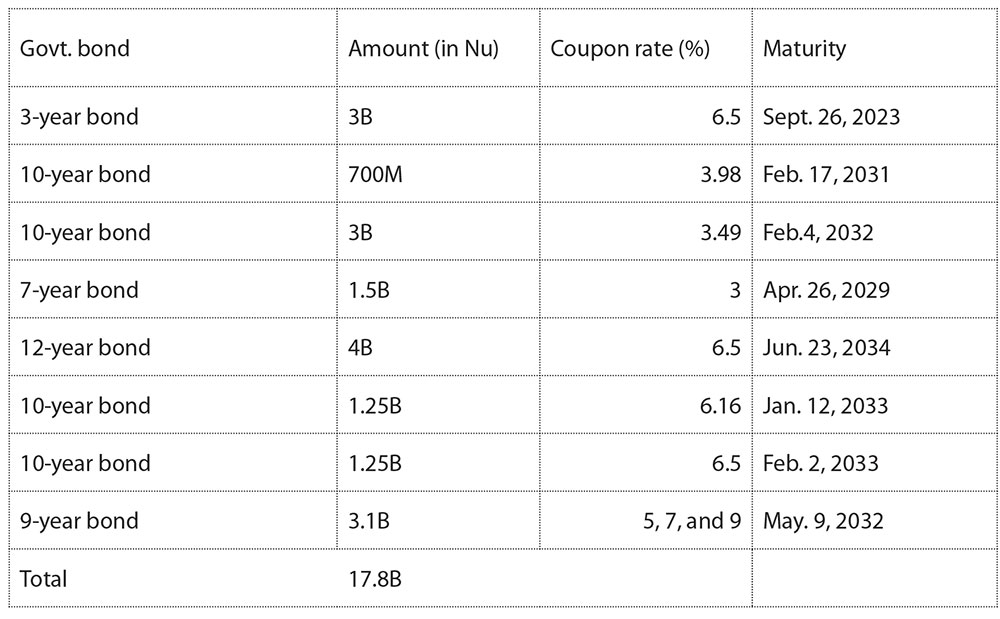

In the fiscal year 2020-21, the government was short of Nu 15.33B or 7.36 percent of gross domestic product (GDP), the government offered Nu 3B and Nu 700 million bonds in September 2020, and February 2021, respectively.

Similarly, the government offered bonds worth Nu 8.5B in 2022. During the fiscal year 2021-22, the country’s fiscal deficit was Nu 17.5B or 9.3 percent of the GDP.

With the country’s estimated domestic revenue of Nu 36.37B for this fiscal year 2022-23, which is enough to meet the recurrent expenditure of Nu 36.34B, the government raised Nu 1.25B each in January and February this year, and Nu 3.1B in May this year.

In this fiscal year 2022-23, the fiscal deficit was projected at Nu 22.88B or 11.25 percent of the GDP. According to the second quarter budget report as of December last year, the fiscal deficit increased to Nu 22.9B.

The Constitution states that the government has to ensure that the cost of recurrent expenditures has to be met from the internal resources of the country.

The government offers bonds, a long-term debt instrument to finance to meet this fiscal gap for the capital expenditure.

The government uses the amount raised from bonds for construction related projects like roads, schools, farm roads among others. This helps to drive the country’s economy.

Raising money from bonds also means an additional Nu 17.8B domestic debt to the country.

As of March, this year, the country’s domestic debt was recorded at Nu 26.55B. It accounted for 12.9 percent of the estimated gross domestic product and 9.9 percent of the total debt.

Most of these bonds mature by 2034 with an annual coupon (interest) rate between 3 and 9 percent.

Most of the subscribers are financial institutions (FIs) because of their liquidity with banks and the opportunity for them to invest while individuals are not fully aware of the debt instruments.

Going by the bonds market, the coupon (interest) rates are increasing while subscribers are declining.

The recent offering of a 9-year bond of Nu 5B, offered from April 29 to May 5 this year saw under subscription with only Nu 3.1B orders received from eight subscribers-three financial institutions and five individuals.

This time the bond was offered at the multiple pricing unlike in the past at uniform pricing. Multiple pricing is applicable when the bonds are undersubscribed. The interest rates this time ranges from 5 to 9 percent.

The low interest rate for bonds issued during the Covid-19 period is an evidence that investors were looking for investment opportunities with no economic activities taking place.

However, with economic activities picking up, the subscribers, FIs and individuals had other avenues for credit lending as FIs prefer short-term investment than the long-term.

Govt. bonds are risk free

An official from Royal Securities Exchange of Bhutan said as the government bonds are backed by the government asset, it is risk-free and there will be no default payment.

He said that the interest rate is lower compared to the bank’s lending rate, which will be beneficial for the government as well as to the investors especially the FIs which have huge liquidity.

Bhutan’s bond market is called the infant domestic security market. This is because as it matures, it can be traded in the secondary market and can also be used as collateral to avail loans from FIs.

The interest earned from the bonds is non-taxable for personal income tax. However, the interest income from the bond is taxable income (5 percent as tax deducted at source) for the business income tax and corporate income tax-paying entities.

Any Bhutanese, firms, companies, corporate bodies, financial institutions and trust funds can subscribe to the bond. As per Section 126 of the Public Finance Act 2007, the finance ministry can borrow money to finance fiscal budget deficits and refinance maturing debt or a loan paid before the redemption date.

The ministry can also issue bonds to maintain credit balances in the bank accounts, and on lending to State enterprises and other legal entities, on-lending to state enterprises and other legal entities, or for any other purposes approved by the Cabinet.