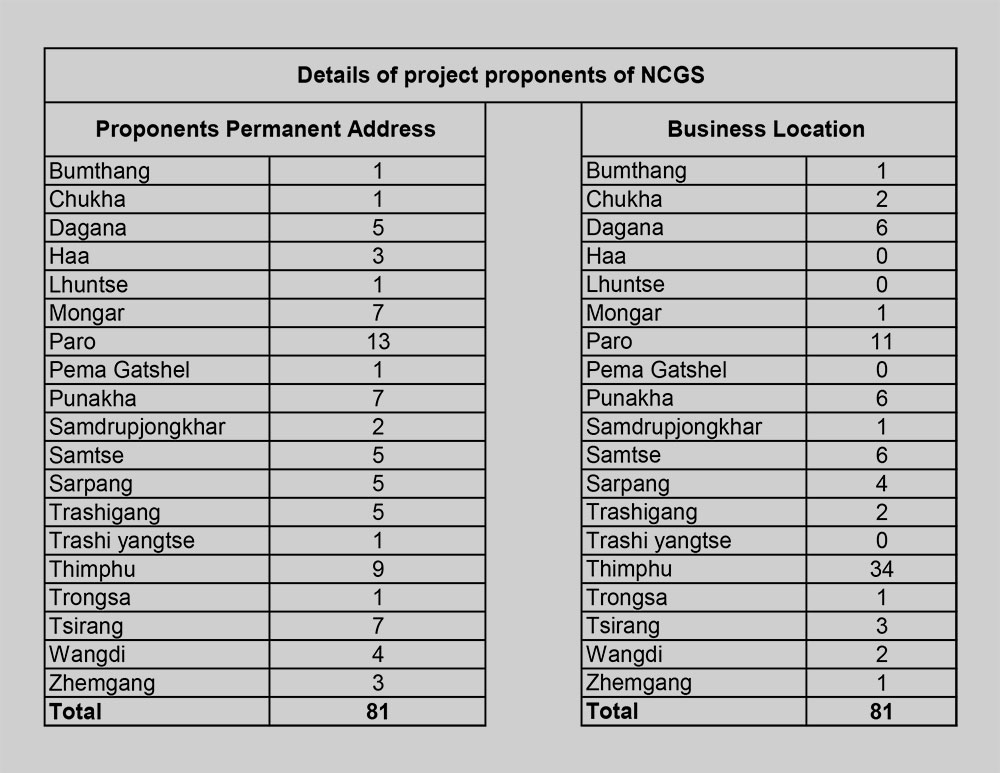

More than 55 percent of the 81 business projects approved under the National Credit Guarantee Scheme (NGCS) is spread in Thimphu and Paro, according to project details shared with National Assembly members yesterday.

The Speaker had instructed Finance Minister Namgay Tshering, who is the chairperson of the NCGS committee, to provide details of projects in terms of the proponents (beneficiaries) and business location.

The NCGS has approved 34 and 11 projects in Thimphu and Paro respectively. Thirteen of the proponents who have received NCGS loans, which is the highest, have permanent addresses in Paro.

The number of projects and beneficiaries from the rest of the dzongkhags are in single digits. Five dzongkhags—Haa, Lhuentse, Gasa and Trashiyangtse—have not received any NCGS project.

The National Assembly’s economic and finance committee had pointed out that most of the NCGS projects were in the western dzongkhags and that it had failed to cater to far-flung dzongkhags and gewogs. They said that it would ultimately create regional imbalance and an upsurge in rural-urban migration.

However, the finance minister, who is from Paro, said that the distribution of projects under NCGS is approved based on the feasibility of the businesses and their potential to increase exports, substitute imports, create jobs, and promote ICT and innovation.

“As I’m the chairperson of NCGS committee, it’s natural for some people to have doubts about why many of the projects are based in Paro, which is my dzongkhag. The project is only nine months old and we have been transparent on it,” he said.

He said that banks would not approve loans for non-viable businesses given repayment risks and that the applicant’s credit history would also be assessed. The businesses, he said, were spread across 15 dzongkhags.

Trashigang’s Bartsham Shongphu MP Passang Dorji (PhD) said that the interest rate should be reduced for businesses to be established in dzongkhags that have fewer businesses. NCGS today provides loans at 4 percent irrespective of business location.

Wamrong MP Karma Thinley said that the project had just started and that the flaws should be corrected. He added that approving most of the programmes in highly populated dzongkhags would aggravate the rural-urban migration problem.

The Speaker said that although it was difficult to spread businesses across all the dzongkhags evenly, the NCGS should strive towards achieving that.

The House adopted the committee’s recommendation to create extensive awareness on NCGS and institute a mechanism of hassle-free loan accessibility amongst all the citizens with a regionally balanced plan.

The government initiated NCGS programme to enhance access to credit to promote cottage and small industries (CSI) and medium industries through banks for a period of three years with a fund of Nu 3 billion (B) to bolster the economy during the pandemic.

The House concluded the deliberation on the annual budget. The House endorsed the Budget Appropriation Bill of Nu 80.483 billion (B) with the current expenditure of Nu 35.598B and the capital expenditure of Nu 44.884B.

The House also unanimously endorsed the Supplementary Budget Appropriation Bill of Nu 2.783 billion (B).

By MB Subba

Edited by Tshering Palden