… USD saw all-time high at Nu 84

Thukten Zangpo

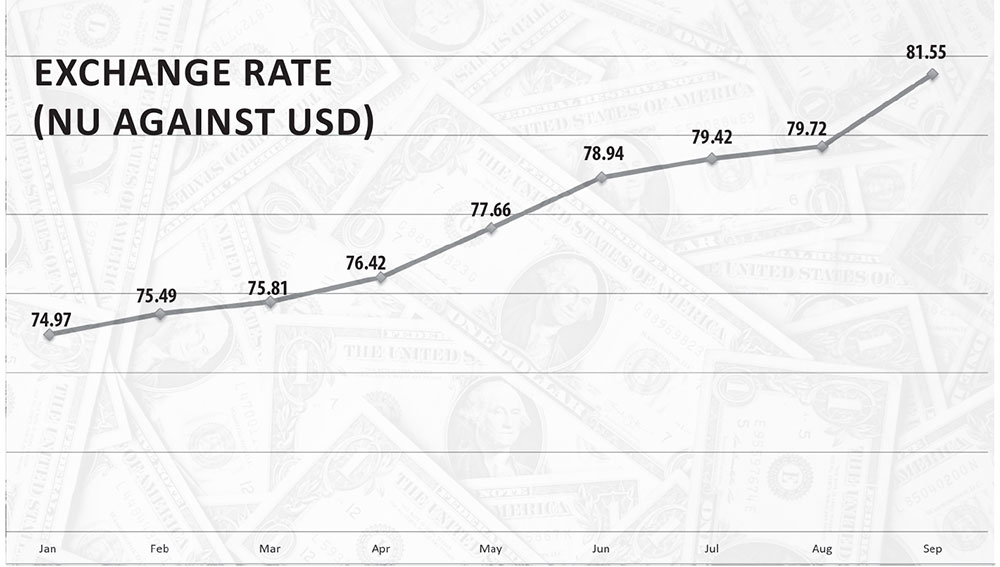

The Ngultrum value to the USD weakened by about 12 percent from January this year which ended at an all-time high at Nu 84 per USD as of yesterday. This means we have to pay Nu 84 to buy a USD.

The Ngultrum depreciated to 74.79 (provisional) against USD in January this year from Nu 73 in the same month of the previous year, as per the Royal Monetary Authority.

Globally, the rate of depreciation of currencies against the USD over a few years was because of the Ukraine-Russia conflict and rising inflation.

Besides, the United States of America’s (USA) central bank, the Federal Reserve, also hiked the interest rates for borrowings to fight inflation.

The USA’s inflation saw an increase at 7.1 percent in November this year compared to the same month last year, according to the media reports.

On December 14, the Federal Reserve again raised the interest rate for the seventh time this year by 50 basis points (0.50 percentage point interest rate hike) taking it to a targeted range between 4.25 to 4.5 percent. The Federal Reserve indicated to keep rates higher through next year, with no reductions until 2024.

On December 14, the Federal Reserve again raised the interest rate for the seventh time this year by 50 basis points (0.50 percentage point interest rate hike) taking it to a targeted range between 4.25 to 4.5 percent. The Federal Reserve indicated to keep rates higher through next year, with no reductions until 2024.

Bhutan is an import-dependent country with about 70 percent of its goods imported from India and the remaining from other countries. With a weaker Ngultrum, the country has to make more payments in INR to India and in USD to other countries.

India also depends on imports, including crude oil, metals, electronics and semiconductors, and raw materials. India also has to make more payments in USD.

This will trigger further inflation and Bhutan’s trade deficit which stood at Nu 48.14 billion (B) as of September this year will further widen.

The country’s foreign currency reserve which is draining will also be under threat.

Bhutan’s total reserves can only meet 13.11 months of essential imports, more than a month’s reserve mandated by the Constitution of 12 months.

The total foreign currency reserves have decreased by over 40 percent to USD 729.7 million (M) as of September this year from USD 1.29B in the same month last year.

Similarly, the rupee reserve will be able to meet only 1.15 months of the merchandise imports. The rupee reserve decreased to about INR 9B from INR 25.8B in September last year, a decrease of INR 16.8B.

A depreciating value in Ngultrum would also mean that we have to pay more for the convertible currency (CC) concessional loans from multilateral institutions and bilateral partners.

With the pegging arrangement, a major portion of external debt denominated in INR has cushioned the impact of exchange rate risks.

However, the CC debt amounting to USD 907.34M equivalent to Nu 74.41B as of March this year is subject to exchange rate risk.