MB Subba

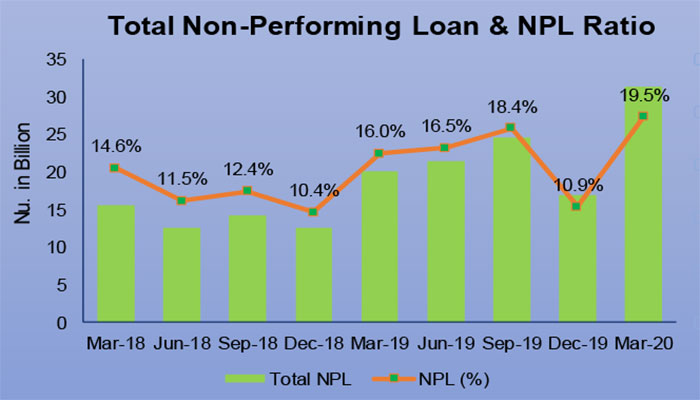

The non-performing loans (NPL) ratio to total credit has jumped to 19.5 percent in March from 10.9 percent in December 2019. The total credit, as of April stood at Nu 142.689 billion (B), according to the Royal Monetary Authority’s monthly statistical bulletin for August.

The total NPL ballooned to Nu 27.5B by the end of the first quarter from Nu 15.161 in December last year. This is an increase of more than Nu 12.3B within the three months.

The figures could be much higher by now, but officials said that the NPL occurred during the Covid-19 pandemic should be given special treatment. Interests were waived and loan repayment deferred as part of the Druk Gyalpo’s Relief Kidu since April.

Sector wise, the total loan in the building and construction sector stood at Nu 39.05B or 27 percent of the total credit, which was the highest.

Credit in the service and tourism sector amounted Nu 37.897B while the total loan in the trade and commerce sector was Nu 17.674B.

Loans to the agriculture sector, which engages more than half of the population, stood at Nu 6.505B or only 4.6 percent. This is slightly higher than the credits in the transport sector, which stood at Nu 6.183B.

The total personal loans stood at Nu 14.336B, which accounted for 10 percent of the total credit. The central bank, however, has not released sector-wise NPLs for comparison of which sector has been performing well.

A high-level committee consisting of officials, including the central bank governor and heads of the financial institutions, is expected to be formed and study the problem and come up with a solution to the NPL problem.

President of the Financial Institutions Association of Bhutan (FIAB), Karma last week said that a team (of officials) is looking at possible options. However, he did not elaborate, saying that he would inform the media later.

Some officials from a financial institution said that the high prevalence of NPL was partly because of lack of due diligence on part of the financial institutions.

A bank official said that in some cases, the collaterals were not verified properly and that the loans could not be recovered. The Covid-19, he said, had made the situation worse.