2,168 members retired in just one year

Thukten Zangpo

The increasing number of people resigning, including those leaving for Australia, could cost the National Pension and Provident Fund’s (NPPF) scheme.

The number of members withdrawing from the pension scheme has outweighed the new contributing members lately.

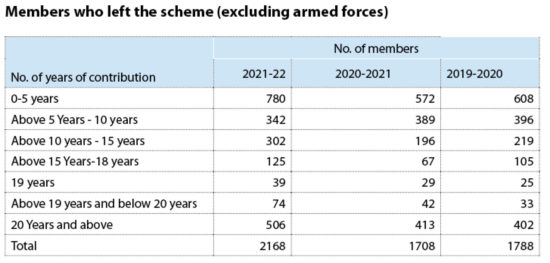

Records with the NPPF show that 2,168 members (excluding armed forces) have withdrawn from June 30 last year (2021) to June 30 this year.

During the same period, there was a net increase of 1,652 members. Out of this, 1,129 members from the private sector joined the scheme.

In the same period the year before, (June 30, 2020 to June 30, 2021), 1,708 members (excluding armed forces) left the scheme while there was 476 net increase in members.

With the expectations that many young members would move to Australia in coming years, the number of contributing members to the fund is expected to decline further.

According to the national pension and provident fund policy 2018, the conventionally-defined pension scheme suffers from inherent sustainability issues. This is before the current exodus of NPPF members to Australia, Canada or the Middle East. “Current demographic trends indicate that eventually there will be a larger number of pensioners than contributors leading to ultimate exhaustion of funds.”

NPPF’s pension and provident fund chief, Tshering Dorji said that civil service’s pension with the current formula would be sustainable until 2060, after which it will be at loss, as there would be more pensioners than those contributing.

The armed forces pension, he said, could be sustainable only until 2043 if the retirement age was not changed. The retirement age of armed forces has been revised at par with the civil servants.

Contributions

A civil servant contributes 11 percent in the scheme with the government contributing an equivalent 15 percent coming to a total of 26 percent. The NPPF takes 16 percent into the pension and 10 percent to the provident fund (PF).

A civil servant, on retirement, gets the PF amount back in bulk along with the interest accrued. To calculate the monthly pension under defined benefit, as per the current formula, the last basic pay is multiplied by 40 percent into the number of years in service divided by 30 years.

For instance, a civil servant with the last basic pay of Nu 40,000 who worked for 30 years would get a monthly pension Nu 16,000. For calculation, the life expectancy of 82 years old is taken into account.

As per the data, many people with contributing years of less than 20 years are leaving, Tshering Dorji said. He added that this could have an impact in the short term, but not in the long term.

“Members resigning is higher compared with members joining the scheme recently. However, it is still manageable as of now,” Tshering Dorji said.

Young members leaving is a concern. Tshering Dorji said that the migration cannot be stopped and more people would have left if the Covid-19 pandemic had not disrupted the outflow. A civil servant retiring after 10 years would take benefits that would be enough to pay for a tuition fee to study in Australia.

According to NPPF records, members who left the scheme after contributing to the scheme for about 10 to 15 years saw an increase from 196 to 302 (excluding armed forces) in the last two fiscal years.

Many members, to avoid becoming a pension member, retire after serving 19 years to avail the lump sum provident fund benefits. This number increased from 67 to 125 in just one year.

According to the NPPF’s report, there were 67,542 pension members including 1,129 private provident fund members as of June 30 this year. They contributed Nu 4.23 billion (B).

The number of pensioners increased to 8,821 during the same period. About Nu 828.48 million (M) was paid as pension benefit between June 30 last year and this year.

In just one month, this June, Nu 74.19M was paid in pension benefits.

The statistics also shows that the company’s current accrued liability at Nu 68.83B as of June last year. This is an increase of Nu 14.13B from June 2019. The company’s deficit rose to Nu 36.36B as of June 2021 from Nu 28.57B as of June 2019.

Tshering Dorji said that the deficit had existed since the start of the scheme. “The major concern is to balance the benefits to contribution.” Since the contribution of members was lesser in the past and the benefits calculated on the last basic pay, there will be deficits, he added.

Tshering Dorji expects that increasing the retirement age in armed forces will see a decline in the current liability. He also said that the pension scheme under the pay-as-you-go model redistributes the contributed money where the younger generation would contribute to the older generation (intergenerational transfer) and higher contributing members subsidise lower contributors.

Reforms

Facing financial sustainability, the pension scheme needs appropriate reforms, the annual report stated. The National Pension Board, along with the finance ministry, sought technical assistance from the Asian Development Bank to carry out reform of the schemes.

The reforms which are still under discussion will focus on structural reforms, legal and regulatory framework and segregation of assets.

It would also bring about clarity in the underlying issues with the current scheme and accordingly propose appropriate measures to improve the current schemes.

The current scheme covers only 8.5 percent of the population and 19.6 percent of the economically active population.

As per the National Labour Force Survey 2020, there are 331, 222 economically active population in the country that is projected to increase.

The NPPF needs to extend the voluntary provident scheme to the entire economically-active population and those working in the private sector.