Housing sector benefits the most

MB Subba

As part of the monetary and fiscal measures to tackle the Covid-19 situation, financial institutions and other financial service providers waived a total interest of Nu 1,251.93 million (M) for April, which is borne on a 50/50 basis between the government and the lenders.

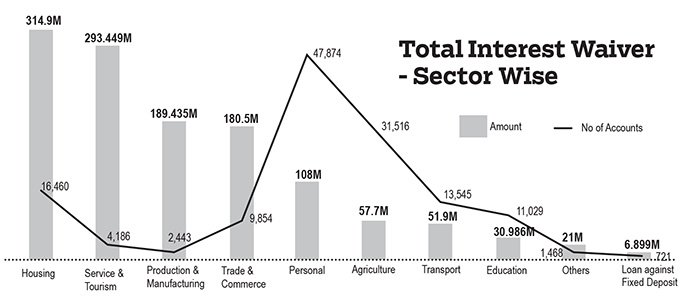

The biggest beneficiary was the housing sector that received about 25 percent (Nu 314.9M) of the total waiver. A total of 16,460 housing loan accounts, which is the second-highest after personal accounts, benefited from the interest waiver.

The Royal Monetary Authority revealed that 47,874 personal loan accounts benefited from the interest waiver.

Tourism, which is the most affected sector, however, was the second-largest beneficiary. The financial institutions waived a total of Nu 293.449M benefiting 4,186 loan accounts in the tourism sector.

Slightly more than 4 percent (Nu 54.706M) of the total waiver went to the agriculture sector.

Prime Minister Dr Lotay Tshering handed over the 50 percent of the interest waivers to financial service providers in a ceremony at the RMA hall yesterday.

Lyonchhen said that health was taking a backstage and that the economy had emerged as a more critical issue for the government to tackle. He expressed his satisfaction with the role played by the central bank and the financial institutions.

However, he highlighted challenges in dealing with the situation in the absence of proper data and enough options.

“We should be ready to take bolder steps (in the interest of the economy),” he said, asking financial institutions to come up with innovative products. “The bigger question is the way forward as the Covid-19 is not likely to go by July.”

Chief executive officer (CEO) of the Royal Insurance Corporation Ltd. (RICBL), Karma, said that the interest waiver was not sustainable and that the government should resort to social protection norms. “It has a huge implication on the economy,” he said.

He said that neither the economy nor the financial institutions should prosper at the cost of the other.

According to the RMA, there were a total of 139,096 loan accounts eligible for interest waiver in April. There were 117,691 regular loan accounts and 18,570 non-performing loan (NPL) accounts.

Dzongkhag-wise, the maximum beneficiaries were in Thimphu with 44,940 loan accounts followed by Chukha with 11,957 loan accounts and Paro with 7,268 loan accounts.

According to a press release from the Prime Minister’s Office, finalization of the interest waiver for May and June will be completed by the end of June.

The interest waivers were provided on the command of His Majesty The King. His Majesty The King in the address to the nation on April 10, stated that one of the biggest concerns of the people and businesses is the difficulty faced in meeting their loan repayment obligations due to the economic uncertainties arising from the effects of the Covid-19 pandemic.

To provide immediate relief to indebted businesses and individuals throughout the country, His Majesty The King commended the RMA and financial institutions to consider deferment of loan repayments and waiving interest payments for three months from April to June 2020.

“Following the Address of His Majesty The King to the nation, the RMA has been working closely with the financial services providers in implementing several monetary measures including the loan deferment and interest waiver for a period of three months (April to June 2020),” the press release stated.

These loan deferments and interest waivers are expected to provide relief to the borrowers, individual as well as businesses, during the period of crisis.

The RMA, in collaboration with the financial services providers, constituted two committees to ensure smooth implementation of loan deferment and interest waiver.