From Nu 5.29B to Nu 4.69B in the last eight months

Thukten Zangpo

What was feared and a concern, inflow of remittance has dropped from Nu 5.29B to Nu 4.69B or by 11 percent from January to August.

The country, in the last eight months (January to August) this year received Nu 4.69B in remittance equivalent to USD 61.66 million (M). This is a decrease by 11 percent or Nu 606.65 million (M) compared to the same period last year.

While hundreds of Bhutanese are leaving to work or study in Australia, remittance in AUD has been declining while remittance in USD has been growing. About 50 percent of remittance was in USD, which accounted for Nu 2.34B. In the same period last year, the figure was Nu 2.1B.

Remittance in AUD, which contributed over 50 percent in the same period last year, has gone down to 40 percent this year. Bhutan received Nu 1.82B worth in AUD from January to August this year. AUD worth Nu 2.82B was received in the same period last year.

Bhutanese travelling to Australia tend to pull their families and relatives along, leading to decline in inward remittance.

Remittance in terms of Singaporean Dollar, Canadian Dollar, and in Pounds Sterling saw an improvement. However, remittance in EURO and Japanese Yen has dropped.

Remittance in EURO was Nu 69.37M, Canadian Dollar at Nu 82.45M, Singaporean Dollar at 129.69M, Japanese Yen at Nu 67.61M, and Pounds Sterling at Nu 35.97M in the last eight months.

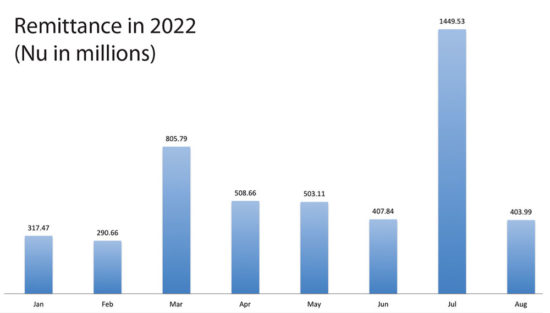

The remittance inflow saw an all time high at Nu 1.45B in July this year when the exchange rate of USD against Ngultrum increased to Nu 79.62.

However, of the total remittance, about 80 percent or Nu 1.15B, was denominated in USD.

The lowest inflow was Nu 290.66M in February this year when the exchange rate of USD against Ngultrum was Nu 75.03.

Remittance helps improve foreign exchange reserves and reduces the deficit in the country’s current account by improving the balance of payments.

An economist said that at micro level, remittances received by family members help to boost household consumption, strengthen the resilience of the poorer households, and improve living standard. In the long run, it improves the distribution of income and promotes social mobility.

To encourage remittance inflow, the Royal Monetary Authority increased cash incentives from 1 to 2 percent for inward remittance from June last year until December this year.

Under the scheme, beneficiaries receive cash incentives of 2 percent upon converting the remitted amount to Ngultrum using the prevailing exchange rates through banking channels and international money transfer operators.