MB Subba

The appreciation of the US dollar (USD) against the ngultrum has come as some relief to the economy, which has been affected by the COVID-19 pandemic.

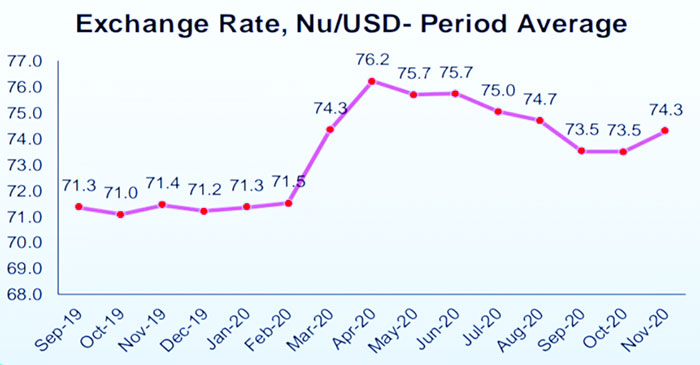

According to statistics released by the Royal Monetary Authority (RMA), the monthly average exchange rate of the ngultrum jumped to 76.2 per dollar in April from 71.3 per dollar in January this year.

The exchange rate of the dollar against the ngultrum slightly decreased to 73.5 in October this year. But in what is a good indication, the dollar again appreciated against the ngultrum in November to 74.3, which bodes well when it comes to external borrowings.

Finance Minister Namgay Tshering said in the recently concluded Parliament that the government has been able to gain from the currency fluctuations in the recent times. For instance, he said that the government last year borrowed USD 30 million (M) from Asian Development Bank (ADB) as a budgetary support and that an agreement to borrow the same amount has been already signed with the same bank.

He said that the USD to ngultrum exchange rate, when the government borrowed the amount last year, was about Nu 71 per dollar. But he added that the exchange rate is expected to be around Nu 75 per dollar when the new loan of another 30M is received, in which case the government will get about Nu 95M more in ngultrums.

However, appreciation of the dollar against the ngultrum will have the opposite impact on the economy when it comes to debt servicing. This means that the government will need more money for debt servicing should the ngultrum depreciate against the dollar.

The total public debt as of September 30 this year was Nu 223 billion (B), which is 120 percent of the GDP. Of the total debt, Nu 214B was external debt, about 87 percent of which are hydropower related borrowings.

According to the finance minister, the government in the last two years borrowed a total of Nu 28B, of which Nu 16B was related to Punatsangchhu I and II, Mangdechhu, and Nikachhu projects. The rest, Nu 12B, was borrowed for non-hydro purposes.

The government plans to borrow more with the passing of the European Investment Bank (EIB) framework agreement recently by both Houses of Parliament. The EIB agreement has been passed at a time when there are concerns expressed from various quarters about the increasing burden of public debts.

According to the finance minister, the risks of exchange rate fluctuations are analysed before availing external loans and that the impact of the dollar appreciating against the ngultrum are not felt so much because the debts are serviced in instalments over a long period of time.

The government says that additional borrowings are required not only for post-Covid-19 recovery efforts but also to maintain and strengthen the convertible currency reserve as the convertible currency earnings from tourism has been affected.