…increase in tax for goods harmful to health and environment

Thukten Zangpo

Finance Minister Namgay Tshering proposes, in the Tax Bill 2022, to increase taxes on goods that are harmful to health and the environment while lowering taxes on essential commodities as he introduced the Bill in the National Assembly on November 8.

Of the 417 goods proposed for tax revision, 235 goods amendments in sales tax, 165 on customs duty and 53 goods on green tax.

The minister said that the country’s economy has been facing economic shocks after the Covid-19 pandemic and the Ukraine-Russia conflict like other countries globally.

With the value of Ngultrum and Indian Rupee depreciating against the dollar and inflation recording high at 7 percent, he added that the country has to pay in USD and INR because Bhutan is an import-dependent country.

The finance minister said that goods like rice, oil and milk would see a decrease in tax, while non-healthy goods like alcohol, cigarettes, noodles, chocolate, biscuits, and ice cream will have an increase in tax.

He added that the tax revision is not to add additional revenue but to fix the macroeconomic imbalance in the economy and for economic revival.

The minister said that the Bill was introduced mainly to ease the shortage of foreign currency reserves while promoting the local priority sector, which has import substitution potential.

“If we tax the imported goods that we can produce in the country, the locally produced goods would be cheaper compared to the imported ones,” he said.

The finance minister also said that the Bill will address the inflationary pressure on food prices and ensure food supply and nutrition security, protect and preserve the environment, encourage and promote healthy living, and support the development of priority local industries.

The Bill proposed to do away with the 10 percent customs duty for rice and oils.

While for milk and cream, the Bill proposes to do away with a 10 percent sales tax and levy only a 10 percent customs duty.

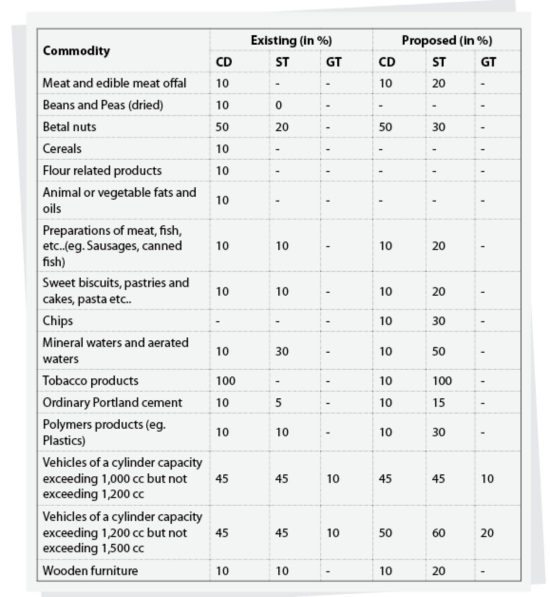

However, an additional 20 percent sales tax on a 10 percent customs duty for the meat and edible meat items.

Ice creams and non-dairy milk, additional 30 percent sales tax from 15 percent and 10 percent customs duty.

Chips are to be taxed 40 percent-10 percent sales tax and 30 percent customs duty.

Water and aerated water to increase 30 percent sales tax to 50 percent on 10 percent customs duty.

However, sales Tax on domestically-manufactured cement and aerated water shall continue to be taxed at 5 percent and 30 percent respectively.

Tobacco products will have additional 10 percent tax customs duty with 100 percent sales tax.

Betel nuts will have an additional 10 percent sales tax on 50 percent customs duty and 20 percent sales tax.

Vehicles depending on the cylinder capacity will see an increase of up to 20 percent in sales tax, a 5 percent in customs duty and 10 percent green tax.

Bartsham-Shongphu MP, Passang Dorji said that when the goods are taxed it is important to look at the supply-side economics.

He added the tax on food items has to go along with improving the agricultural produce, increase in vehicle tax and efficiency of public transport, and increase in high tax on furniture and supply of the raw materials for furniture-manufacturing units.

Opposition Leader, Dorji Wangdi said that the Bill could also include how to make the competitive advantage of the domestic industries.

He added that steel and cement are the major raw materials for construction in the country and we have the potential to manufacture them in the country.

Drametse-Ngatshang MP, Ugyen Wangdi said that if the country could produce goods, the increase in the tax would apply. “However, if the country could not produce enough then we still have to depend on the imported goods paying higher prices.”

Supporting the need to improve the competitive advantage of the local industries, Prime Minister Dr Lotay Tshering said that iron ore or pig iron which is the main raw material for the steel industries have to be imported from India.

Similarly, he said that coal is the main raw material in the cement industry. With Bhutanese coal, having a higher content of ash is not favourable for high-quality cement production.

Lyonchhen said that we have to import less ash-content coal from India. Bhutan needs and requested 300,000MT of coal from India. However, the Indian government has provided only 130,000MT.

He added that the economic policy experts would work to explore the potential of the country’s export trade.

The Bill was referred to the Economic and Finance Committee as a Money Bill for further review.

The committee will report to the house with its findings and recommendations on November 16.