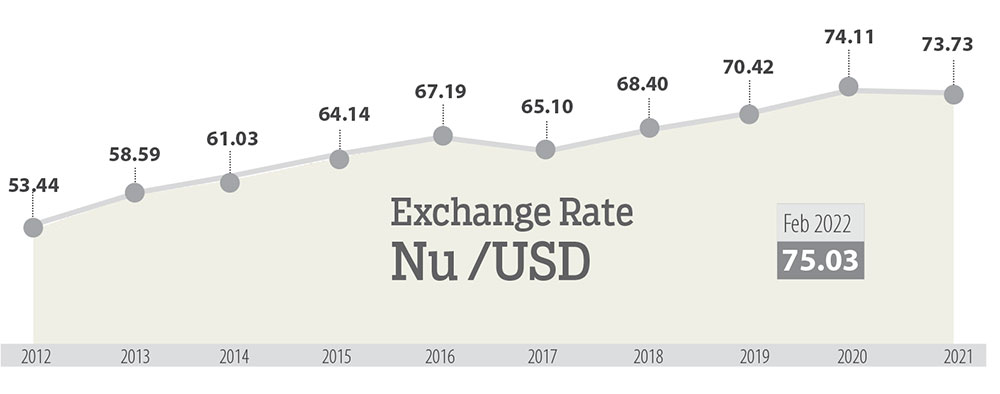

USD hits record high in February at Nu 75.03, expected to rise further

Thukten Zangpo

The Indian rupee (INR) has been depreciating against the US dollar (USD) in recent months and with the Ngultrum (Nu) pegged to the INR, there is a lot of pressure from the exchange rate fluctuations.

Since the Covid-19 pandemic, the Ngultrum has weakened by 5 percent. In February this year, the Ngultrum depreciated to 75.03. In 2021, it was Nu 73.33 against USD and Nu 53.44 in 2012.

Professor of economics at Royal Thimphu College, Sanjeev Mehta attributes widening India’s current account deficit (CAD) to the depreciation in the INR value. India’s CAD increased to USD 23 billion (B) in the third quarter (January to March) this year. The Reserve Bank of India (RBI) has more than USD 600B in convertible currencies (CC) reserves.

The USD appreciating significantly to INR is threatening India’s current account deficit.

This has led to a depreciation in the value of Rupee since more INR needs to be used to pay for higher imports.

The Russia-Ukraine tension has led to higher energy prices, which recorded a high of more than USD 100 per barrel. India imports nearly 85 percent of its crude oil from OPEC (Organisation of the Petroleum Exporting Countries) and payment is made in USD.

The US Federal Reserve has hiked the rate by 0.25 percent in March this year to reduce spiraling inflation and has signaled six more rate hikes this year, according to media reports. This means the cost of borrowing will increase.

Damber S Kharka, an economist, said the depreciation in the currency is because of an increase in demand for foreign currency.

He said that the increase in demand could be because of trade deficit, debt servicing, economic shocks critical due to sudden spikes in the prices of critical inputs, and economic recession. “Price goes up when demand goes up.”

According to Indian media reports, the INR is expected to depreciate to around 77.5 by March 2023. INR is currently the worst-performing Asian currency, according to media reports.

However, Sanjeev Mehta said that the actual magnitude of the depreciation will be lower if the RBI is willing to undertake exchange market intervention if India gets access to cheaper imports of oil from Russia.

Impact of Ngultrum depreciation

The immediate impact of depreciating Ngultrum is on importers. Importers need to shell out more Nu per dollar to make their payments.

However, it is a boon for exporters as they receive more Ngultrum in exchange for USD because overall export competitiveness improves an economy.

Bhutan’s export trade accounts for about half of its imports. While the import and export from countries other than India accounted for about 21 percent in 2021.

Bhutan imported Nu 90.23B worth of goods and exported Nu 57.99B worth of goods as of December 2021.

During this fiscal year, the central bank expected the CAD to deteriorate by 48.4 percent during this fiscal year, amounting to Nu 30.85B with a deterioration of trade balance combined with higher payments in primary income. Bhutan’s CAD was Nu 27.78B in the 2020-21 fiscal year or 12.7 percent of gross domestic product.

Costly imports will have a cascading effect on local prices, which will push the already inflated prices of goods in the country.

Moreover, the depreciating INR will also cause a further spike in fuel prices, which in turn will push up prices of other essential items.

Inflationary pressure has ticked to 6.03 percent in January this year breaching the RMA upper threshold inflation level of 6 percent.

General Manager of Bhutan Hyundai Motors, Pema Lodey, said that an electric car imported from Korea was costing Nu 2.5 million (M) to 2.6M when one USD was worth Nu 65. However, with depreciation, the same car cost Nu 2.7M.

Bhutan Hyundai motors imports 95 percent of Indian-made cars and 5 percent from Korea. Pema Lodey said that about 15 percent of the raw materials to build a car in India would have been imported.

Similarly, Procurement Manager of Kia Bhutan Motors, Saroj Rai, said his company used to procure vehicles from countries other than India and stock up. “The high dollar rate has discouraged people from buying,” he said, adding that there is an increase of Nu 3,000 to Nu 5,000 every year due to the Ngultrum’s depreciation against the dollar.

A depreciating value in Ngultrum would also mean that we have to pay more for the CC concessional loans from multilateral institutions and bilateral partners.

As of June 2021, the outstanding external debt increased by 11.5 percent to USD 3.2B (Nu 238.14B), of which 71.2 percent is INR debt and 28.8 percent is CC, according to the RMA.

With the Rupee/Nu pegging arrangement, a major portion of external debt denominated in INR has cushioned the impact of exchange rate risks. However, the CC debt amounting to USD 922.8M is subject to exchange rate risk.

“With the appreciation of the exchange rate from Nu 75.5 in June 2020 to Nu 74.4 in June 2021, the cost of CC debt servicing decreased by Nu 51.5M and the CC debt stock by Nu 1.06B,” according to the RMA.

Damber S Kharka said that the requirement to service foreign debts has a negative impact on reserve position but foreign direct investment (FDI) investments in our domestic market will help us.

“Negative changes in reserve position will have impacts on our capacity to import foreign goods, technology, and pay loans,” he added.

Bhutan has a CC reserve of about USD 1.3B as of December 2021 which is meeting the requirement of 12 months of essential imports as mandated by the constitution.

A main source of CC has been concessional external borrowings and grants from development partners. The tourism sector which used to be the major CC flow avenue is on hold because of the Covid-19 pandemic and travel restrictions. Tourism sector earned USD 225M in 2019.

However, Bhutanese living overseas sent Nu 8.6B or USD 108.74M as remittance of which Nu 3.4 was denominated in USD.

“Going abroad for short trips where you land up spending forex, will reduce our forex reserve but if people are going out to work, earn and send money home then our reserve will increase,” Damber S kharka said.

Similarly, a falling Ngultrum could also hurt those looking for overseas education as their costs swell, according to economists.