Thukten Zangpo

In the first quarter of this year, Bhutan witnessed a significant surge in imports, raising concerns over the country’s depleting foreign currency reserves.

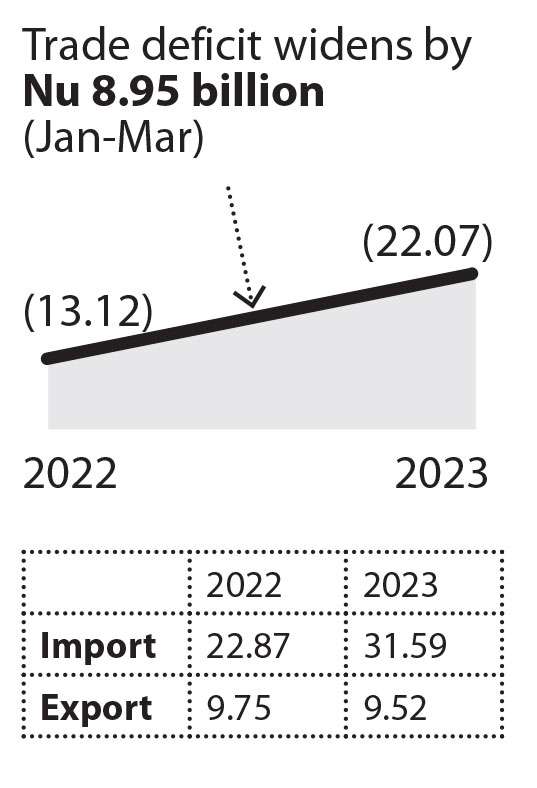

Recent figures from the Department of Revenue and Customs reveal a staggering 38 percent increase in imports, totalling Nu 31.69 billion compared to Nu 22.87 billion in the same period last year.

By percentage, the import figures were 6 percent higher compared to 2022 and the previous year.

In 2022, Bhutan’s import bill rose by approximately 32 percent to Nu 118.79 billion compared to the previous year.

Among the top ten imports, the surge in import bills was primarily driven by an increase in fuel, which soared to Nu 3.3 billion from Nu 1.71 billion during the same period. Additionally, smartphone imports rose to Nu 635.85 million from Nu 379.12 million, ferrous products increased to Nu 777.08 million from 357.44 million, and rice imports rose to Nu 751.71 million from Nu 677.19 million.

In contrast, exports to India and other countries experienced a decline of about 2.5 percent. Exports, including electricity, fell to Nu 9.52 billion from Nu 9.75 billion during the same period. Notably, ferrosilicon exports, one of the country’s top export goods, witnessed a decrease of approximately 23 percent, totaling Nu 3.73 billion in the first quarter of this year compared to Nu 4.85 billion in the previous year’s quarter.

Furthermore, Bhutan’s electricity export to India plummeted by about 70 percent, falling from Nu 721.84 million to Nu 218.51 million due to poor hydrology.

The surge in imports coupled with declining exports has widened the country’s trade deficit to Nu 22.07 billion in the first three months of this year, marking an increase of Nu 8.95 billion from the same period last year.

This trade deficit, where the value of imports exceeds the value of exports, has serious implications for Bhutan’s foreign currency reserves. The unsustainable rate of import increase, inflationary pressures, and the depreciation of the ngultrum against the USD further contribute to the decline of foreign reserves. These reserves are vital for financing imports, fulfilling international financial obligations, and managing sudden capital movements.

As of March 31, Bhutan’s debt in Indian Rupees stood at 159.16 billion and convertible currency in USD at 988.69 million.

Despite the government’s moratorium on the import of non-essential vehicles since August last year, the foreign currency reserves have dwindled from USD 736 million in August to USD 698.3 million as of March this year.

In an effort to preserve the foreign currency reserves, the government has suspended all housing loans, including those for home and hotel construction, from June 9 until December 31 this year.

According to the Asian Development Bank, if the reserves continue to decline at the rate of 2 percent per month as seen in 2022, Bhutan’s reserve position will breach the constitutional mandate of maintaining 12 months’ worth of essential imports.

The revised essential import values for 2023 stand at USD 603 million for the normal period and USD 464 million under critical circumstances.

With Bhutan heavily reliant on imports for more than 80 percent of its goods, the inadequate reserves pose a risk of being unable to pay for essential imports.

If the country’s reserves fail to improve, further moratoriums or bans may be imposed, potentially targeting the import of furniture, processed meat and food items, junk foods, alcohol, and LED televisions.

The urgency to address the issue and strengthen foreign currency reserves is paramount to ensure the country’s economic stability and ability to meet essential import needs.