… enough to finance 53 percent of domestic investment

Thukten Zangpo

Bhutan’s gross national savings last year went up by about 10 percent or Nu 4.85 billion (B) after falling for the last two consecutive years. However, it was below the pre-pandemic level.

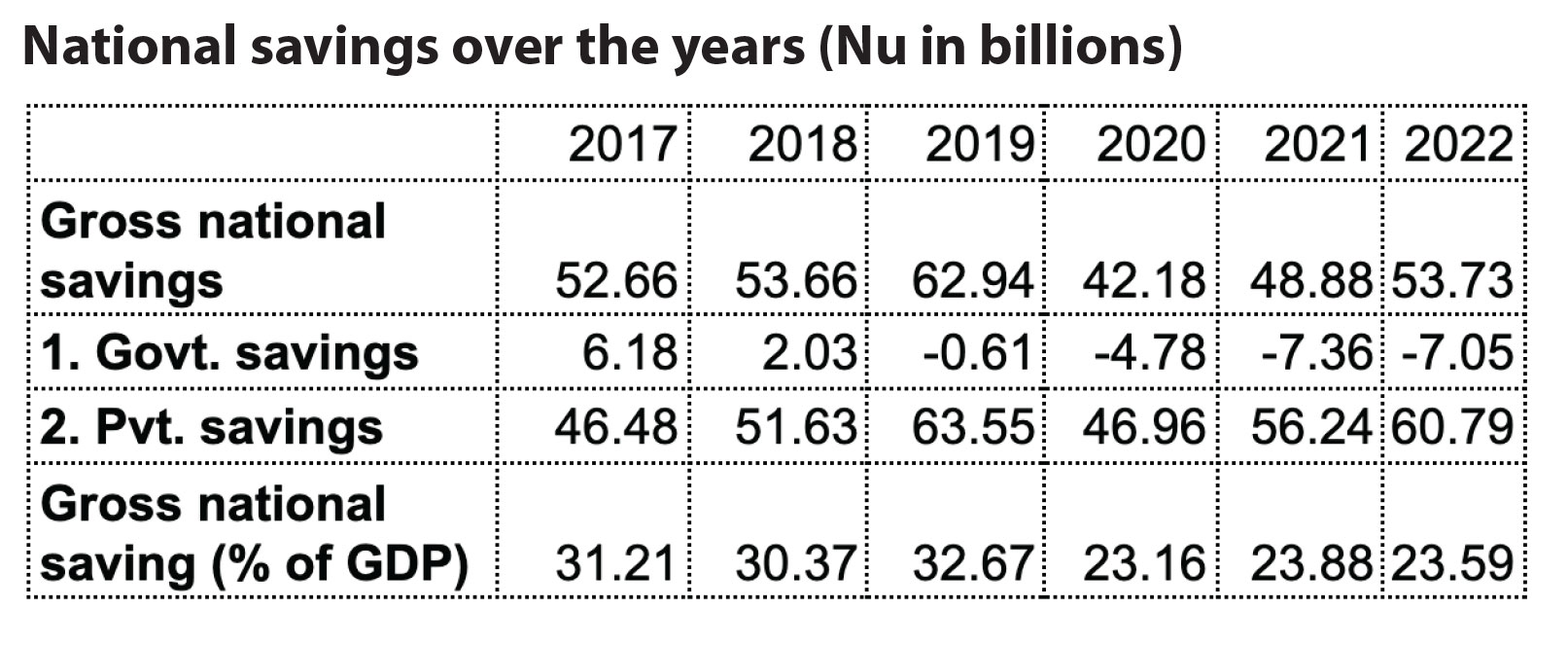

According to the National Statistics Bureau’s National Accounts Statistics 2023, the last year’s gross national savings were recorded at Nu 53.73B compared to Nu 48.88B in the previous year. The 2019’s savings was reported at Nu 62.94B.

According to the National Accounts Statistics 2023 report, the country’s gross national savings slightly declined to 23.59 percent of gross domestic product (GDP) in 2022 from 23.88 percent of GDP in 2021. However, it was below pre-pandemic levels—gross national savings stood at 32.67 percent of GDP in 2019 and 30.37 percent of GDP in 2018.

Gross national saving is derived by deducting final consumption expenditure from gross national disposable income and consists of savings for household, business, and government.

It is the difference between the nation’s income and consumption and is an indicator of a nation’s financial health which provides a source of funds for domestic investment-a key driver of labour productivity and living standards.

Despite trade and current account deficit, the national savings also consider capital inflow from loans and grants, which gives room for disposable income.

Of the total national savings, government savings stood at a deficit of Nu 7.05 billion and private savings was at Nu 60.79B.

Despite the increase in national savings last year, it could not meet the domestic investment demand, resulting in a savings-investment gap of Nu 70.84B.

“National savings were able to finance 53 percent of domestic investment which is a percentage point higher than 2021,” the report said.

The nominal investment last year was estimated at Nu 127.07B, which is higher than the gross national saving of Nu 48.36B in 2020. In real terms, investment recorded a growth of 9.93 percent 2022 as against 15.89 percent in the previous year—a decrease of 5.96 percentage points. Saving-Investment (SI) ratio for the economy was recorded at 0.53 in 2022, down by 0.09 percentage points from 0.62 in 2021.

The report also stated that the final consumption expenditure reported a growth of 3.1 percent last year compared to a growth of 0.17 percent in 2017. It was recorded at Nu 178.99B last year.

The private final consumption expenditure grew by 5.55 percent last year from the previous year. It was a drop of -2.41 percent in 2021, marking an increase of 7.96 percentage points. In current value terms, it was estimated at 131.11B last year, standing at 57.55 percent of GDP. The share of GDP increased by 5.43 percentage points compared to the previous year.

At the same time, the government’s final consumption expenditure, which accounted for 26.75 percent of the total final consumption expenditure, saw a drop in share by 0.04 percentage points compared to a share of 30.1 percent in the previous year. At current prices, it stood at Nu 47.88B, which is 21.02 percent of GDP.