Tshering Palden

A gewog account misappropriated more than Nu 10 million from the funds of Bidung, Radhi, Phongmey, and Shongphu gewogs in Trashigang in the past three financial years.

The accountant, Samten Lhamo served as the gewog accountant of the four gewogs. Most of the misappropriations occurred in fiscal years 2017-18, and 2018-19.

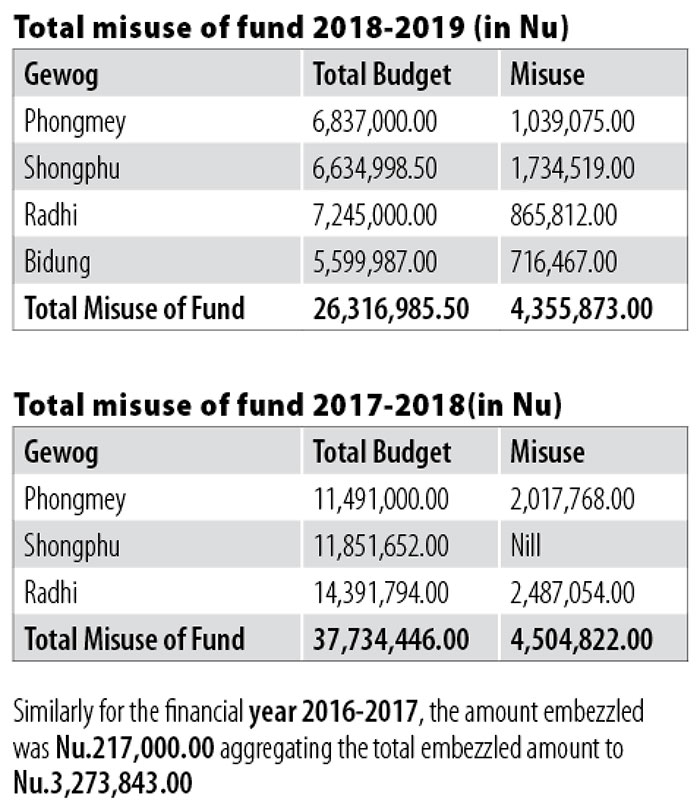

In the fiscal year 2018-19, she misappropriated Nu 4.356M which comes to about 17 percent of the entire budget allocated to the four gewogs in that particular fiscal year.

She misused Nu 1.735M or 26 percent of the Shongphu gewog budget, embezzled Nu 1.039M from Phongmey gewog budget and the rest from Bidung and Radhi gewogs.

In 2017-18 fiscal year, she had misappropriated Nu 4.505M or 12 percent of the budget allocated to the two gewogs of Radhi, and Phongmey.

She had misappropriated Nu 716,467 from the Bidung gewog budget in 2018-19 fiscal year.

Radhi gewog lost Nu 4.308M in the three financial years including Nu 855,000 that she embezzled in 2016-2017 colluding with her husband a gewog Agriculture Extension supervisor, during the period of three financial years.

She embezzled Nu 2.365M from the Shongphu gewog funds in three fiscal years from 2016-17 to 2018-19.

Phongmey gewog lost Nu 3.57M for the financial year 2017-2018 and 2018- 2019. She misused close to Nu 1.04M in 2017-18 fiscal year which was 16 percent of the gewog’s total budget for the year. In the following fiscal year, she misused 18 percent or about Nu 2.02M of the gewog’s total budget.

Similarly, for the financial year 2016-2017, she embezzled Nu 217,000. Altogether she embezzled about Nu 3.3M.

The accountant had bought sesho kira, tego, cosmetic creams, other clothes and items, and also paid towards the cost of a Toyota Hilux she bought. She also paid transportation charges for sand delivered to her house construction from the gewog funds.

Although gewog administrations claimed to complete the capital activities and achieve the work progress, the physical verification revealed that some works were not completed but the budget for the same activity was already exhausted. In some instances, there was a balance left from the capital activity, which was later misused.

How did the accountant do it?

One of the major factors for such a huge lapse was the lack of proper supervision and monitoring controls to curb such fraudulent and corrupt practices in future.

Auditors said that in some cases blank cheques were signed by the Gup and gewog administrative officer which provided avenues for SamtenLhamo to embezzle the gewog fund.

The gup and the gewog administrative officers in their response to the auditors stated that they have operated based on trust.

The gewog administration stated that they did not know about the deposits made from the gewog LC account as the accountant has manipulated the system.

Samten Lhamo admitted that she had prepared the voucher in the system without making payment to make system tally and also prepared the double voucher to make system tally.

Samten Lhamo considered the budget of four gewogs of Shongphu, Radhi, Phongmey and Bidung as a single budget head and made payments as per her convenience, without considering the budget lines.

To manipulate the records, she created fake names and particulars in the vouchers just to make it appear that the expenditures were made from individual detailed account code and name to ensure that the balances in the PEMS and bank statement tally faultily.

Auditors pointed out that the compliance with the requirements of monthly reconciliation of transaction of the gewogs by the dzongkhag administration was not in practice for these four gewogs providing avenues for manipulating the financial records.

In some cases, she tempered documents/records, and fund transfer.

Samten Lhamo’s misconduct will also land supervisors in the dzongkhag into trouble.

As per the provisions of Bhutan Civil Service Rules 2018 (BCSR 2018), the dzongkhag administration has to take administrative actions against her supervisors.

Section 3.5.4 of the BCSR 2018 states that a civil servant, particularly in a managerial and supervisory role, would be liable for supervisory accountability in the event serious corruption or official misconduct charges are brought against his subordinates, for the lack of his supervision and reporting to an authority.

Section 19.5.8 stipulates, “A supervisor shall be liable for administrative actions, for any major corruption or grave official misconduct of his subordinates even if the supervisor concerned is not directly involved in such misdeeds.”

The accountant was transferred to the dzongkhag court in December last year. Auditors found that there were no proper handing-taking records done.