Thukten Zangpo

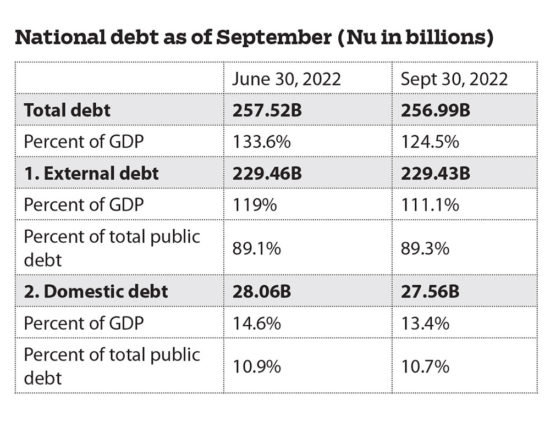

The country’s national debt as of September was Nu 256.99 billion (B), showing a marginal decline of 0.2 percent or Nu 526.05 million (M) from June, the recent report from the finance ministry states.

This was mainly because of external debt declining by Nu 26.05M and domestic debt by Nu 500M in the same period.

The total debt to gross domestic product (GDP) ratio estimate for the fiscal year 2022-23 decreased from 133.6 percent to 124.5 percent during the same period.

While the level of public debt is still high, the finance ministry’s report stated that the risk of public debt distress is moderate. This is because about 95.3 percent of the debt is at the fixed interest rate and that limits the exposure to interest rate variables.

Additionally, the major portion of external debt is for hydropower (71 percent of the total external debt) with 95.5 percent of hydro debt denominated in INR with a ready electricity trade market in India. It does not pose any risks as Rupee is pegged at par with Ngultrum.

The remaining 29 percent are convertible currency (CC) debt that are concessional loans with nominal interest rates from 0 percent to 1.5 percent and long grace periods between 8 to 10 years and repayment periods up to 40 years.

The outstanding Rupee debt was INR 155.03B while USD 907.34M which is equivalent to Nu 74.41B was outstanding CC debt.

“The Ngultrum value of CC debt increased marginally by Nu 345.38M in September from June owing to the ongoing project loan disbursement,” the report stated.

Hydro debt of Nu 162.85B is the debt stock of six hydropower projects – Mangdechhu, Punatsangchhu-I, Punatsangchhu-I, Nikachhu, Dagachhu, and Basochhu. It constituted 72 percent of total external debt and 78.9 percent of the estimated GDP.

The non-hydro debt of Nu 66.58B constitutes 29 percent of the external debt and 32.3 percent of the estimated GDP. “The non-hydro debt to GDP of 32. 3 percent is within the 35 percent threshold prescribed by the Public debt policy,” the ministry stated.

The non-hydro debt is categorised under non-hydropower development debt, non-hydro commercial debt and non-hydro central bank debt.

As of September, the outstanding non-hydro development debt was Nu 52.54B, the outstanding non-hydro commercial debt was Nu 7.05B and the non-hydro central bank debt was Nu 7B.

The Indian government remains the country’s largest creditor. As of September 30, 66 percent of the total external debt was owed to the Indian government, followed by 15 percent to Asian Development Bank and 13 percent to the World Bank. The remaining, about 6.4 percent, was owed to the International Fund for Agricultural Development, Japan (JICA), Austria, SBI or EXIM bank and SAARC Development Fund.

The domestic debt, however, stands at Nu 27.56B, constituting 10.7 percent of the total public debt. It saw a decrease of Nu 500M in September from June this year.

This is because of Nu 15B government treasury bills and Nu 11.5B issued to manage cash flow fluctuations and domestic borrowings from National Pension and Provident Fund for refinancing of Bhutan Hydropower Services loan to the Deutsche Investitions (DEG), Germany.

External borrowings, 89.3 percent of the public debt, stand at Nu 229.43B as of September this year.

The government budgetary debt at Nu 210.46B constitutes 91.7 percent of the total external debt. It includes borrowings for budgetary activities, hydropower projects, and loans availed by the government and lent to public corporations. The debt service obligations for these loans are borne directly by the government.

Corporate debt, borrowings directly contracted by the public corporations, was Nu 11.97B accounting for 5.2 percent of the total external debt. The debt service obligations for these loans are borne by the state enterprises.

The central bank debt is made of Standby Credit Facility of INR 7B availed from the Reserve Bank of India swap arrangement to support the country’s balance of payment.

Besides, the government has also issued sovereign guarantees for state enterprises namely National Housing Development Corporation Limited, Bhutan Agro Industries Limited, Bhutan Development Bank Limited, and Drukair Corporation Limited worth Nu 5.31B.