Thukten Zangpo

Over the past five years, Bhutan’s tax-to-gross domestic product (GDP) ratio has averaged at 13.5 percent, a figure that falls below the World Bank’s benchmark of 15 percent.

According to the World Bank, countries with tax collections below this level must strive to enhance their revenue generation in order to meet the essential needs of citizens and businesses.

Attaining this level of taxation is seen as a crucial tipping point that propels a state towards viability and sets it on a trajectory of growth.

The tax-to-GDP ratio serves as a measure of how effectively a government manages the country’s economic resources.

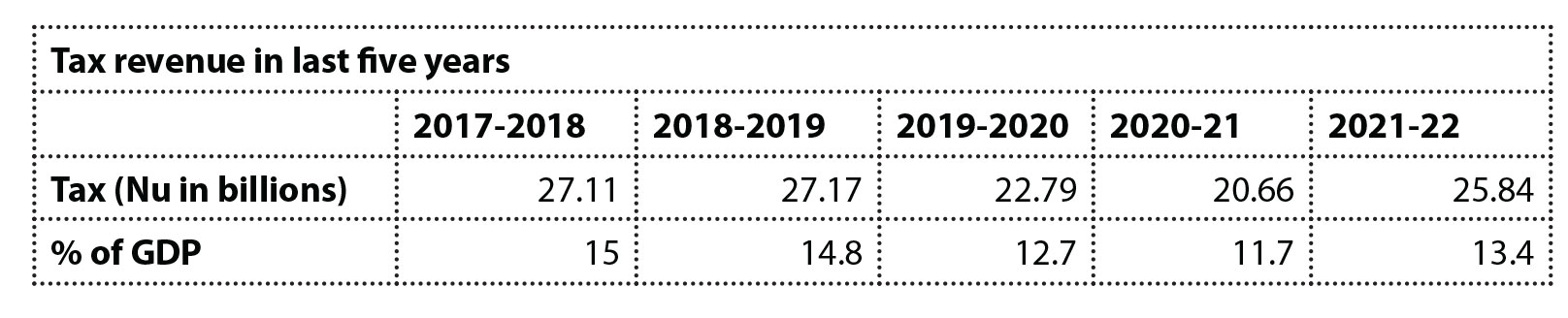

Prior to the Covid-19 pandemic, Bhutan achieved a 15 percent tax-to-GDP ratio in the fiscal year 2017-18, with tax revenues totaling Nu 27.11 billion. However, revenue collection gradually declined to Nu 20.66 billion, equivalent to 11.7 percent of GDP, in the fiscal year 2020-21.

In the fiscal year 2021-22, tax revenue witnessed a 25 percent increase to Nu 25.84 billion compared to the previous year, contributing to 13.4 percent of GDP. This represented a 1.7 percentage point increase.

The Asian Development Bank (ADB) points out that numerous developing countries struggle to achieve a tax yield of 15 percent of GDP due to a limited tax base and the overall low capacity of tax administration, which are now widely recognised as hindrances to sustainable development.

The ADB emphasises the significant importance of strengthening domestic resource mobilisation and increasing tax revenues for countries to finance their sustainable development goals and promote medium-term fiscal sustainability.

Bhutan’s tax-to-GDP ratio lags behind the Asia and Pacific countries’ average of 19 percent, as well as the 33.5 percent average among OECD countries.

Tax revenue plays a crucial role in addressing Bhutan’s growing fiscal deficit. The country’s projected fiscal deficit of Nu 15.33 billion, or 7.36 percent of GDP, is expected to rise to Nu 22.9 billion or 11.25 percent of GDP, by 2022-23.

Based on the revenue collection figures from the fiscal year 2021-22, the highest share of tax revenues stemmed from corporate income tax. Among the major tax components, corporate income tax accounted for 38.9 percent, goods and services tax contributed 28.8 percent, and royalties made up 17 percent of the total tax revenue.

Corporate income tax saw a significant improvement, reaching Nu 10.06 billion in the fiscal year 2021-22, representing a 39 percent increase from the previous year. This boost was attributed to higher tax revenue from state-owned enterprises.

Business income tax also increased to Nu 1.3 billion from Nu 1.08 billion, while personal income tax rose to Nu 1.96 billion from Nu 1.37 billion during the same period, among other positive trends.

Sales tax revenue experienced a notable jump from Nu 4.11 billion to Nu 5.6 billion. Various sectors, including sales tax on goods and commodities, petroleum products, and hotels and restaurants, including tobacco products, contributed to this tax category.

However, customs duty, which pertains to tax collections from international trade and transactions, witnessed an 8.1 percent decrease, totalling 509.98 million. This decline was primarily due to the reduction of the customs duty rate to a flat rate of 10 percent.

Royalties also recorded a decline of 9 percent, amounting to Nu 4.39 billion during the same period. This decrease was primarily attributed to reduced collections from mines and minerals royalty, along with a slight decrease in hydropower royalty.

Furthermore, the government estimated a foregone tax revenue of Nu 3.31 billion in 2021-2022 due to the implementation of fiscal incentives. These incentives are policy tools devised to stimulate private sector growth, generate employment opportunities, and attract foreign investments to Bhutan.

According to the Royal Monetary Authority, tax revenue is expected to increase to 13.2 percent and 13.8 percent of GDP in the fiscal years 2022-23 and 2023-24, respectively. This growth is anticipated to stem from improvements in domestic tax revenue, including customs duty, sales tax, domestic excise duty, and green tax.