Capital budget gets the bigger share this time

MB Subba

The annual budget for the fiscal year (FY) 2020-21 has reversed the trend of increasing share of current expenditure vis-à-vis the capital expenditure.

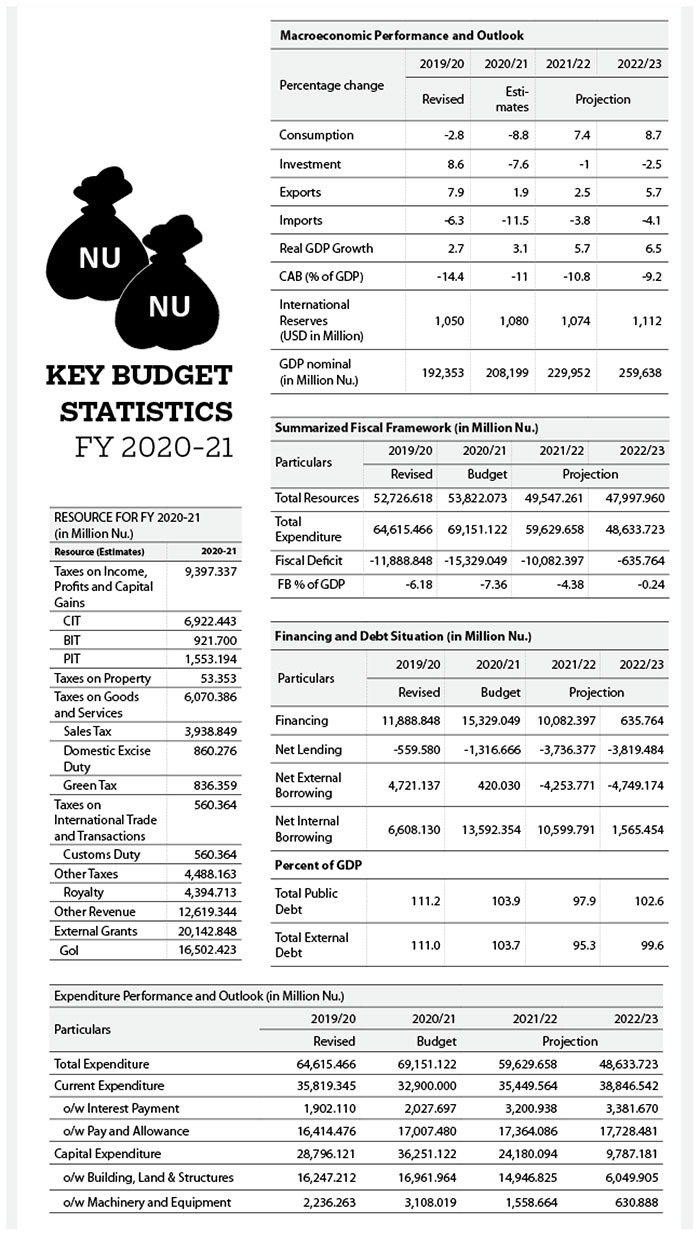

The finance minister presented a total budget appropriation of more than Nu 73,989 million (M) in the National Assembly yesterday.

The government has allocated Nu 32,900M, which is 44 percent of the total allocation, for recurrent expenditure and Nu 36,251M or 49 percent as capital expenditure. The balance of Nu 4,838.759M, which is 7 percent, is for principal repayment and on-lending.

The government has increased the total budget allocation by 14 percent from FY 2019-20 despite an estimated 14 percent decrease in the domestic revenue on account of Covid-19. The budget increase is attributed to the frontloading of 12th Plan activities to offset the impact of the pandemic on Gross Domestic Product (GDP).

“In many years, the government has allocated more capital budget than the recurrent budget,” Finance Minister Namgay Tshering said.

The recurrent budget has decreased by 5 percent from the FY 2019-20. Accordingly, the current expenditure has been adjusted within the available domestic revenue in keeping with the constitutional requirement of meeting the recurrent expenditure from internal resources.

Of the total capital expenditure requirement, 56 percent would be mobilised through grants, 11 percent through external borrowings and the rest through internal borrowings.

“The government will make concerted efforts to additional grant financing and concessional external borrowings to improve fiscal position and minimise domestic borrowings,” the finance minister said.

During the new fiscal year, the total repayment is more than Nu 3,624M, of which Nu 3,612M is for external borrowings and Nu 12M for domestic borrowings.

Financing and fiscal deficit

The fiscal deficit for FY 2020-21 is estimated at Nu 15,329M.

Lyonpo Namgay Tshering said that the net borrowing requirement for the FY 2020-21 was Nu 14,012M. The government will resort to external borrowing of Nu 420M and domestic borrowing of Nu 13,592M.

According to the budget report, while external borrowings will be made from multilateral development banks at concessional terms, domestic financing will be raised from the domestic market through issuance of T-Bills and long-term government bonds. “The government will ensure that private sector credit is not crowded out,” he said.

On the level of domestic borrowing for financing the fiscal deficit, the government has consulted the Royal Monetary Authority (RMA), which has advised the government to mobilise fund through the issuance of marketable government securities.

External borrowings are sourced from the ADB, World Bank and International Fund For Agricultural Development (IFAD) for financing investment projects and programmes.

“The borrowings from these institutions are at highly concessional terms, with a nominal interest rate of 0 percent to 1.5 percent, and service charge of 0.75 percent. The loans from these institutions have a maturity period of 32 to 40 years, including a grace period of eight to 10 years,” the finance minister said.

The government estimates external budgetary borrowings during the new fiscal year at Nu 4,032M, of which Nu 1,842M is project-tied borrowings, and Nu 2,190M is programme borrowing.

While the entire programme borrowing is for financing budgetary activities, the project-tied borrowing of Nu 1,214M is for on-lending (lending borrowed money).

Concessional external borrowings sourced by the government will be provided for financing projects by State Owned Enterprises (SOEs) in the form of on-lending.

The government will on-lend Nu 140.72M to Bhutan Power Corporation (BPC) for rural electrification project, and Nu 1,073M to Druk Holding and Investments for Phuentshogling township development project.

The domestic borrowing for FY 2020-21 is estimated at Nu 13,604M.

The total debt servicing for the fiscal year is projected at Nu 5,652M, of which interest payment is Nu 2,027M and principal repayment is Nu 3,624M.

The external debt servicing is Nu 5,387M, which accounts for 95.3 percent of the total debt servicing, and domestic debt servicing is Nu 264M, which is 4.7 percent of the total debt servicing.

About 44.1 percent of the external debt servicing is to the Government of India on account of the Mangdechhu Hydropower Project (MHP) debt servicing. The rest is to multilateral agencies such as ADB, World Bank, IFAD and bilateral creditors.