Bhutan’s domestic energy requirement is expected to more than double in the next two years according to the electricity tariff revision proposals submitted by the power sector to the Bhutan Electricity Authority earlier this year. The Druk Green Power Corporation (DGPC), Bhutan Power Corporation (BPC) and Mangdechhu Hydroelectric Project Authority, which constitutes Bhutan’s power generation, transmission and distribution companies has proposed to revise the tariff for efficient business operation and for infrastructural expansion and up-gradation.

The demand for energy in the country will be pushed by a row of new power intensive industries that are proposed to be established in the country. A multitude of HV (high voltage) and MV (medium voltage) industries are being set up in the Jigmeling and Motanga industrial parks, in Gelephu and Samdrup Jongkhar. Also The Jigmeling industrial estate will be Bhutan’s biggest and in November last year, it started the construction of 10 factories.

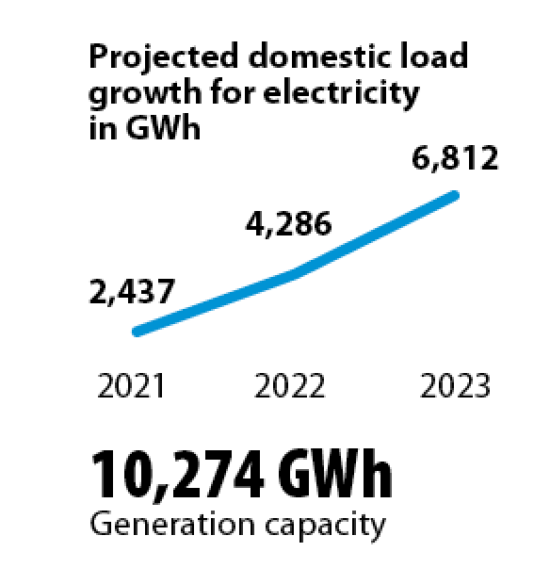

With the establishment of many high and medium voltage industries, Bhutan’s total domestic requirement will increase from 2,437 Giga Watt hours (GWh) this year to 6,812 GWh by 2023 (see graph). Although Bhutan produces surplus energy, generation will not be able to meet domestic requirement in the lean seasons. According to BPC’s proposal, the power scenario in Bhutan has undergone a major shift with demand growth in the industrial sector outpacing capacity addition. “We are already experiencing instances of net imports during the lean generation months.”

DGPC’s managing director, Dasho Chhewang Rinzin in an earlier interview said, with renewed focus on industrial development based on the projected 10,000MW plan by 2020, there has been unprecedented acceleration in the demand growth of electricity, but on the supply side, capacity addition has not taken place and is unlikely to gain momentum at least in the near future. Last winter, while Bhutan’s domestic peak demand was at 450 megawatt, the firm power capacity of the generating plants was 400 megawatt.

Bhutan will continue to be a net exporter of electricity on an annual basis, but in the lean generation months, Bhutan will be required to import more power. Currently, the power shortage faced by Bhutan during winter is met through imports from India. Although there has been no significant imports so far, the Druk Green Power Corporation has started importing power from the Indian Energy Exchange for the first time last winter.

Due to hydrology and design of the existing hydropower plants, generation in winter dips to about a fifth of its installed capacity.

The solution to meet the rising domestic demand for energy is to add more generation capacity to increase firm power capacity. However, this also poses the problem of how to market the over capacity during the summer months. While Bhutan could develop mini and small hydropower plants or hybrid solar to meet the demand, developing storage or pondage plants are being considered in the long run. Industries could also be allowed to develop captive power plants.

As Bhutan’s power shortage worsens in the face of rising domestic demand especially from industries, it presents a strong case for the region to develop new and efficient model of electricity import by HV industries from India during winter, such as through power purchase agreements between Bhutanese industries and Indian distributors.

Bhutan has already participated in the Indian energy exchange, called the Day-Ahead market for purchase of power from India last winter. It is anticipated that overtime, India will open up new market mechanisms for neighboring countries that will further ease cross border trade of electricity in the region.

Hydropower development in the country is expected to pick up pace with the opening up of the economy post pandemic and availability of Indian workers. The sector faced extreme labor shortage at the peak of the pandemic which delayed the construction of the Punatsangchhu II and Nikachhu hydropower projects.

The two hydropower projects are now set to be commissioned in 2023.

Energy cooperation in the region through regional grid interconnection was discussed during the BIMSTEC ministerial meeting in April. In the long run, a common regional grid will address Bhutan’s concern of marketing its overcapacity in summer as it could sell to other countries in the region as well as ease imports during winter.

Going forward, Bhutan and India must also reconsider the current model of hydropower development in the country to avoid further cost escalations and delays.

Contributed by

Nidup Gyeltshen

The story is being covered by the Institute of Happiness for a research conducted on the effects of cross border

energy trade.