Thukten Zangpo

The domestic revenue saw a growth of 14.94 percent with the collection of Nu 44.87 billion in the fiscal year 2022-23 compared to the previous fiscal year.

This, according to the finance ministry, was equivalent to 18.93 percent of the gross domestic product.

Tax revenue accounted for 70.12 percent of the domestic revenue while non-tax revenue accounted for 29.88 percent.

In monetary terms, the tax revenue increased to Nu 31.47 billion, an increase by Nu 5.62 billion or 21.8 percent because of higher collection from corporate income tax, business income tax, personal income tax, sales tax among others.

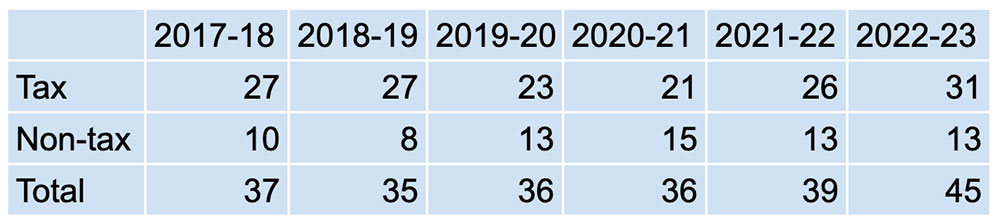

Domestic revenue in last five fiscal years (Nu in billions)

Non-tax revenue, which is mainly dividends, interests from corporations, and administrative fees, contributed Nu 13.41 billion, an increase of only about 1.5 percent compared to the previous year.

According to the finance ministry, the increase in tax revenue was due to an increase in direct tax by Nu 1.34 billion, indirect tax by Nu 1.99 billion, and other taxes by Nu 2.3 billion, which is an increase of 9.93 percent, 24.97 percent, and 52.12 percent respectively.

Increase in direct tax was mainly due to increase in tax on income, profit and capital gains while increase in indirect tax was due to taxes on international trade and transactions and increase in other taxes was due to increase in royalty from tourism.

Corporate tax collected in the fiscal year 2022-23 saw an improvement to Nu 10.49 billion from Nu 10.06 billion from the previous fiscal year.

Business income tax increased to Nu 1.71 billion from 1.3 billion while the personal income tax also saw an increase to Nu 2.44 billion from Nu 1.96 billion during the same period.

Taxes on goods which includes sales tax, excise duty, and green taxes also saw a jump by 22.95 percent to Nu 9.16 billion from Nu 7.45 billion in the previous fiscal year.

At the same time, the customs duty, which is tax collection on international trade and transactions (customs and other import duties) was up by 54.39 percent to Nu 787.38 million during the same period.

Royalty recorded a 51.13 percent to Nu 6.63 billion in the 2022-23 fiscal year. This was mainly because of the government collecting Nu 1.17 billion sustainable development fee and visa fees, of which Nu 1.1 billion was from USD-paying tourists (10, 802 individuals) and Nu 67.97 million from Indian Rupee-paying tourists after the opening of international borders in September last year.

However, the revenue collected from property income and social contribution saw a decrease by Nu 69.75 million or 0.6 percent from the previous fiscal year. The decrease was mainly because of a decrease in dividend contributions from Druk Holding and Investments by Nu 552. 23 billion followed by interest receipts from the corporation at Nu 33.5 billion.

While, the profit transfers from the Royal Monetary Authority and Mangdechhu hydro project increased by 8.91 percent, amounting to Nu 370.76 million and Nu 60.74 million respectively.

Conversely, the current expenditure for the fiscal year 2022-23 saw an increase by 2.85 percent compared to the previous fiscal year at Nu 35.43 billion.