MB Subba

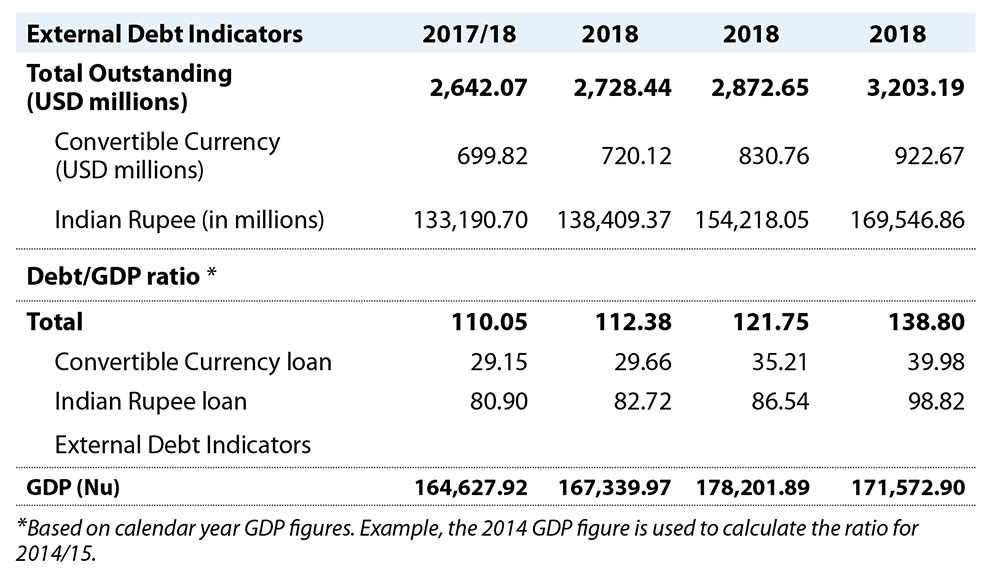

The country’s outstanding external debt increased to a record high of 138.8 percent of the Gross Domestic Product (GDP) at the end of the fiscal year 2020-21 from the previous high of 121 percent.

The external debt in the convertible currency (CC) and the Indian Rupees (INR) combined stands at Nu 238.143 billion (B), according to the central bank’s monthly statistical bulletin for March 2022.

The debt stock does not include debts raised by the government from the domestic market.

While Nu 68.596B (USD 922.7M) of the debt was is in convertible currency, Nu 169.546B was in INR.

Of the total INR debt, Nu 148B is of the four hydro projects of Punatsangchhu I and II, Mangdechhu and Nikachhu.

Observers say that the country was highly indebted at a time when the revenue had decreased and the CC earning from tourism had stopped since March 2020.

Some express concerns that the country could face difficulties to repay if the loans continue to pile up given the limited sources of the convertible currency.

The government has claimed that the hydropower projects are self-liquidating in nature. However, officials said that the delay in hydropower projects could worsen the debt situation due to cost escalations.

About 71 percent of the total external debt is in INR while about 29 percent are in the convertible currency.

The country owes a majority of the CC debts to the World Bank, the Asian Development Bank, Japan International Cooperation Agency (JICA), and the governments of Austria and Denmark.

Finance Minister Namgay Tshering said that the government had expedited grants while the loans were concessional.

He added that the government had limited sources of earning hard currency and that concessional borrowings were one of the few options. He added the concessional borrowings were invested in areas that would yield returns.

According to the State of the Nation report, the domestic debt stock increased by Nu 4B million (23.4 percent) in September last year, compared to the domestic debt stock of 30 June 2021.

The increase was due to the additional issuance of T-bills for cash management purposes during the quarter.

However, the State of the Nation report acknowledged that the cost escalations and delay in commissioning of ongoing hydropower projects, which increases interest during construction (IDC), would significantly increase the debt-servicing cost of the projects.

Non-hydro debts are contracted from bilateral and multilateral development banks at highly concessional terms, with very low-interest rates ranging from 0.75 percent to 1.5 percent, and repayment periods as long as 30 years.

According to the government, more than 95 percent of the external debt is fixed-rate debt indicating a low-interest rate risk. The rollover risk is also low as only two percent of the debt is projected to mature in the next one year.

The GDP decreased from Nu 178.2 at the end of the fiscal year 2019-20 to Nu 171.572B at the end of the fiscal year 2020-21.