The country’s external debt is projected to increase by 5.8 percent, totaling to Nu 225.735 billion (B) by the end of June 2021 from Nu 213.383B in June 2020, according to the annual budget report 2021-22.

The growth is mainly due to hydro loan disbursements of Nu 9.895B in the fiscal year 2020-21 and budgetary loan disbursements of Nu 6.44B mainly from the Asian Development Bank (ADB) and World Bank.

The external debt to Gross Domestic Product (GDP) ratio is projected to peak at 125.9 percent in the fiscal year 2022-23 before sliding to 113.7 percent in the fiscal year 2023-24.

Among other factors, the projected loan disbursement for Kholongchu and Punatsangchhu-I hydropower projects are also expected to contribute towards the increase in the external debt-to-GDP ratio.

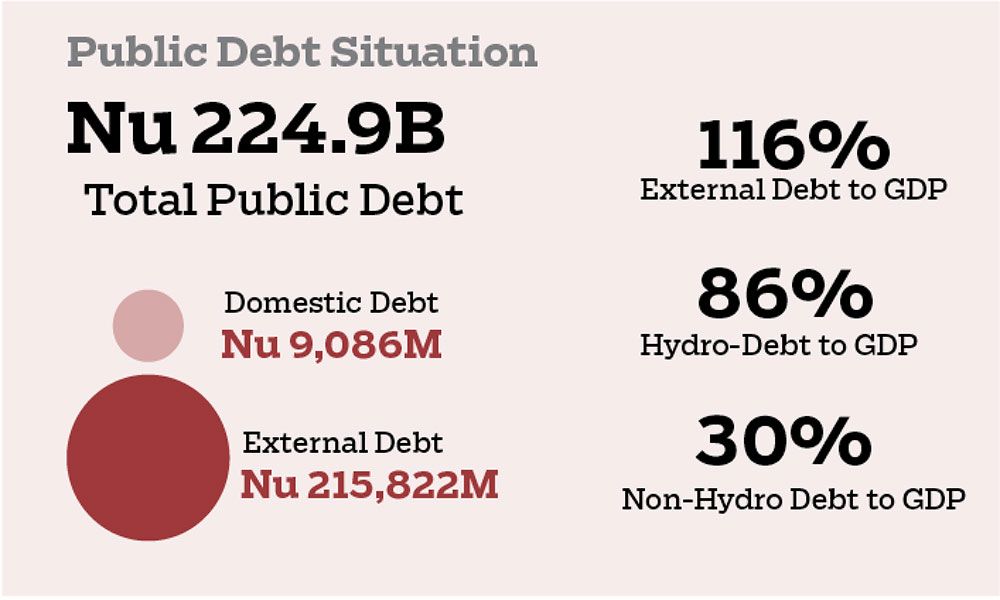

The total public debt stock, including domestic borrowings as of March 31 stood at Nu 224.909B, accounting for 120.5 percent of GDP.

Of the total public debt, the external debt is Nu 215.822B million and domestic debt is Nu 9.086B.

The hydropower debt stock is more than Nu 160B which accounts for 74.2 percent of total external debt. The non-hydro debt is Nu 55.787B, which is about 29.9 percent of GDP.

The non-hydro-to-GDP ratio is well within the Public Debt Policy threshold of 35 percent.

The gross financing need (GFN), which includes the fiscal deficit, for the new fiscal year is estimated at Nu 19.722B.

Presenting the budget on May 28, Finance Minister Namgay Tshering said that the GFN would be financed through borrowings from the external concessional windows and domestic market.

According to the budget report, the government claimed that its financing decisions are prudent and public debt is maintained at a sustainable level.

“The government will continue managing public debt in such a manner that the public sector’s financing needs and debt service obligations are met in a timely manner, at the lowest possible cost, while also supporting development of an efficient domestic capital market,” the report stated.

It also stated that the government plans to prioritise borrowing from external concessional windows to lower the financing cost, while meeting balance funding needs from the domestic market through issuance of T-Bills and long-term bonds to facilitate development of a vibrant domestic debt market.

As of March 31, 2021, the external debt constituted 96 percent of total public debt and accounted for 115.6 percent of GDP.

The external debt is mainly on account of borrowings for hydropower development and concessional external borrowings to finance infrastructure development.

The non-hydro debt to GDP ratio is projected to reach 32.7 percent in the fiscal year 2021-22 mainly caused by project-tied and program borrowings of Nu 6.086B. However, the ratio is forecasted to fall after fiscal year 2021-22.

The non-hydro debt to GDP ratio is forecasted to remain within the 35 percent threshold.

The external borrowing for fiscal year 2021-22 is estimated at Nu 6.086B, of which Nu 4,470.634B is programme borrowings and Nu 1.616B is project-tied borrowings.

The entire programme borrowings are for financing the government’s budgetary activities, whereas Nu 909.4 million (M) of the project-tied borrowings are for lending to the state-owned enterprises.

In the fiscal year 2021-22, external concessional borrowings are expected to meet only 30.9 percent of financing requirements.

The government has estimated that about 69.1 percent or Nu 13.636B has to be financed from the domestic market.

By MB Subba

Edited by Tashi Dema