Thukten Zangpo

In the last four years, the country’s external debt repayment burden has continued to rise and is projected to increase further in this 2023-24 fiscal year.

The finance ministry, however, maintains that it is within the threshold limit.

As the country’s external debt grew from Nu 213.38 billion in fiscal year 2019-2020 to Nu 244.19 billion in fiscal year 2022-23, external debt service ratio has also increased.

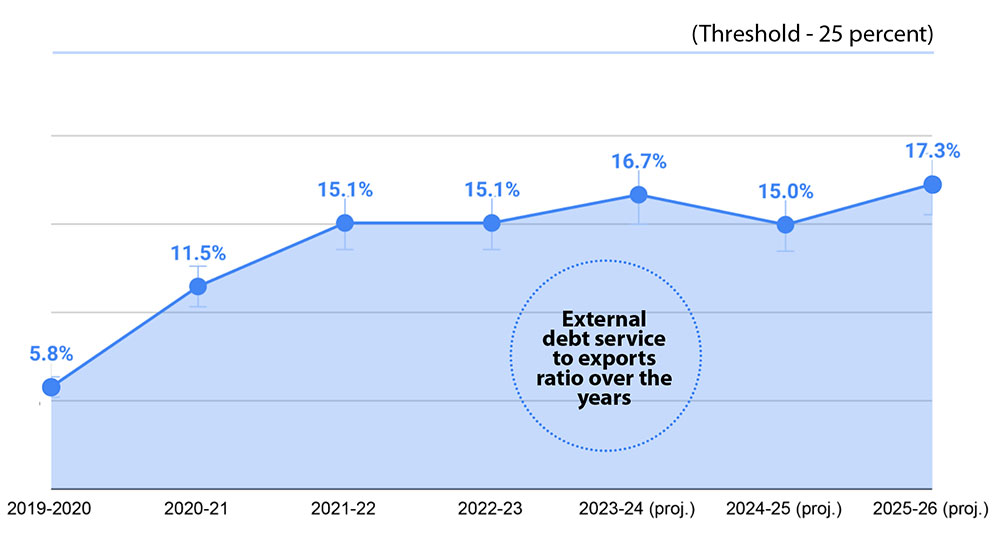

The debt service ratio is the ratio of a country’s debt service payments, including both principal and interest repayments, to its export earnings.

A lower ratio signifies a healthier economy, as it indicates either an expansion of export earnings or a smaller amount of loan repayment.

The country’s external debt service ratio, as per the finance ministry, increased to 15.1 percent or Nu 9.22 billion in 2022-23 fiscal year from 5.8 percent in fiscal year 2019-2020. This is projected to grow to 16.7 percent or Nu 9.49 billion in this fiscal year 2023-24, and ease to 15 percent in the following fiscal year.

For this fiscal year, more than 50 percent or Nu 4.8 billion debt servicing will be for Mangdechhu in INR and remaining convertible currency to Asian Development Bank equivalent to Nu 2.34 billion, Nu 1.3 billion to World Bank, Nu 723 million to Austria, 180.1 million to the International Fund for Agriculture Development, and Nu 144 million to Japan International Cooperation Agency.

In the 2025-26 fiscal year, debt service ratio is expected to climb to 17.3 percent.

The Public Debt Policy requires the annual external debt service ratio to be maintained at 25 percent.

According to the finance ministry, the commissioning of Nikachhu in December this year and Punatshangchhu II in December next year will increase exports but also will increase the debt servicing. “The growth in export earnings is expected to outweigh the growth in debt servicing.”

The government had arranged short-term borrowings to ease rupee shortage—INR 3 billion in June 2012 and INR 4 billion in March 2013. As of June, this year, the government had repaid INR 3.51 billion as interest which left an outstanding payment of INR 7 billion.

The government of India extended the settlement period for these two-rupee standby credit facilities by five more years with a reduced interest rate of 2.5 percent from 5 percent. The settlement period was due to expire on June 30 last year.

The total INR borrowings as of June this year stood at INR 160.15 billion, about 65.6 percent for hydropower projects. Debt in convertible currency stood at USD 1.02 billion or Nu 84.03 billion.

The external debt to GDP ratio was recorded at 120.6 percent of gross domestic product.