Thukten Zangpo

Judging by the detailed study the Royal Audit Authority (RAA) conducted on the function of the National Cottage and Small Industry (CSI) Development Bank Limited, the bank’s fate is likely to be sealed.

The bank is not covering its operating cost and has to depend heavily on the government’s equity injection while its operation is not viable financially, the study found.

The bank’s function was also found overlapping with that of Bhutan Development Bank Limited (BDBL) and the authority recommended curtailing avoidable and unwarranted cost centers.

Last month, Finance Minister Namgay Tshering said that the ministry would ask RAA to relook into the mandate of the bank “not superficially but to deep-dive it.”

As a non-deposit-taking bank, Lyonpo said that there would be operational inefficiency because interest rates are highly subsidised. “What matters most is the impact the bank has made,” he told Kuensel.

However, an official from RAA said that the authority requested the government to review the bank’s mandate based on the analysis after finding the bank’s inefficient operation was not sustainable. “It is the prerogative of the government to reassess the bank’s mandate, and the authority’s mandate is only to recommend based on the analysis considering economic efficiency and effectiveness in using public resources,’ he added.

However, an official from RAA said that the authority requested the government to review the bank’s mandate based on the analysis after finding the bank’s inefficient operation was not sustainable. “It is the prerogative of the government to reassess the bank’s mandate, and the authority’s mandate is only to recommend based on the analysis considering economic efficiency and effectiveness in using public resources,’ he added.

“The same schemes provided by the bank can be run by the BDBL because the BDBL has more outreach in the country. There is a scope of integrating the existing structure with BDBL,” he added.

The official questioned the sustainability of the bank when it is dependent on the government’s equity injection.

“If the bank’s operation is to be continued, the bank’s cost-efficiency has to be improved with different operation modality,” he said.

Higher cost of operation than revenue

The bank had incurred consecutive losses since its inception on February 21, 2020 and depended heavily on the government’s equity injection. The government had provided 90.82 percent equivalent to Nu 712.5 million (M) as equity injections in 2020 and Nu 185.2M in 2021.

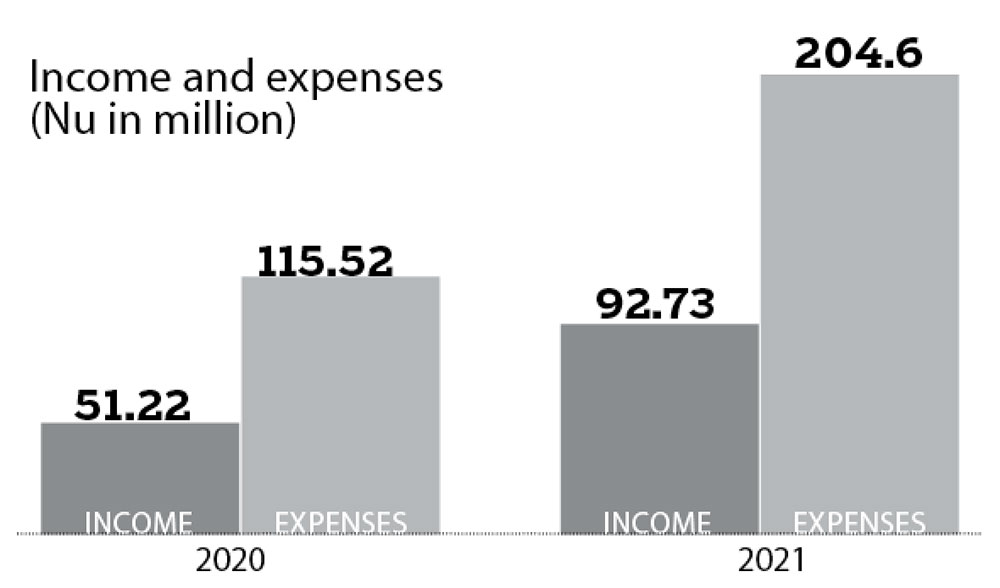

However, revenue generated through interest income was only Nu 42M (5.35 percent) in 2020 and Nu 83.48M (31.07 percent) in 2021. This was not enough to cover the bank’s operating cost of Nu 115.52M in 2020 and Nu 204.6M in 2021 respectively. The deficit between income and expenses was Nu 64.31M in 2020 and Nu 43.57M in 2021.

The report also found that the financial self-sufficiency (FSS) ratio of the bank worked out to 0.44 and 0.79 in 2020 and 2021 respectively. For any bank to sustain its operation, the desirable FSS ratio should be equal to or greater than one.

“Assuming everything remains constant except for equity injection by the government the bank’s equity would be fully eroded within the next five years based on the financial performance of the bank as of December 31, 2021,” the RAA stated.

The RAA also revealed that each employee, on average, has generated income of Nu 0.19M in 2020 and Nu 0.59M in 2021, the least among financial service providers.

The bank’s return on equity for 2020 and 2021 were 4.42 percent and 2.67 percent indicating the bank had not been able to add value to the shareholders equity through generation of adequate returns but instead sustained losses.

Overlapping function with BDBL

RAA found that most of the bank’s loan products were similar to what was offered by the BDBL. The loan disbursement and equated monthly instalment (EMI) collections were also routed through the BDBL.

Its micro loans were similar to agriculture and livestock loans offered by BDBL. Also, the bank’s cottage industry and small industry loans were similar to BDBL’s manufacturing, priority-sector lending, and small-scale industrial loans.

The RAA stated that the bank was not fully involved in its core business of providing credit services and merely acted as a channel for directing the loan applications and EMI collections to BDBL. “This did not add value to the loan life cycle but instead increased the administrative cost as the bank has effectively been a cost center,” it added.

High NPL

The CSI bank saw its non-performing loans (NPL) increase by 493.13 percent or Nu 279.11M in 2021 from 2020. As a result of high NPL, litigation cases were high with the bank. There were 57 cases under litigation amounting to Nu 7.77M as of December 2021.

It was found that the NPL in loss category (366 days and above) as categorised by the Royal Monetary Authority’s Prudential Regulations, 2017 had the highest with 229 loans with an outstanding amount of Nu 196.52M.

NPL in doubtful (181 to 365 days) category was about Nu 106.33M from 184 loans and substandard (91 to 180 days) Nu 89.47M from 217 loans accounts.

Micro-loans had the highest NPL accounts with 439 loan accounts (Nu 66.62M), followed by cottage and industry with 177 loans (Nu 242.21M) and 14 loans under small industry (Nu 83.49M).

The bank had also sanctioned additional loans to three default clients amounting to Nu 7.86M.

The authority found that most of the NPL was because of the bank’s failure to carry out timely follow-up recovery measures as envisaged and outlined in the bank’s regulation.

Poor loan system, regulations violated

RAA found that the bank’s loan system did not record vital information-loan application date, sanction date, sanction amount, details of credit appraising officers.

There were several cases of multiple loans sanctioned to some clients, exposing the bank to unwarranted operational and credit risk.

RAA also observed that the bank had sanctioned 53 loans to 26 clients amounting to Nu 76.24M in the same year without closing the previous loan accounts.

There were several cases of loan sanctioned without adhering to the provisions of the regulations.

Seven micro loans amounting to Nu 1.92M were sanctioned beyond the loan term period of 8-10 years. As per the bank’s credit manual, the micro loan term period was 5 years.

There were 1,071 loans sanctioned with a gestation period beyond the maximum of two years and 277 loans were sanctioned on weekends – non-working days.

In reviewing the monthly EMI deposit, RAA found that the bank had not refunded the excess EMI of Nu 831, 500 received from clients as of December 2021. The bank had also not provided 1 percent rebate amounting to Nu 63,011 to the 13 regular loan repayments.

Accountability

Despite issues being raised in the past audit reports, RAA stated that the bank had not initiated timely and adequate corrective actions in ensuring improvements on the observed deficiencies.

Finding non-compliances by the bank, RAA concluded that the bank has not complied with the bank’s Credit Manual and the Prudential Regulations 2017.

Meanwhile, RAA had asked the bank’s Board to hold officials accountable and appropriate action taken for failing the responsibilities and dereliction of duty.