… no moratorium as of now

Thukten Zangpo

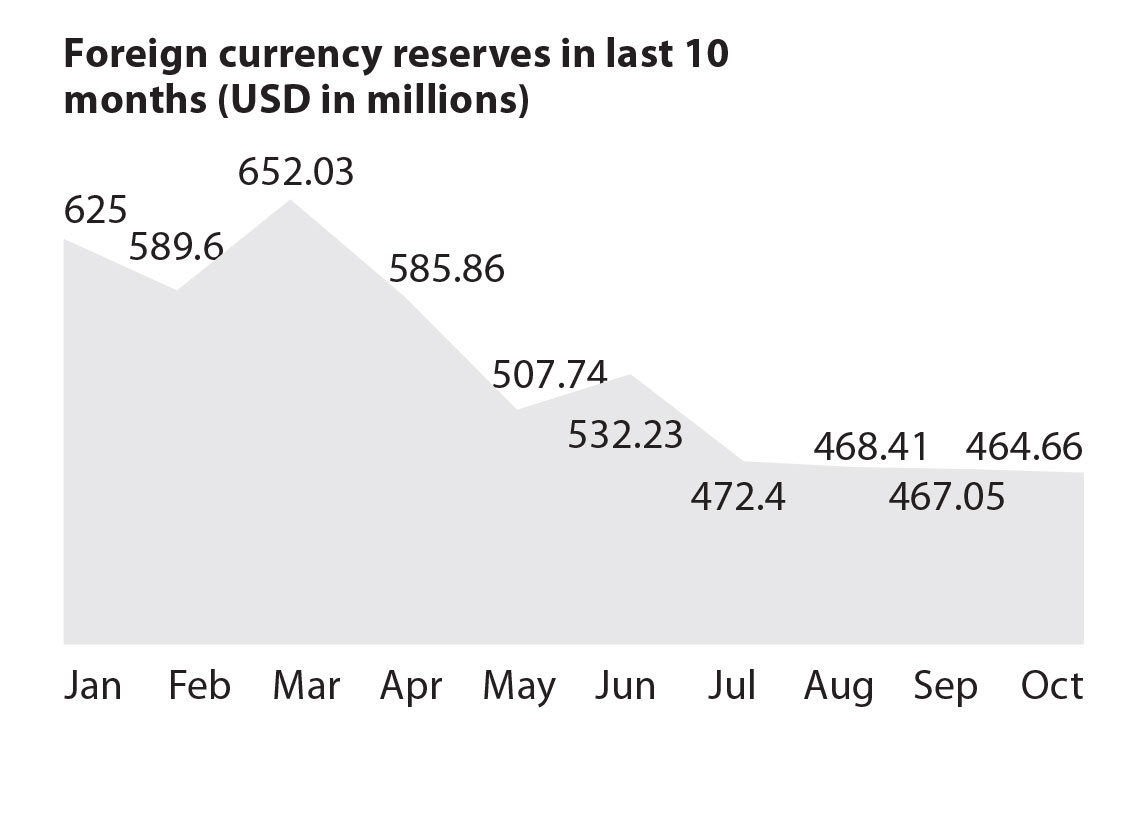

Bhutan’s foreign currency reserve at USD 464.66 million as of October, nears the minimum reserve threshold of USD 464 million, according to figures released by the Royal Monetary Authority.

The reserve is only enough to cover 12.02 months of essential imports, almost on the verge of breaching the Constitutional threshold, which mandates a minimum foreign currency reserve adequate to meet the cost of no less than one year’s essential imports.

However, there has been no deliberation on any moratorium as of now, according to the finance ministry.

Going through the foreign currency reserve trend over the last 10 months (January to October), it has fallen by over 25 percent from January’s figure of USD 625 million.

At the same time, the Ngultrum has depreciated by Nu 1.34 to Nu 83.23 against the USD during the same period.

In October alone, the reserve declined by USD 2.39 million from the previous month. Given limited revenue from exports, tourism earnings, and remittances, grants, commercial borrowings, there is a risk that the reserve may breach the Constitution in the coming months.

As of October, the country’s total foreign exchange reserve stands at USD 505.6 million, comprising USD 464.66 million in foreign currency reserve (convertible currencies, Indian Rupee, and monetary gold), USD 34.19 million in special drawing right (SDR) holdings, and USD 6.75 million as a reserve tranche position in the International Monetary Fund (IMF).

With Bhutan being an import-dependent country, the import figure as of September was recorded at Nu 85.69 billion (USD 1.04 billion) against the export value of Nu 41.48 billion (USD 503.53 million).

Calculating the average of the last nine months, the monthly import value comes to USD 86.69 million.

Looking at the country’s export-import trade in the last nine months, this leaves a gap of USD 536.7 million more required to finance the country’s imports.

Shoring up the foreign currency reserve is one of the urgent issues the incoming government needs to address immediately.

It is evident that one of the two political parties—Bhutan Tendrel party (BTP) and People’s Democratic Party (PDP)—will form the government after the general elections’ polling day on January 9.

Both parties have pledged to maintain the foreign currency reserves to meet the 12 months of essential imports and rebuild reserves through a review and revision of the foreign direct investment (FDI) policy.

BTP commits to maintaining the foreign currency reserve through a long-term strategy focusing on increasing foreign currency inflow through the promotion of tourism, export enhancement, import substitution, and attracting investment inflows. The party aims to attract a minimum FDI of USD 1 billion by 2029.

PDP pledges to increase the FDI inflow from Nu 43 billion to Nu 500 billion in the next five years, by 2029. To achieve this, the party pledged to establish special economic zones or autonomous economic areas, export processing zones, and casinos in southern border towns.

The PDP also plans to enable Bhutanese entrepreneurs to invest in businesses outside the country and establish special windows to attract investments from Bhutanese residing abroad.

Observers say that Bhutan’s reserves threshold is one of the highest globally, as other countries maintain reserves to cover only three to six months of imports.