…prompting economic reckoning

Thukten Zangpo

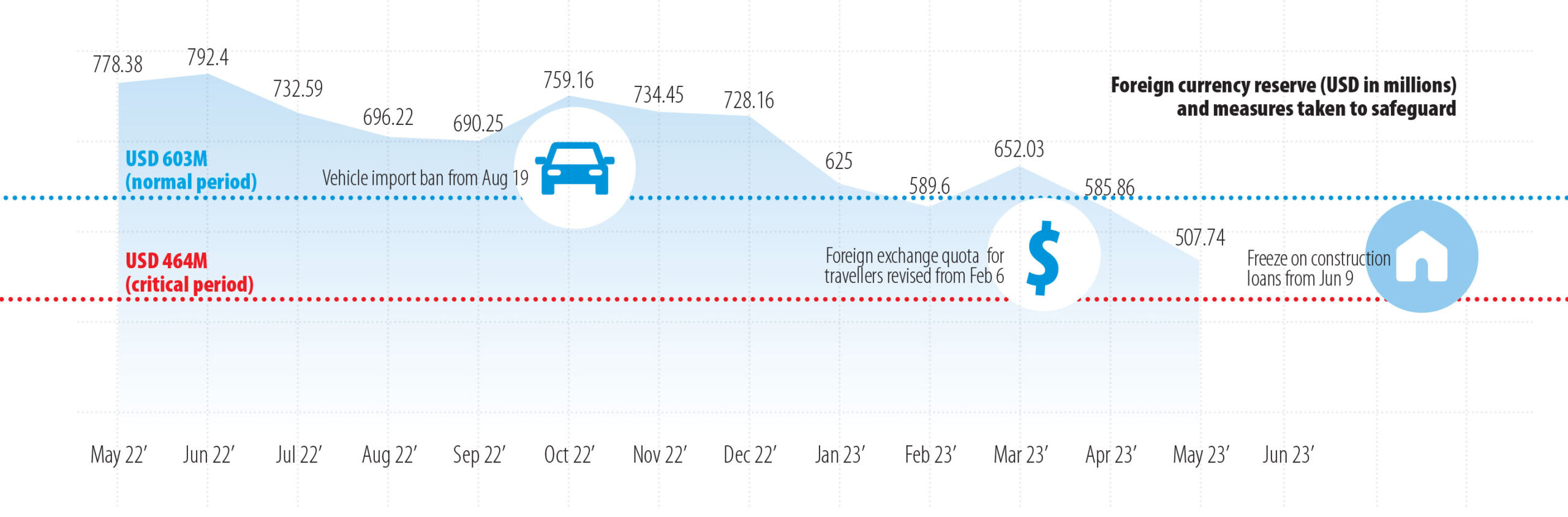

The country’s foreign currency reserves, standing at USD 507.74 million as of May this year, have dipped below the threshold required to cover one year’s essential imports during a normalperiod, according to the Royal Monetary Authority (RMA).

In accordance with the Constitution, the mandate necessitates maintaining foreign currency reserves equivalent to at least one year’s worth of essential imports.

The foreign currency reserves fall short of the benchmark set at USD 603 million for normal periods, while it is still above USD 464 million for critical periods.

The composition of the foreign currency reserve encompasses convertible currencies, Indian rupees, and gold reserves.

The foreign currency reserves witnessed a precipitous decline of 34.77 percent from the USD 778.38 million recorded in May of the previous year.

This downward trajectory is not an isolated incident; over the past year, the reserves have dwindled at an average rate of approximately 3.2 percent. Should this pattern persist, the current reserve level of USD 507.74 million is projected to breach the Constitutional mandate within a mere 2.7 months.

As a contingency measure, RMA is obligated to forewarn the government about the impending reserve deficit at least three months in advance of its occurrence. This statutory provision serves as a mechanism to catalyse proactive responses from the government to mitigate potential economic repercussions.

In a bid to safeguard the country’s financial stability, the government has adopted stringent measures. Notably, all housing loans, encompassing both home and hotel construction loans, have been suspended from June 9 to December 31 of this year. This temporary cessation aims to channel resources towards shoring up the country’s foreign currency reserves.

The spectre of additional restrictions looms on the horizon. The government’s lists of proposed moratoriums includes a prohibition on the import of non-essential items such as junk food, processed meat, alcohol, and LED televisions.

Moreover, the moratorium on vehicle imports, initially slated to conclude on August 18 this year, is anticipated to extend further.

From August 19 Last year, a comprehensive ban on vehicle imports, excluding utility vehicles, heavy earth-moving machinery, and agricultural equipment, was implemented in response to the pressing need to save the declining foreign currency reserves.

In tandem with these measures, the RMA undertook a revision of the foreign exchange quota for travellers starting February of this year. The monthly private travel allowance of INR 25,000 in cash per person has now been adjusted to INR 25,000 per person semi-annually, or every six months.

Correspondingly, the USD annual travel scheme, which governs residents’ overseas travel, has been modified. Residents travelling to third countries can now access USD 1,000 in cash and USD 2,000 in cards per year. This marks a departure from the previous cash limit of USD 3,000 per annum for private travellers to third countries.

Bhutan, as a nation heavily reliant on imports, confronts the perils of burgeoning import bills that gradually erode its foreign currency reserves. In the first quarter of this year, the country’s imports burgeoned by an impressive 38 percent, climbing from Nu 22.87 billion in the same period last year to Nu 31.69 billion. Moreover, the import bill ballooned by approximately 32 percent to Nu 118.79 billion in 2022, starkly contrasting the previous year’s figures.