Thukten Zangpo

The government can borrow an additional Nu 18.21 billion as non-hydro budgetary debt based on the estimated gross domestic product (GDP) for fiscal year 2022-23 with the revised debt policy.

The new Public Debt Management Policy 2023 requires the non-hydro budgetary debt stock to be within 55 percent of GDP at any given year. The government revised Public Debt Policy 2016 in June this year.

At Nu 93.13 billion, the non-hydro budgetary debt as of June this year, comprising of 46 percent of GDP estimate (Nu 202.43 billion), was under the threshold, according to the finance ministry.

With this revised policy, the government has an additional space of 9 percent or Nu 18.21 billion to borrow at non-budgetary debt.

However, at the 2023-24 GDP estimate of Nu 219.51 billion, the government can borrow an additional of Nu 27.6 billion as non-hydro budgetary debt.

The government borrows to meet the financing of the budget deficit from both external and domestic financing where liabilities fall directly to the government.

This financing is borrowed as capital expenditure because the Constitution mandates the government to meet the recurrent expenditure from internal resources of the country.

For the fiscal year 2023-24, the fiscal deficit is estimated at Nu 21.35 billion or 9.7 percent of 2023-24 GDP estimate. This will be financed through concessional external borrowings and balance would be raised from the domestic market.

Of the total non-hydro budgetary budget, external debt comprises of 30.2 percent of GDP, equivalent to Nu 61.04 billion and domestic debt of Nu 32.09 billion or 15.8 percent of GDP.

The country’s domestic debt increased by Nu 6.24 billion or 23.5 percent from Nu 26.55 billion in March last year. The domestic debt consists of Nu 9.05 billion treasury bill, Nu 18.8 billion government bonds and Nu 4.94 billion for use of ways and means advances and overdraft facility.

The revised policy also states that the total annual debt service for government debt (through budget) should not exceed 35 percent of the total annual revenue.

At the same time, the sovereign guarantee shall not exceed 10 percent of the country’s GDP at any given year. Sovereign guarantee, which stood at Nu 5.15 billion, accounting for 2.5 percent of GDP, is under the threshold.

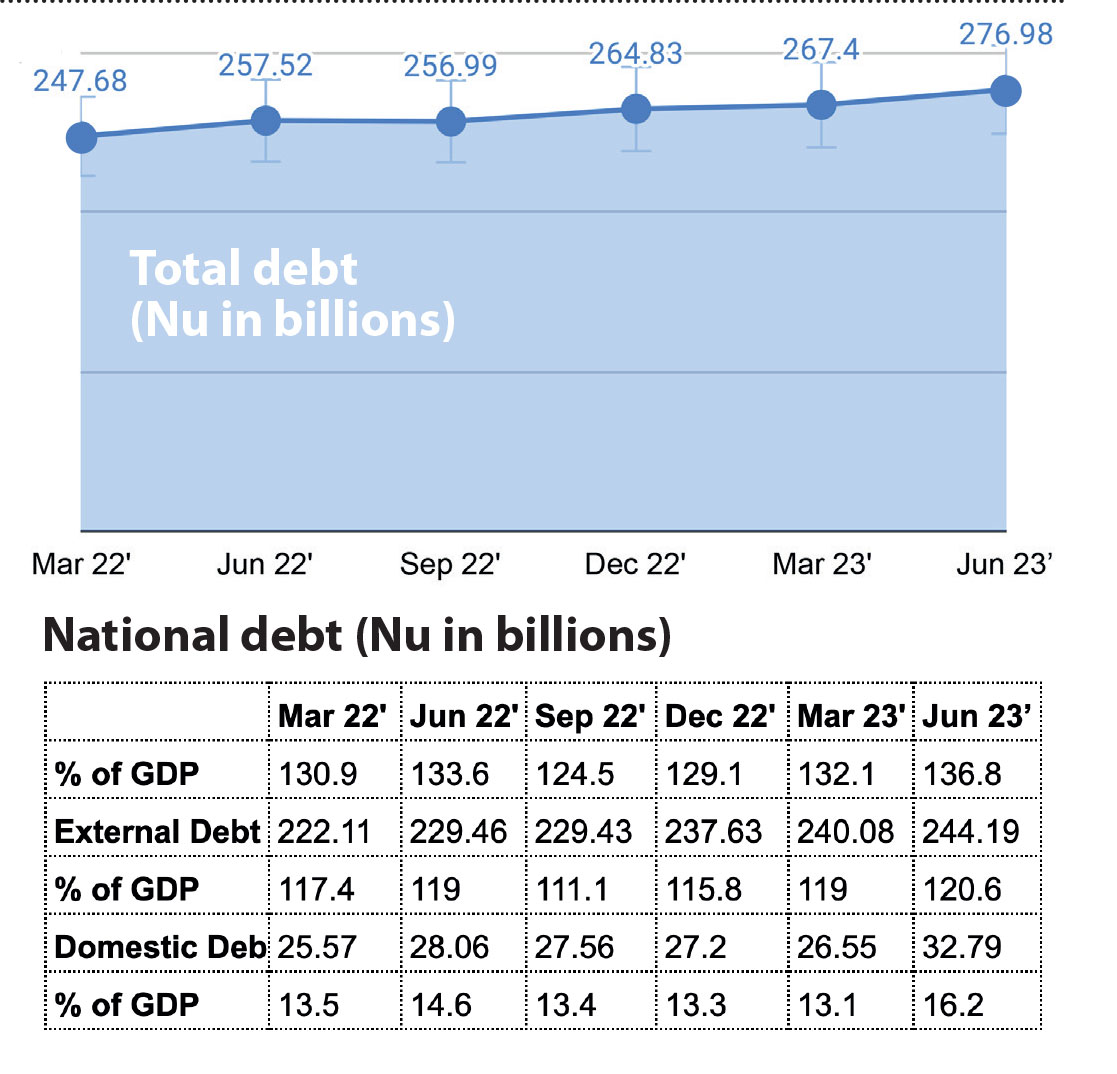

The nation’s total debt as of June this year was recorded at Nu 276. 98 billion or 136.8 percent of GDP, an increase of 3.6 percent from March last year.

External debt comprises of 88.2 percent (Nu 244.19 billion) while domestic debt accounted for 11.8 percent or Nu 32.69 billion.

By external debt category, hydro-debt comprised 69.1 percent of total external debt at Nu 168.65 billion and non-hydro debt at Nu 75.54 billion or 30.9 percent of external debt. Indian Rupee debt comprises of 65.6 percent of external debt (INR 160.15 billion), and convertible currency debt of Nu 84.03 billion or USD 1.02 billion.

As per the revised policy, there is no limit to hydro debt. However, the debt service coverage ratio should be above 1.2. Moreover, the ratio of hydropower debt service to hydropower export should be maintained within 50 percent at any given year.

Despite elevated levels of total public debt at 136.8 percent and external debt at 120.6 percent of GDP, the overall risk is deemed manageable, and external debt distress is considered moderate.

Breach of threshold

The government may exceed the prescribed debt threshold during an economic crisis. However, the government has to declare such emergencies through official channels and inform the next parliament sitting of any circumstances along with plans to stabilise debt levels and servicing to meet the required thresholds.