Thukten Zangpo

The government had foregone estimated tax revenue of Nu 3.31 billion (B) in 2021 with the implementation of the fiscal incentives measures, according to the National Revenue report 2021-22. In 2020, the tax foregone was estimated at Nu 5.01B.

The fiscal incentives are government policy tools and the Fiscal Incentives (FI) 2017 was formulated to stimulate private sector growth, generate employment opportunities and entice foreign investments in Bhutan.

Tax foregone amount is tax exemption granted to small and rural business units in rural areas and tax holiday granted to business income tax and corporate income tax filers in accordance with FI 2017.

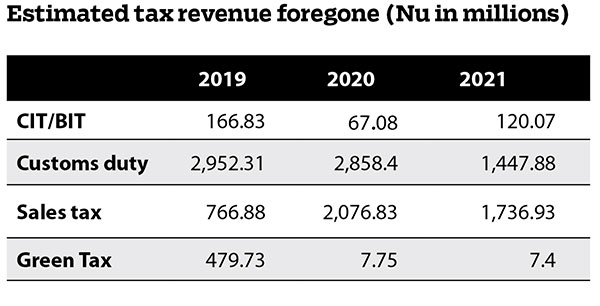

The revenue foregone from sales tax was the highest at Nu 1.74B, followed by customs duty of Nu 1.45B, corporate income tax and business income tax of Nu 120.07 million (M), and green tax was Nu 7.4M.

In sales tax, the highest revenue foregone was from exemption and refund on vehicles amounting to Nu 374.68M.

The exemption on vehicles includes the vehicle import quota provided to public servants and staff or diplomats of international organisations or embassies, refund for public transport and also the exemption on tourism sector vehicle imports.

However, the Parliament in the winter session last year did away with the vehicle import quota or monetised amount of Nu 1.5M and Nu 0.25M for all public servants.

An exemption to the manufacturing sector, which includes import of plant and machinery and raw materials, was second highest amounting to Nu 354.77M.

Exemption on hydropower projects amounted to Nu 108.67M, which was similar in 2020 with exemption amount of Nu 123M indicating similar economic activities in the sector in the two years.

According to the report, tax exemptions to all exempted parties or persons were at the same levels in 2020 and 2021 as compared to lower exemptions in 2019, indicating slower economic activities.

Section 11, chapter 2 of FI Act of Bhutan 2021 exempts income tax to small and micro businesses located in rural areas until December 31, 2024.

The government introduced FI 2021 in November 2021 with the objective of further stimulating the economy that was severely affected by Covid-19 pandemic.

The incentives look into promoting thrust sectors such as education, tourism, information and communication technology, manufacturing, cottage and small industry for balanced economic growth.

One of the major highlights of the FI 2021 was the reduction in the business income tax to 10 percent from 30 percent for small, cottage, and micro-businesses located in border towns of Gelephu, Phuentsholing, Samtse, and Samdrupjongkhar for the income year 2021.

The incentives also provide a 5 percent concessionary tax rate to newly established businesses and 15 percent for existing businesses.

Enterprises carrying out construction projects using locally-manufactured construction materials will be entitled to a 30 percent additional tax deduction on the cost incurred with respect to such materials.