Thukten Zangpo

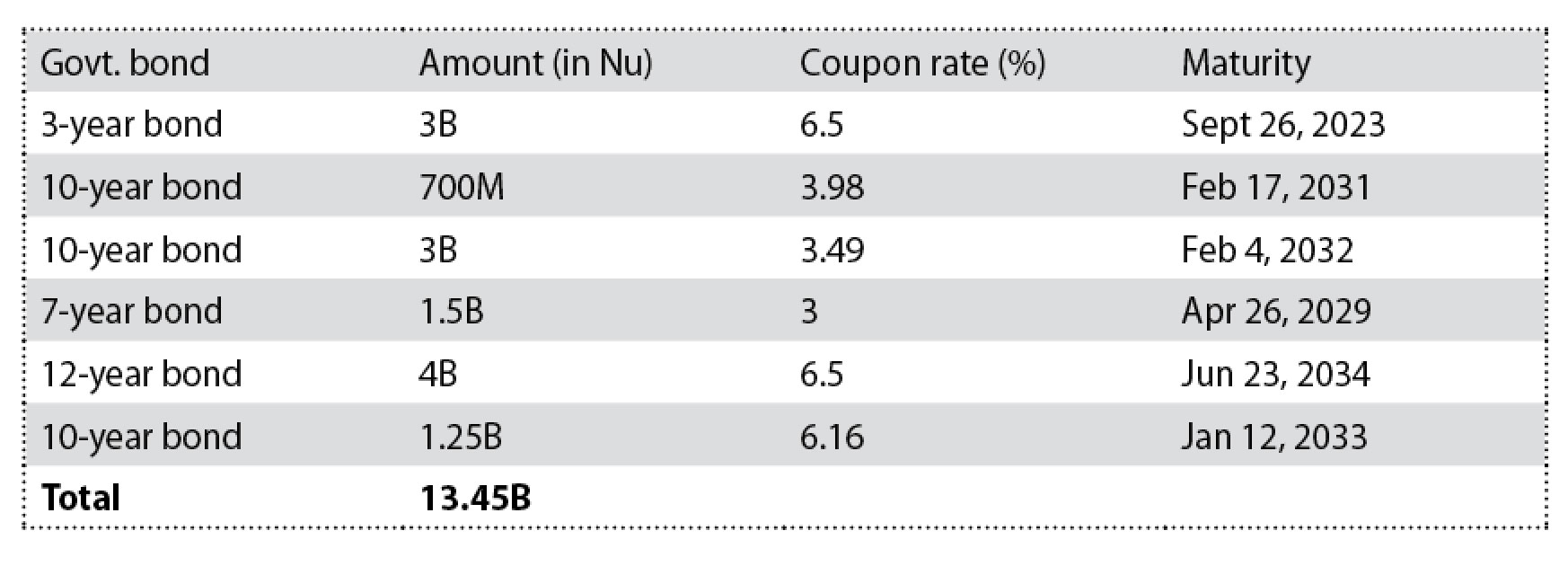

With the government raising Nu 1.25 billion (B) through the issuance of a 10-year sovereign bond on January 12 this year, the government has raised Nu 13.45B today, according to the Royal Monetary Authority.

An official from the finance ministry said that of the Nu 2.5B 10-year bond offered for subscription, only Nu 1.25B was allocated because the coupon rate was high, unacceptable at 8 percent.

The remaining 10-year bond of Nu 1.25B will be opened for public subscription from January 20 to January 30.

This marks the sixth consecutive issuance of sovereign bonds by the government since September 2020. This also means that the country has a domestic debt of Nu 14.7B more from the issuance of bonds.

A government bond or sovereign bond is a debt obligation issued by the government to support government spending. An official said that the government offers the bonds as a debt instrument to finance the gap for the projects based on infrastructure development. “The government bonds are cheaper and risk-free.”

Bonds are also a secure investment option for those who are looking for a regular return.

It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

The government earlier had borrowed Nu 12.2B from the domestic market to meet the fiscal requirements with the issuance of a series of government bonds.

Three-year government bond of Nu 3B was issued in September 2020, a 10-year bond of Nu 700 million in February 2021, a 10-year bond of Nu 3B in February 2022, a 7-year bond of Nu 1.5B in April 2022, and a 12-year bond of Nu 4B in June 2022.

Most of these bonds mature between 2031 and 2034 with an annual coupon (interest) rate between 3 to 6.5 percent.

The recent, 10-year bond transaction was well received with more than 50 percent oversubscription and orders received at about Nu 4.3B, consisting of 6 subscribers-5 financial institutions, and 1 non-financial institution.

The annual coupon rate for the bond, as determined by the auction, was 6.16 percent which means the subscribers will be paid an annual coupon (interest) rate of 6.16 percent on a half-yearly basis by the finance ministry.

The ministry will pay the first coupon on July 12 this year and the second on January 12, 2024, into the bank account that a bondholder has registered for receiving the payment.

The maturity date is January 12, 2033, on which the principal amount and final interest will be paid.

However, if the payment falls on a weekend, or a public holiday, the payment will be made, without any additional interest on the next business day.

The interest earned from the bonds is non-taxable for personal income tax. However, the interest income from the bond is taxable income (5 percent as tax deducted at source) for the business income tax and corporate income tax-paying entities.

An official added that with the offering of the bonds the government is trying to build a vibrant stock exchange market.

He said that Bhutan’s market is in its infant stage and the coupon rates are high at about 6 percent, however, the rates would go down, when the market matures in future.

“This will also prepare Bhutan to graduate from least developed countries, where money can be borrowed from the domestic market and money circulating in the economy,” an official said.

Most of the takers are financial institutions (FIs) because FIs have liquidity with the banks and it is an opportunity for them to invest while individuals are not fully aware of the debt instruments.

Any Bhutanese persons including Bhutanese citizens, firms, companies, corporate bodies, financial institutions and trust funds can subscribe to the bond.

As per Section 126 of the Public Finance Act 2007, the finance ministry can borrow money to finance fiscal budget deficits and refinance maturing debt or a loan paid before the redemption date.

The ministry can also issue bonds to maintain credit balances in the bank accounts, and on lending to State enterprises and other legal entities, on-lending to state enterprises and other legal entities, or for any other purposes approved by the Cabinet.