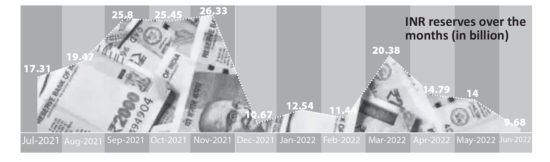

… falls by over 50 percent in June

Thukten Zangpo

Bhutan’s rupee reserve (INR) has dropped below the central bank’s required threshold of INR 10 billion (B) for all time to come. From March this year to June, the reserve has plunged by over 50 percent.

The reserve was at INR 20.38B in March and fell to INR 9.68B by June, according to the Royal Monetary Authority’s provisional figure.

The available reserve can meet only 1.4 months of the essential imports.

In the last three months from March to June, the reserves saw a drop of INR 10.7B. It was mainly because the imports from India doubled in the same period.

Imports from India increased to Nu 24.24B in the second quarter (April to June) from Nu 16.04B in the first quarter (January to March). This has also increased Bhutan’s trade deficit with India from Nu 8.48B in the first quarter to Nu 12.03B in the second quarter.

If there was no increase in the export to India by Nu 4.65B in the same period, the deficit could have been much higher.

Bhutan also has to pay INR for the external debt with India. The country’s INR debt as of June this year stands at INR 155.4B.

In the first quarter, the country paid INR 2.58B for debt servicing. The latest figure is not available.

Bhutan’s external debt also includes the INR 3B borrowed in June 2012 and INR 4B in March 2013 to come out of the rupee shortage.

The two-rupee standby credit, at an interest rate of 5 percent, expired on June 30 this year, was extended by the Indian government by five more years with a reduced interest rate of 2.5 percent.

Bhutan’s disbursed outstanding debt of these two facilities stands at Nu 7B.

To save the country’s foreign currency reserve, the finance ministry put a moratorium on the import of vehicles from August this year. This could save the country around INR 4B in a year.

The ministry also announced that the moratorium would be reviewed and amended (where necessary) after six months depending on the foreign currency reserve position.

Assuming that Bhutan’s imports grow at the same pace in the second quarter or higher, because of an increase in the domestic credit mainly in housing, manufacturing and service sectors as the economy picks up is going to put more pressure on the rupee reserves.

The central bank has an arrangement made with the Reserve Bank of India (RBI) where the RBI would facilitate the exchange of USD for INR and vice-versa.

However, Bhutan’s convertible currency as of June reported at USD 717 million (M) was short by USD 40M from the central bank’s threshold of USD 757M.

Revenue from the export of electricity to India at Nu 719.79M and Nu 6.34B in the first and second quarter respectively is expected to increase in the next two quarters.

Similarly, the incoming tourists from September 23 are expected to improve the foreign currency reserves in the country.