Thukten Zangpo

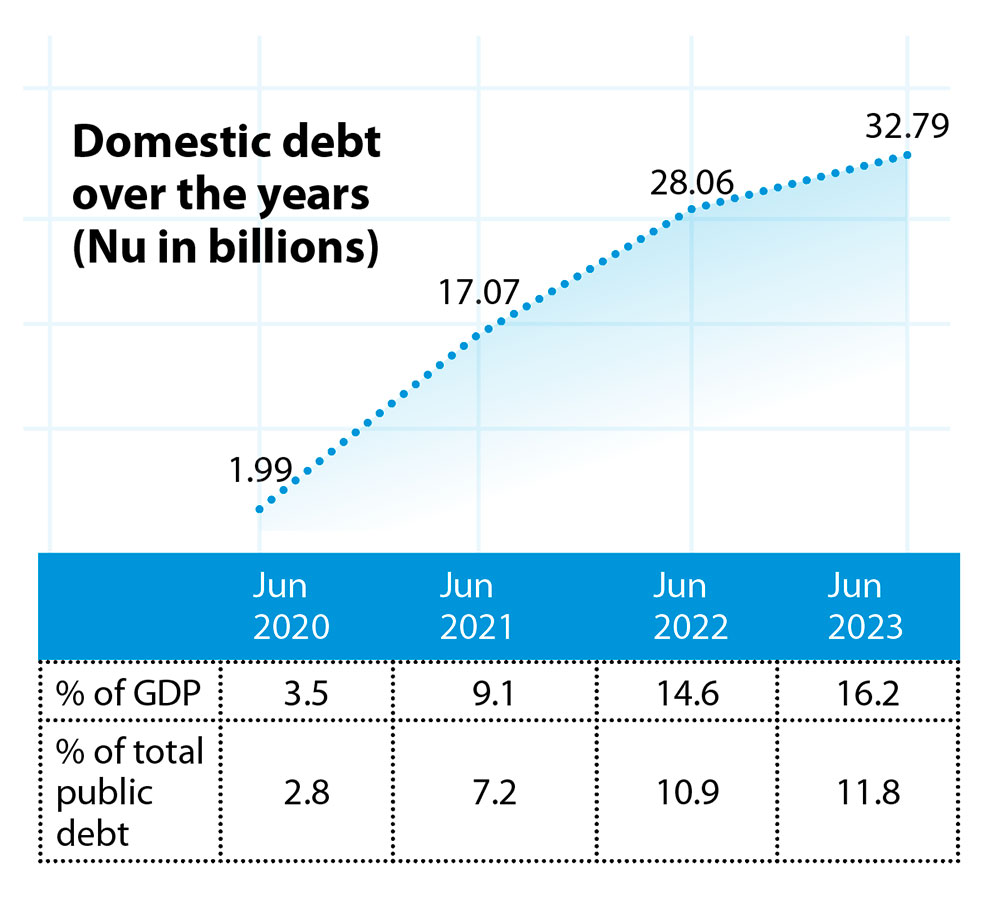

Going by the available figures, the country’s domestic debt has grown by over 1,500 percent in the last four years, mainly to finance the country’s fiscal imbalance.

In absolute figures, the domestic debt saw an increase to Nu 32.79 billion (16.2 percent of GDP) as of June this year from Nu 1.99 billion (3.5 percent of GDP) in June 2020.

Domestic debt refers to the amount of money raised by the government from its own citizens or institutions within the country’s borders and under the local legislation through issuance of bonds, treasury bills, and other forms of debt securities.

The government raises the money to cover the budgetary shortfalls from issuance of treasury bills and bonds. Majority of the subscribers are banks.

The country’s fiscal deficit has been rising over the years because of limited revenue growth and increased public spending.

Fiscal deficit grew from Nu 3.39 billion in the fiscal year (FY) 2019-20, Nu 11.14 billion in FY 2020-21, Nu 15.03 billion in FY 2021-22, to an estimated Nu 15.92 billion in FY 2022-23 (7.9 percent of GDP).

For FY 2023-24, domestic debt is projected to grow to Nu 21.35 billion which is equivalent to 9.7 percent of GDP.

Growing domestic debt will create fewer available resources because the money used to subscribe to this debt could be alternatively used for other investments especially by private entities.

This will lead to a crowding out effect, a situation wherein the rising public sector spending drives down or even eliminates private sector spending.

On the other hand, if the government spends most of its revenue in servicing debt, there will be fewer public investments, including for social and developmental projects.

According to the Public Debt Management Policy 2023, the central government debt (external and domestic) should not exceed 55 percent of GDP at any given year.

If we look at the credit to the private sector, it has seen a growth of 15.4 percent in FY 2016-17, 20.5 percent in fiscal year 2018-19, which decreased to a growth of 8.6 percent in FY 2021-22.

However, most of this credit was dominant in the housing sector.

Figure shows that housing credit increased to Nu 51.83 billion which is 27 percent of total credits as of September last year from Nu 35.19 billion as of the same month in 2019. This has limited the access of credit to other sectors.

Households and government spending and decisions affect the overall outcome of economic growth.

There is rising domestic debt and loan exposure in the housing sector, which means that for a sustainable and broader-based growth path economy, Bhutan must create a conducive business environment for the private sector.