Dechen Dolkar

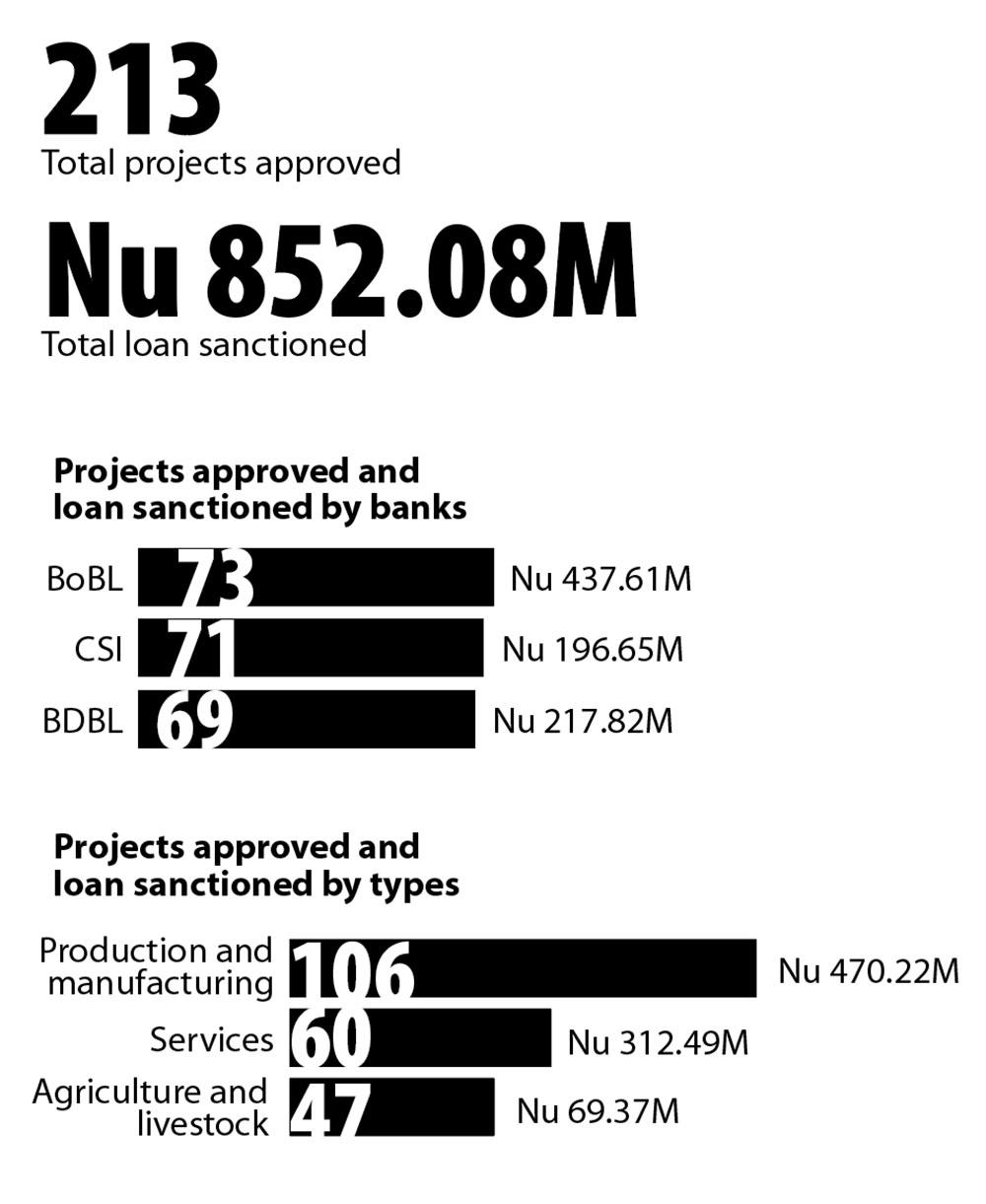

Over a span of two years, a loan of Nu 852.08 Million (M) has been extended across 213 projects through the avenues of the National Credit Guarantee Scheme (NCGS), signifying a robust stride towards bolstering economic endeavours.

In October 2020, the government set in motion a financial assurance framework amounting to Nu 3 billion (B) under the purview of NCGS, slated to span three years.

However, last September, the grant of loans and supplementary credit came to a standstill.

The minister for finance, Namgay Tshering, said that NCGS was conceived to mitigate the reverberations of the Covid-19-induced economic turbulence, and to nurture projects already endorsed and enveloped within the ambit of transformative reforms.

The process of sanctioning fresh loans, Lyonpo said, came to a halt as the government pivoted its focus toward bolstering the already approved initiatives, manifesting a prudent stewardship of resources.

From October of the preceding year to August this year, NCGS officials had been monitoring the sanctioned projects.

The production and manufacturing sector saw the highest number of approved projects at 106 with a total loan amount sanctioned Nu 470.22M, followed by 60 in services with a total loan amount sanctioned Nu 312.49M and 47 projects in agriculture and livestock sectors with a total amount Nu 69.37M spreading across 18 Dzongkhags.

Of the total, 164 projects are commercially operational and two projects completed repaying their entire loan amount. Thimphu has the highest project approvals with 90 followed by Paro with 23 and Sarpang 16.

Sixty-nine projects are approved under the Bhutan Development Bank Limited (BDBL) with a total loan sanction amount of Nu 217.82M, 73 under Bank of Bhutan Limited (BoBL) with a total loan sanction amount of Nu 437.61M, and 71 under the National Cottage and Small Industries Development Bank Limited (NCSIDBL) with total sanction amount Nu 196.65M under NCGS projects.

As of June, this year, the non-performing loan (NPL) stands at 11 percent at the amount of Nu 95.6M.

Similarly, as of June this year, Nu 63.94M loan amount was repaid. The officials from NCGS said that some projects are not able to repay the loan amount for two to three months due to their less cash flow and they enter into NPL as defined by the banks. However, they will repay loans from the next month in bulk when they have cash flow.

Currently, 49 projects are in the gestation period. The average gestation period is from three months to two years.

Meanwhile, two projects failed under NCGS so far. The officials said that they came up with products but could not survive in the market.

The NCGS was established to overcome one of the major impediments in availing credit facilities from financial institutions by providing collateral-free loans for investments in the cottage and small category. The government guaranteed a portion of the loans availed for establishing a viable business.