… trade and commerce sector have the highest NPL

Thukten Zangpo

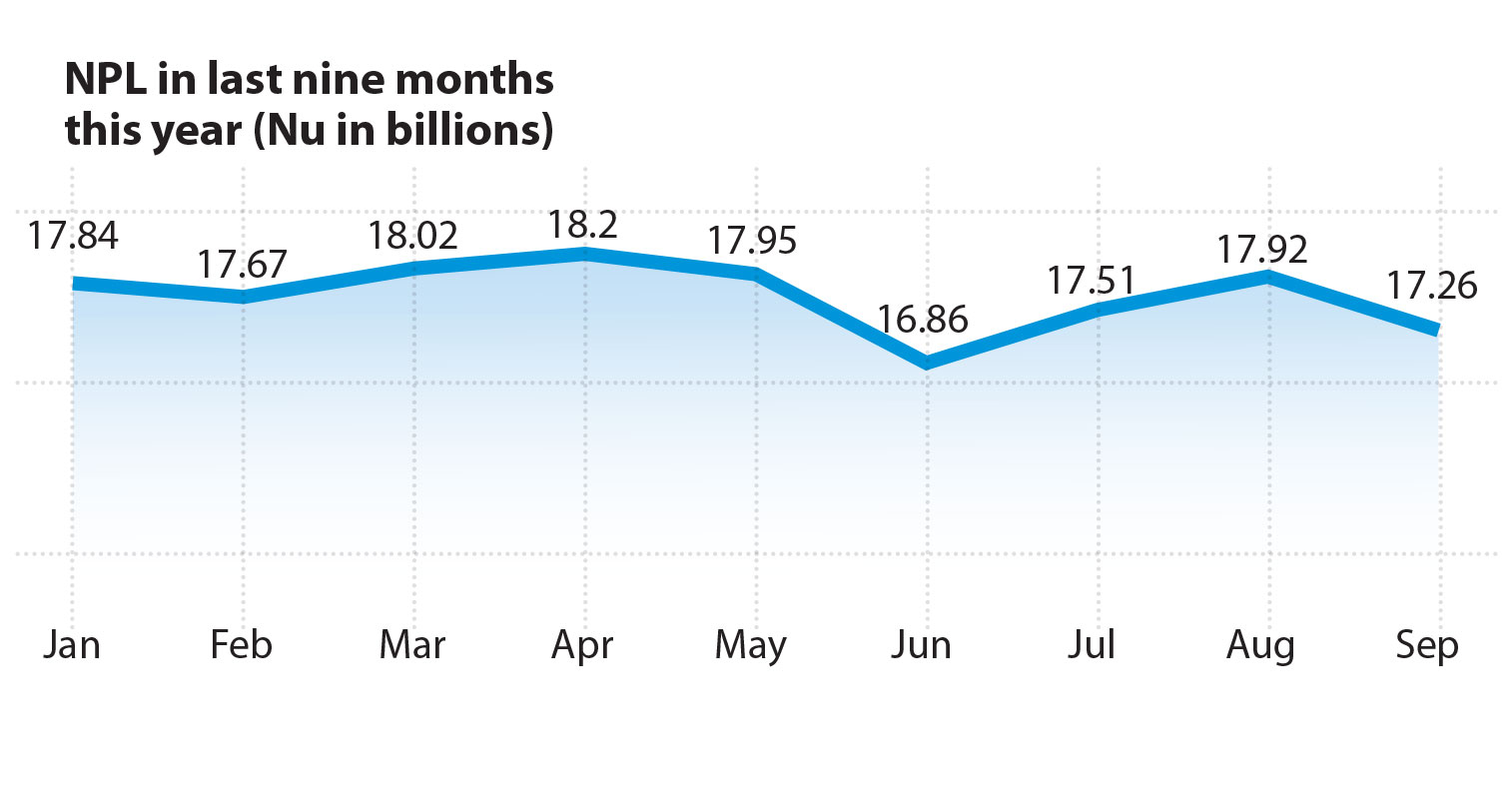

The non-performing loans (NPL) with the financial institutions (FIs) declined by about 3 percent from January to September this year, according to the Royal Monetary Authority’s figures.

NPL reached Nu 17.26 billion as of September compared to Nu 17.84 billion in January this year. Banks recorded an NPL of Nu 10.12 billion and non-banks at Nu 7.14 billion.

NPL are loans with payments that are overdue by 90 days or more.

NPL ratio to the total credit in the economy reduced to 7.89 percent from 8.56 percent during the same period last year. The highest NPL was recorded at Nu 24.4 billion in 2020.

At Nu 1.46 billion, the trade and commerce sector topped the NPL, followed by Nu 1.38 billion in the housing sector. NPL as loans to contractors and transport was recorded at Nu 1.12 billion and Nu 975.44 million respectively.

NPL in the trade and commerce sector was mainly because of the overdraft loan accounts or working capital.

Overdraft loan facilities or working capital is a short-term loan availed by businesses (wholesalers and retailers) and manufacturers for operating their businesses against value of their stock and sufficient collateral security.

The contractors can also avail overdraft loan facilities after award of work. These loans are for a period of one year.

Under the Monetary Measures IV, the overdraft loan accounts or working capital was not given deferment because it was not considered as term loans.

Despite the decrease in NPL, the total credit grew by about 5 percent to Nu 218.89 billion in September from Nu 208.42 billion in January this year.

Housing sector has the highest credit at Nu 60.87 billion, followed by Nu 23.94 billion in hotel and tourism, and Nu 17.44 billion in the service sector. Credit to trade and commerce was reported at Nu 16.04 billion.

However, as the Monetary Measures IV deferment which ends by June 2024 and no further deferment could bring in more loan defaulters.

Under the Monetary Measures IV announced in June last year, the high-risk sectors such as hotels, restaurants, tourism, and airlines were granted a two-year loan deferment, both full and partial, until 2024.

At the same time, FIs profit after tax increased to Nu 3.76 billion as of September from Nu 1.23 billion in January this year.