…Tariff benefits India

Albeit the contraction of Bhutanese economy by 10 percent with Covid-19 pandemic hitting all major sectors of the economy, 2020 was a big year for the energy sector in Bhutan, the obvious reason being commissioning of Mangdechhu hydroelectric project and improved hydrology.

However, there is one more aspect to it. The domestic demand of electricity slumped by 14 percent mainly due to the disruption in the manufacturing sector caused by the pandemic. This means that the Bhutan exported more electricity across the border since the power purchase agreements between India and Bhutan guarantees the market for excess electricity that Bhutan generates, after meeting its local demand.

According to Bhutan Power Corporation’s (BPC) annual report, domestic sales dropped by 14 percent from 2,280 million units (GWhr) in 2019 to 1,961 million units in 2020. This is largely attributed to Covid-19 pandemic resulting in subdued demand from High Voltage, Medium Voltage, and Low Voltage bulk consumers, as industrial consumption continues to dominate the domestic load at 72 percent.

While the Druk Green Power Corporation, the generating company saw a growth of 30 percent increase in generation, from about 8,600 million units to 11,300 million units of electricity, it is primarily due to the commission of the Mangdechhu project. Subsequently, BPC wheeled about 9,200 million units in 2020 to India, an increase from 6,163.19 MU in the previous year.

Taking the Mangdechhu project out of the equation, DGPC has still generated 7,628 million units of energy in 2020. Now this is attributed to the improved hydrology and consequential increase in generation from Tala, Chhukha, Kurichhu and Basochhu hydropower plants. Excluding Mangdechhu, a significant increase of 10 percent was observed from the generation units compared to 5 percent in the previous year.

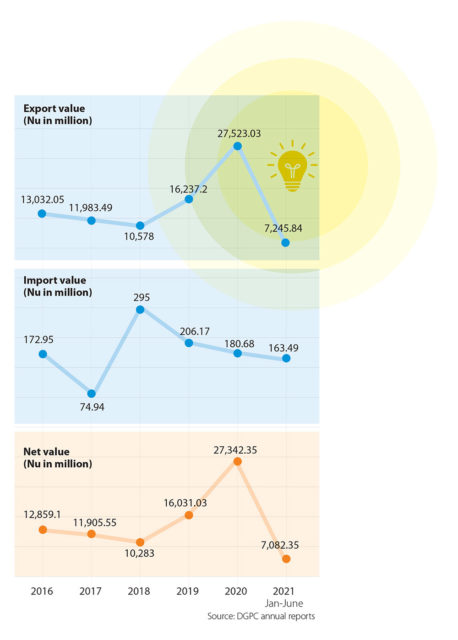

In consideration to increased generation and subdued domestic load, the country’s export of electricity has reached a record high, earning INR 27 billion in 2020 from INR 16 billion in 2021. Even without Mangdechhu, export of electricity could have easily fetched INR 18 billion.

Since the entire generation from Mangdechhu is allocated for export, its tariff being almost double to that of Chukha and Tala, it garnered adequate INR earnings for the country.

However, in the face of growing energy demand, particularly when industrial parks are being developed in the country, the DGPC projected that the local demand will shoot up to more than 7,500 million units by 2025 and about 2,100 million units of energy has to be drawn from Mangdechhu to meet local demand.

If there is no capacity addition in power generation, as the local demand for power increase in the near future, export volume will eventually drop.

However, Bhutan’s competitive advantage for its industries is to access cheap electricity and this has been the only reason why many power intensive industries have been set up along the southern foothills of Bhutan close to the Indian border. The Free Trade Agreement (FTA) with India allows Bhutanese industries to export their finished goods to a large market in India with relatively lower import tariffs compared to other countries.

It is also estimated that for every unit of energy sold to energy intensive industries, there is a value addition of about Nu 7 to the GDP. On the other hand, export tariff is much lower than that of energy market in India.

This gives India the benefit of investing in Bhutanese hydropower projects and India stands to gain whenever Bhutan generates excess electricity. According to the tariff records from Power Trading Corporation of India (PTC), Bhutan’s electricity is far cheaper than those generated by other distributors within India.

For instance, as per the PTC’s energy pricing for the month of April this year, the Andhra Pradesh government bought power at INR 11.3 a unit from SembCorp Energy India Ltd. in the same state. The cheapest energy comes from Gujarat, Tamil Nadu and Odisha, mostly harnessed from renewables and some thermal plants. However, the selling price, even for renewable energy is at least INR 3.5 per unit, making hydropower from Chukha and Tala cheaper.

In comparison to hydropower plants in India, where the minimum tariff starts from INR 5 per unit, power from Chukha and Tala are sold in the Indian market at INR 2.59 and INR 2.27 per unit, respectively. Records from PTC show that Tala and Chukha plants in Bhutan makes electricity cheaper in the Indian states of Jharkhand, Odisha, West Bengal, Sikkim, Bihar, Rajasthan, Jammu and Kashmir, Haryana, Punjab and Delhi. This is as per the form IV published by the PTC on monthly basis highlighting the source and destination of power and reflecting both selling and purchasing price.

On the other hand, Mangdechhu’s tariff is bit higher at a little over INR 4 per unit but it is still competitive in the Indian power exchange. The Indian side stands to gain from the pre-fixed tariff for certain period of time, facilitating price predictability and that too determined at the cost plus model.

This in turn, gives hydropower loan a self-liquidating and INR generator status on the Bhutanese side, while Indian side harnesses the benefits of cheap power. However, increasing cost of construction of upcoming hydropower plants and subsequent increase in tariff may deter India.

Contributed by

Tshering Dorji

The story is being covered by the Institute of

Happiness for a research conducted on the effects of cross border energy trade