What happened exactly?

On 11th May 2022, the price of Bitcoin plunged to its lowest point since 2020. A cryptocurrency that promoted itself as a stable means of exchange called terraUSD collapsed, and more than USD 300 billion was wiped out by a crash in cryptocurrency prices between 9th and 12th May 2022.

“The crypto world went into a full meltdown this week in a sell-off that graphically illustrated the risks of the experimental and unregulated digital currencies. Even as celebrities such as Kim Kardashian and tech moguls like Elon Musk have talked up crypto, the accelerating declines of virtual currencies like Bitcoin and Ether show that, in some cases, two years of financial gains can disappear overnight”, reported the New York Times on 12th May 2022.

What triggered the crash?

Market experts say two main factors are driving the recent slump in the cryptocurrency market: moves by the U.S. Federal Reserve to combat high inflation and stabilize markets, and the collapse of terraUSD, a type of so-called stablecoin. Others say the fall in cryptocurrencies is part of a broader pullback from risky assets, spurred by rising interest rates, inflation and economic uncertainty caused by Russia’s invasion of Ukraine.

In any case, the immediate trigger for the current crisis was the sudden fall in the price of terraUSD or UST which is supposed to be a Stablecoin. Stablecoins, including terraUSD and luna, were touted as a class of crypto asset that, as the name suggests, offered more stability during market volatility.

The value of the UST token is pegged to the U.S. dollar, which means that at all times the value of one UST should be 1 USD. “If the value plunges below a dollar then the coin could be “burned” and exchanged for a dollar’s worth of luna”, say experts.

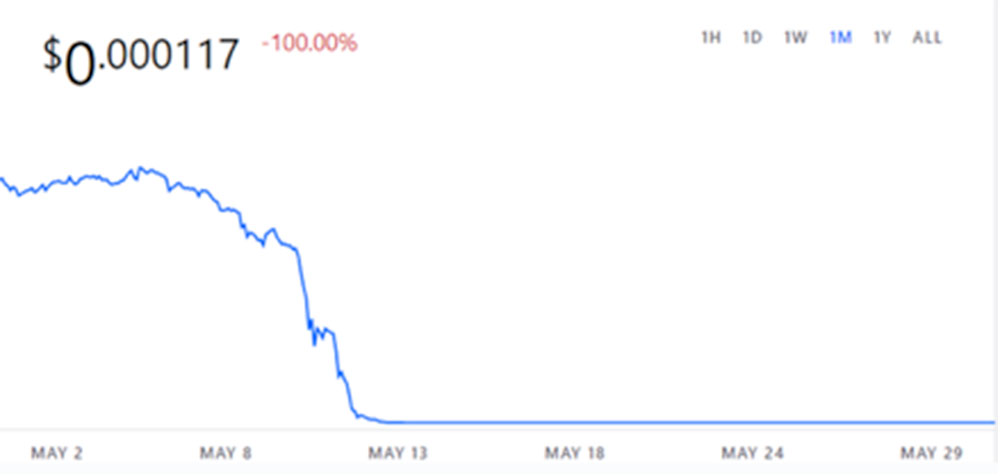

That is what happened on 9th May 2022. UST broke the peg against the dollar and, for the first time, the value of 1 UST fell to less than a dollar and it crashed to less than 30 cents. And as the price of UST crashed, large luna holders cashed out, causing the supply of luna tokens to jump, and its price to crash. Luna lost 99% of its value by 12th May 2022. All of it happened too fast – within a span of few days.

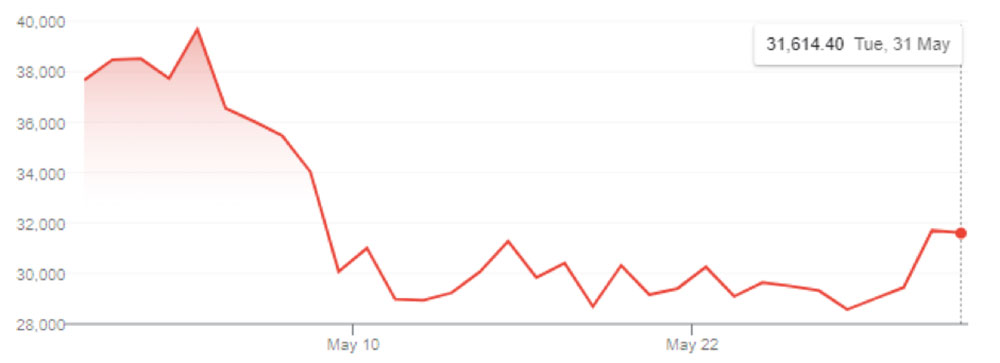

Bitcoin to USD chart for the month of May 2022

Luna to USD chart for May 2022 (Source: Coinbase.com)

How could a Stablecoin crash?

Stablecoin is a cryptocurrency whose value is typically pegged to an underlying currency, and are supposed to provide stability, unlike other cryptocurrencies whose values fluctuate widely. The most popular stablecoin is Tether (USDT for short) which is pegged 1:1 to the US Dollar. Some other popular stablecoins include USD Coin (USDC) and Binance USD (BUSD). There are many other stablecoins that also hold an important place in the market today, and TerraUSD (UST) that caused the recent crash was also one of them.

Reports say that there are four primary stablecoin types, identifiable by their underlying collateral structure: fiat-backed, crypto-backed, commodity-backed, and algorithmic. TerraUSD that crashed was an algorithmic backed Stablecoin.

“Most stablecoins will hold actual assets to function but the algorithmic solution that UST had was unable to handle the market volatility that we are seeing across the bond markets. This led to a widespread panic selling,” an expert was quoted as saying.

What is the impact?

Unlike previous meltdowns, this one would have broader impact because more people and institutions hold cryptocurrencies now. A Pew Resarch Center suvey revealed that people have turned to virtual currencies during the COVID pandemic with 16 percent of Americans now owning some cryptocurrencies compared to one percent in 2015.

In tandem with that, tech stocks also underperformed, with the stock market having its worst week since the start of the COVID-19 pandemic.Netflix had to endure its steepest stock price drop in a decade.

Tesla CEO Elon Musk and Amazon mogul Jeff Bezos have seen their personal fortunes drop significantly due to the crypto crash. Musk has lost 25.1 billion dollars due to the decline in the value of crypto and technology stocks, while Bezos is down about 20 billion US dollars. These are not losses of actual hard cash, but loss of their total assets value. Yet it is very huge loss that an ordinary person like us cannot even imagine, but it is not going to shake them.

On the positive note, experts say that early investors are still probably in a comfortable position despite the recent meltdown. But they say that it would have been especially hard for investors who bought cryptocurrencies when prices surged last year.

What is the impact on NFTs?

An article by Kanav Jain on ambcrypto.com published on 29h May 2022 says that the NFT market is among the first ones to take the huge brunt of the crypto crash. The crash in the NFT prices eventually led to a dramatic downturn in trading volumes. The NFT market was unable to carry the momentum earlier from the year and plummeted starting April 2022.

A weekly update by IntoTheBlock’s Head of research, Lucas Outumuro says, “Buying a BAYC NFT at floor price four weeks ago would have resulted in a loss of nearly a quarter of a million dollars. This coincides with a drop in Ether’s price, which is the main currency in which NFTs are traded. However, ETH is down “only” 30% in May, while most NFT collections have lost over half of their value”.

Kanav Jain’s article says that there was a drop in the social sentiment for NFTs with stark drops in prices and trading volumes. Similar to its trading volume, the Google Searches for NFTs have dropped by 75% since its peak in January.

When will the cryptos and NFTs rise again?

“How long crypto’s collapse might last is unclear. Cryptocurrency prices have typically rebounded from major losses, though in some cases it took several years to reach new heights”, say experts.

But I think Bitcoin is alreadt doing pretty okay with prices now above USD 30,000 per Bitcoin. Some experts feel that as long as the Bitcoin prices stay above the USD 20,000 mark, things will be pretty okay for the Cryptocurrency. Others also feel that the positive side of such meltdowns is that it weeds out cryptocurrencies without solid foundations (probably referring to TerraUSD Stablecoin that crashed).

On the NFT front, a report from Chainalysis says that the transactions since last summer have come in “fits and starts”. Two spikes in particular are responsible for driving the NFT activity. The first is the launch of the Mutant Ape Yacht Club during late-August. While, the second is the launch of a new NFT marketplace called LooksRare that shot up activity in January-February. Ethan McMahon, an economist for Chainalysis, said this indicates that the NFT market is starting to consolidate, with few companies holding a growing market share. “Things are changing,” he said. “[What] we have been seeing is consolidation in the more well-known blue chip collections of NFTs.”