Thukten Zangpo

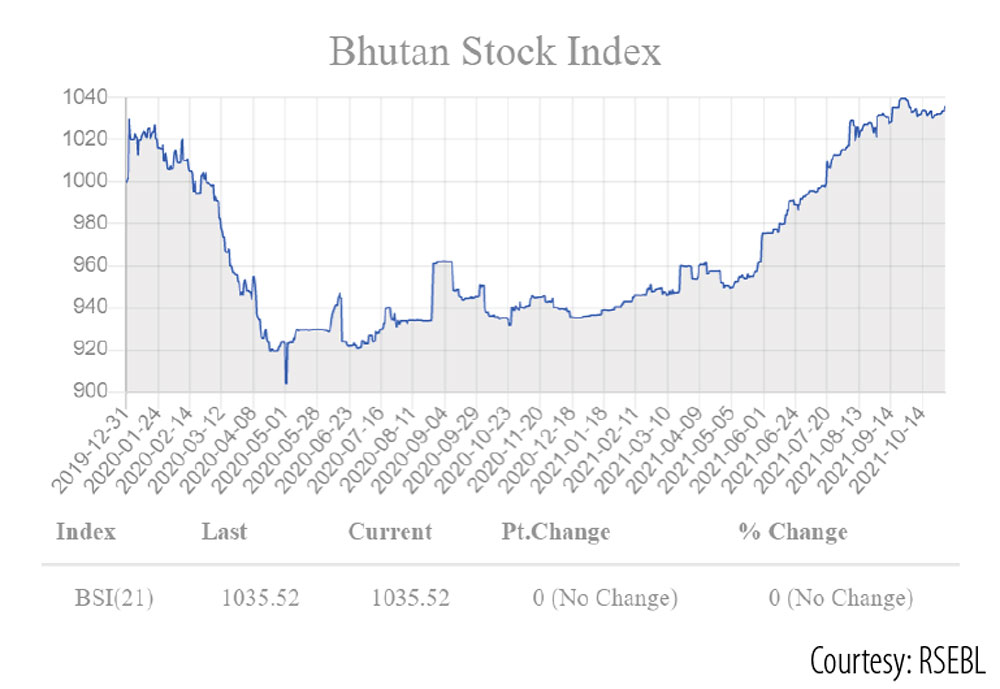

The price of shares listed with the Royal Securities Exchange of Bhutan’s (RSEBL) stock market saw a gain of 35 points as of yesterday, as measured by the Bhutan Stock Index (BSI) in the secondary market.

The BSI was recorded at 1,035.52. The BSI saw a fall from January of last year dipping to 904.17, falling to its lowest ever on May 4, and remained in that range for a year. It saw a gradual gain only beginning in May of this year.

The BSI measures the stock market’s performance and serves as benchmarks for investors measuring the performance of their own investment portfolio.

It was set at 1,000 as the baseline on December 31, 2019. Gains above or drops below the baseline indicate the price change.

Chief Executive Officer of RSEBL, Dorji Phuntsho, said the stock market reflects the sentiments of the investors. “The drop in BSI could be due to Covid-19, as people did not want to take risks,” he said.

The stock market is driven by investment avenues. “With the government’s interest waiver and loan deferment support, there was liquidity in the market and people invested in the stock market,” said a local economist on the gradual gain.

On April 22, the Royal Monetary Authority announced a 50 percent loan interest payment support kidu to grant from the National Resilience Fund to all eligible loan accounts who availed a loan prior to April 10, 2020, until June of next year.

Similarly, the government announced that all loans sanctioned as of June 30, 2020 would be eligible for deferment until June 2022.

An official from the policy division, RSEBL, Lhagyel, said that Bhutanese trade either by looking at the company’s performance or when they have money at hand to invest. He added that most of the companies’ share prices are in an upward trend.

Bhutan National Bank Limited and Royal Insurance Corporation of Bhutan Limited made up around 50 percent of the market shares and these two companies are currently dictating the BSI.

The market price of BNBL recorded Nu 34.35 per share as of yesterday compared to Nu 28 on April 23 of last year.

Similarly, RICBL’s Nu 70 per share on April 23 of last year was Nu 72.50 as of yesterday.

Also, Bhutan Insurance Limited was recorded at Nu 62 per share yesterday from Nu 39 in April 23 of last year, Bhutan Board Products Limited’s Nu 42 from Nu 17.03, Druk Wang Alloys Limited’s (DWAL) Nu 106 from Nu 84.55, and Tashi Bank Limited’s Nu 48.30 from Nu 37.

The market capitalization, which is the value of shares at the current market of 19 companies, was recorded at Nu 51.442 billion as of yesterday.

The sellers cannot sell the shares below or above five percent of the market price to avoid volatility. This practice is known as a circuit breaker in the stock trade.

For example, if the market price of a share is Nu 100, the allowable price range is between Nu 95 and Nu 105.

“Higher stock price volatility often means higher risk and it helps an investor to estimate the fluctuations that may happen in the future,” Lhagyel said.

The secondary market traded 4.22 million (M) shares worth Nu 217.96 million as of June 30 of this year.

Similarly, Nu 24.69M shares worth Nu 863.59M were traded in 2020 as compared to the total traded volume of 23.61M shares worth Nu 1.12B in the previous year, an increase of 4.57% in volume and a decrease of 23.29% in value. The secondary market is a platform where investors buy and sell securities they already own.

The share trading takes place five times a week in five working days. BNBL, RICBL, GIC-Bhutan Re-Limited, DWAL, and Sherza Ventures Limited are the top five most traded shares.

Edited by Tshering Palden