Trading volume decreased by 11.27 million shares last year

Thukten Zangpo

Despite share-trading in the secondary market dropping by over two-folds last year compared to the previous year, the market capitalisation (M-cap) saw an upward trend, indicating a rise in share prices.

According to the Royal Securities Exchange of Bhutan Limited (RSEBL), the market traded 19.35 million shares of 17 listed companies worth Nu 782.02 million as of December 2023. In the previous year, 30.62 million shares worth Nu 1.92 billion were traded in the secondary market.

This means the trading volume decreased by 11.27 million shares (36.81 percent) and Nu 1.14 billion in value (59.21 percent).

Despite the decrease in the trading volume, the M-cap-the total value of all listed companies-climbed by 11.81 percent to Nu 60.19 billion last year, from Nu 53.83 billion in the previous year.

M-Cap is the value of shares at the prevailing market price of the 18 companies listed with the RSEBL. It is derived by multiplying the number of existing shares by current market prices, meaning that an increase in either the number of the prices or stock will contribute to M-Cap.

With the number of shares remaining constant, it is attributed to the prices of shares moving up. This means more people prefer to buy stock (demand) to selling it (supply). This also suggests a growing interest in the market, even if trading activity is subdued.

The dynamic was also reflected in the Bhutan Stock Index (BSI), which increased to 1, 377.53 points as of December last year. This was a rise of 26.56 percent from previous year’s BSI of 1,088.41.

According to the RSEBL, the BSI hit a milestone last year, reaching its peak at 1,427 points, marking the highest point recorded, indicating a notable positive performance in the Bhutanese market.

This year, the highest BSI was recorded at 1,571.99 points on June 19, which dropped to 1,493.73 points as of yesterday.

BSI is a stock market performance index that investors can use to compare the performance of investors’ investment portfolio.

BSI was set at 1,000 as the baseline on December 31, 2019. Gains above or drops below the baseline indicate the price change.

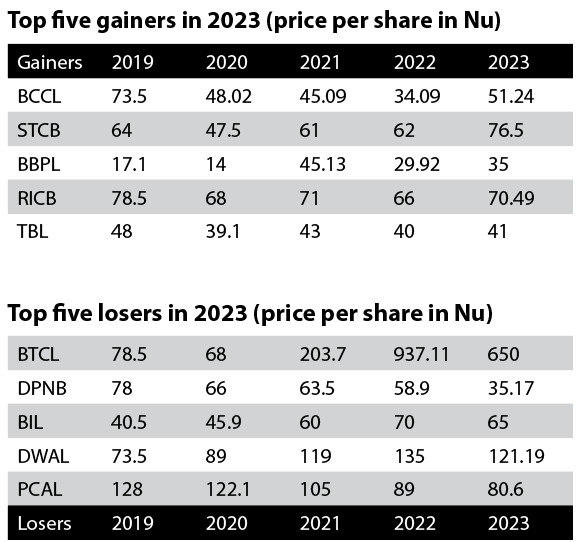

Some of the top gainers in 2023 were Bhutan Carbide and Chemicals Limited, whose share price rose to Nu 51.24 from Nu 34.09 per share.

At the same time, State Trading Corporation Limited (STCBL) and Bhutan Board Products Limited’s share price rose to Nu 76.5 from Nu 62 per share and Nu 35 from Nu 29.92 per share, respectively.

Bhutan Tourism Corporation Limited’s share prices saw the biggest drop, from Nu 937.11 in 2022 to Nu 650 last year, followed by Druk PNB and Bhutan Insurance Limited (BIL), with their share prices dropping to Nu 35.17 and Nu 65 respectively.

Last year, the number of shareholder accounts also increased from 100,422 to 100,572 compared to the previous year despite the de-listing of Druk Satair Corporation Limited from October 6 at the exit price of Nu 14.26 per share.

For the income year 2023, eight companies declared dividends. Bhutan Ferro Alloys Limited declared the highest dividend of 100 percent followed by Royal Insurance Corporation Limited with 35.24 percent. Druk Wang Alloys Limited declared 30 percent dividend while Bhutan Insurance Limited declared 21 percent dividend. Two companies – T-Bank Limited and STCBL declared a bonus share of 1:5 and 1:2 respectively.