…rising share trade is a sign of economy recovering

Thukten Zangpo

Share-trading in the secondary market increased by over two-folds last year with more than 30 million (M) shares of 18 listed companies being bought and sold by individuals and institutions.

The market traded shares worth Nu 1.92 billion (B) last year, more than two-fold increase from 2021 at Nu 708.9M. It saw an increase of Nu 1.21B, according to Royal Securities Exchange of Bhutan (RSEBL) figures.

Secondary market is a platform where investors buy and sell securities that they already own. Stocks are also sold in the primary market when the companies issue initial public offerings.

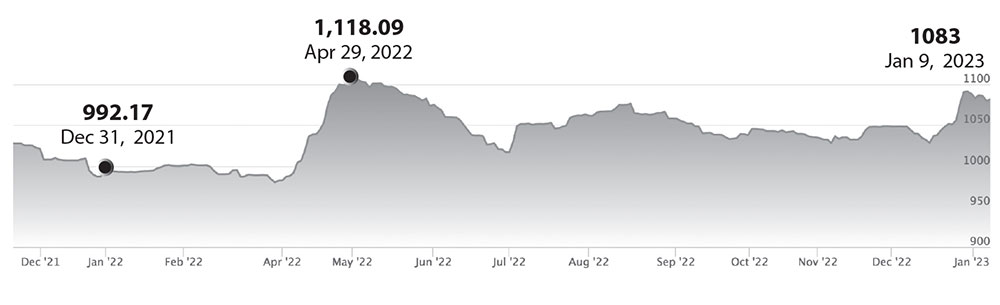

Bhutan Stock Index (BSI), as of December 30 last year, rose to 1,088.41. It was at 992.17 as of December 31 in 2021.

BSI is a stock market performance index that investors can use to compare the performance of investors’ investment portfolio.

BSI was set at 1,000 as the baseline on December 31, 2019. Gains above or drops below the baseline indicate the price change.

As of yesterday, the BSI had gained at 1,083, touching the market capitalisation (M-Cap) of Nu 53B. M-Cap rose by Nu 6B from Nu 47.01B in 2021.

M-Cap is the value of shares at the prevailing market price of 19 listed companies with RSEBL.

Multiplying the number of existing shares by the current market prices derives M-Cap—an increase in either the number of prices or the stock will raise M-Cap.

With the number of shares remaining constant, it is attributed to the prices of shares moving up. This means that more people want to buy a stock (demand) than sell it (supply).

According to RSEBL, the BSI reached a new high of 1,118.09 on April 29, 2022. “After a series of stock price drops in the secondary market beginning in November 2021, the stock price has been rising since March last year.”

An official from RSEBL said that the stock market reflects the sentiments of the investors and the prices of securities in the market depend on the behaviour of the investors.

People trade either by judging a company’s performance or when they have money to invest.

A rising stock market often indicates improving or more favourable economic conditions for companies, resulting in higher revenues and profitability.

The top trading company was Royal Insurance Corporation of Bhutan Limited with a trade volume of 22.45M shares last year. The highest price recorded was Nu 86 and lowest Nu 62.1 per share.

Bhutan National Bank Limited traded about 4.74M shares with the highest price of Nu 36.01 and the lowest price of Nu 29 per share.

Sherza Ventures Limited traded 844, 647 shares with the highest price of Nu 25.57 per share and lowest price of Nu 10.25.

GIC-Bhutan Re-insurance Limited traded 664, 883 shares at the highest price of Nu 34.64 and lowest of Nu 26.

The Bhutan Insurance Limited traded 542, 053 shares at Nu 81 high and price at Nu 56.1 low.

Share-trading takes place five times a week in five working days.