Total dividend contribution increased to Nu 213.16 million

Thukten Zangpo

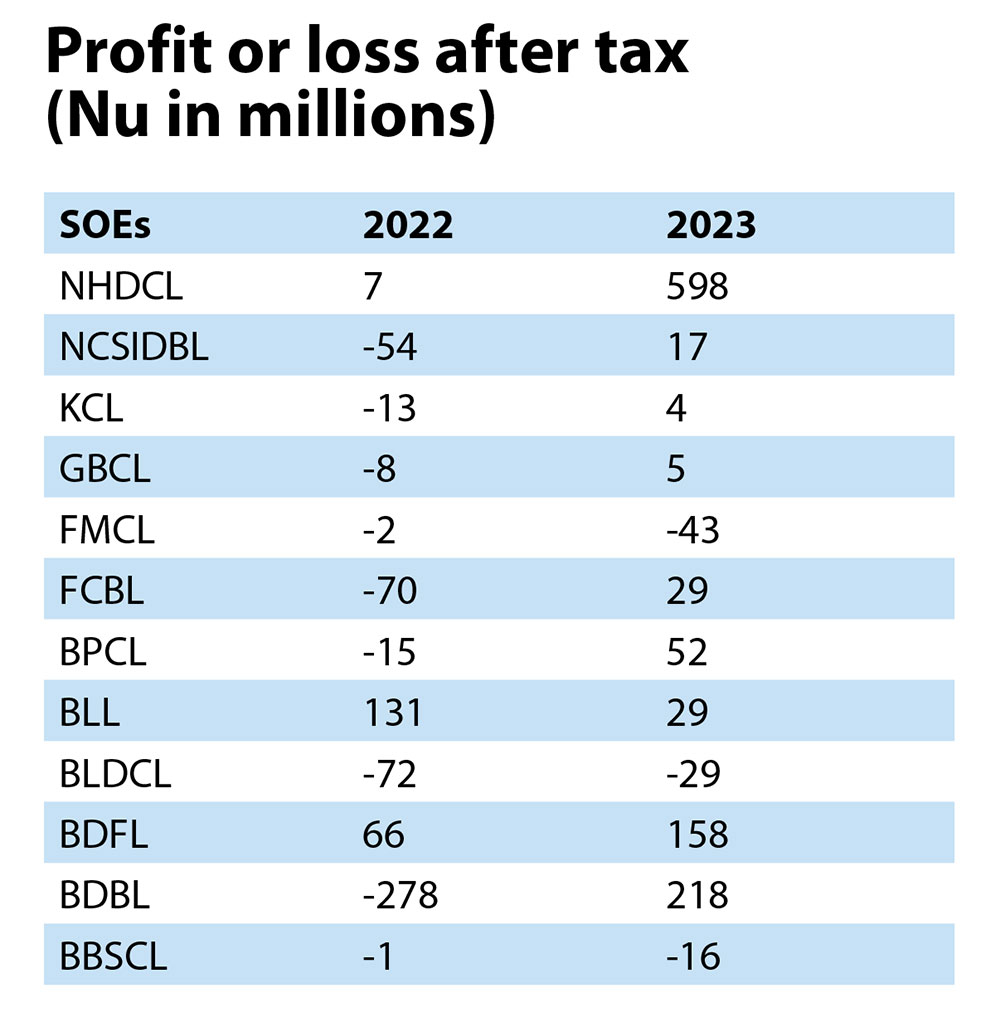

The financial performance of state-owned enterprises (SOEs) under the finance ministry significantly improved last year, with only three companies incurring losses compared to nine companies in the previous year.

This indicates that the SOEs had performed well despite the subsidy from the government declining over the years.

The dividend contribution from SOEs increased from Nu 153 million in 2022 to Nu 213.16 million in 2023, largely driven by the dividend contribution of Bhutan Development Bank Limited (BDBL).

The BDBL alone contributed Nu 151.88 million as dividend to the government last year.During the same period, the corporate income tax from SOEs increased from Nu 95.67 million to Nu 174.03 million.

Collectively, the SOEs recorded a net profit of Nu 1.09 billion, and contributed to Nu 387.19 million in form of tax and dividends.

The SOEs like Green Bhutan Corporation Limited (GBCL) recorded profit of Nu 5 million last year, up from Nu 8 million loss in the previous year.

The Food Corporation of Bhutan Limited also saw an improvement in its financials, bouncing back with Nu 29 million profit last year after incurring a huge loss of Nu 70 million in 2022.

The Bhutan Postal Corporation Limited significantly turned around its financial performance, recording Nu 52 million profit last year after incurring Nu 15 million loss in 2022.

The BDBL also made a profit of Nu 218 million, after incurring Nu 278 million loss in the previous year.

Similarly, Kuensel Corporation Limited also saw a modest improvement in its performance, registering a profit after tax of Nu 4 million last year, from Nu 13 million loss in the previous year.

Among the SOEs, the National Housing Development Corporation Limited’s profit was the highest with Nu 598 million last year from Nu 7 million in 2022.

The three SOEs that ran into losses are Farm Machinery Corporation Limited (FMCL), Bhutan Livestock Development Corporation Limited (BLDCL), and Bhutan Broadcasting Service Corporation Limited (BBSCL).

The losses of all these three SOEs significantly jumped last year. The FMCL’s loss after tax increased to Nu 43 million last year, up from Nu 2 million in 2022 while the BLDCL recorded a loss of Nu 29 million last year, down from Nu 72 million in 2022. The BBSCL recorded a loss of Nu 16 million, up from Nu 1 million in 2022.

The National Cottage and Small Industry Development Bank Limited (NCSIDBL) were merged with the BDBL last year. This was done to enhance efficiency, reduce duplication, and strengthen the financing capacity of the bank.

The NCSIDBL, after seeing a loss of Nu 54 million in 2022, recorded a profit of Nu 17 million last year.

Over the years, the subsidy from the government to SOEs has been decreasing Figures speak for itself.

The government provided a subsidy of Nu 2.28 billion in fiscal year 2019-20 and Nu 2.14 billion in fiscal year 2021-22 to the SoEs. The subsidy amount decreased to Nu 1.11 billion in fiscal year 2022-23, which represents 52.8 percent drop compared to previous fiscal year.

This was largely attributed to the reduction of operational subsidies to BPCL, FCBL, BBSCL, NCSIDBL, and FMCL.

However, the BBSCL, BLDCL, and FMCL received operational subsidy for pay increment, as these companies were not able to absorb the additional impact of the pay revisions.

The finance ministry’s rationalised subsidies to the SoEs for the fiscal year 2023-2024 amount to Nu 836.7 million.

For the fiscal year 2023-24, the BBSCL was estimated to receive a subsidy of Nu 212.84 million from Nu 127.49 million in the previous year.

BLDCL was expected to receive an estimated subsidy of Nu 8.43 million in the last fiscal year.

The FMCL’s subsidy was recorded at Nu 19.81 million in the fiscal year 2023-24.

The government is reducing subsidy support to SOEs in a phased approach, reiterating the need for these companies to be financially viable and sustainable.

As of December 2023, the combined net asset of SOEs stood at Nu 9.18 billion, an increase of 5.9 percent as compared to the previous year.