Salaries of Nu 25,000 or below need not pay PIT

MB Subba

The overhauling of the tax system, which has been at the heart of the government’s economic reform policies, has come into effect retrospectively from January 16.

This means the government will refund the excess payments and deductions to tax payers as per the Income Tax (Amendment) Act 2020 from the date the Bill was introduced in Parliament.

For instance, those who have sold their land or buildings on or after January 16, 2020 are now eligible for refund of 2 percent of the sales value. This is because the property transfer tax has been reduced from 5 percent to 3 percent.

Similarly, the vehicle ownership transfer tax has been reduced to 1 percent from 5 percent. The excess payment on the ownership transfer since January 16 will also be refunded.

The government is hoping that the reduction in vehicle transfer tax will encourage more people to change ownership.

The ministry recently issued notifications on the implementation of the amended provisions of tax Act.

om Pg 1

“The ministry will frame rules to implement the Act in June,” said Finance Minister Namgay Tshering.

The amendment in the Income Tax Act also exempts the pension income from PIT and will be applicable retrospectively from the income year 2020. This means that PIT deductions from pensioners, if any, will be refunded from January.

The other reforms include doing away with the 5 percent voucher tax and increasing the personal income tax (PIT) slab from Nu 200,000 to Nu 300,000, which were among the government’s popular promises.

While the voucher tax removal will apply retrospectively from January 16, the changes in PIT will be applicable from the income year 2020. The 5 percent voucher tax and the excess PIT deduction are also refundable, as per the new Act.

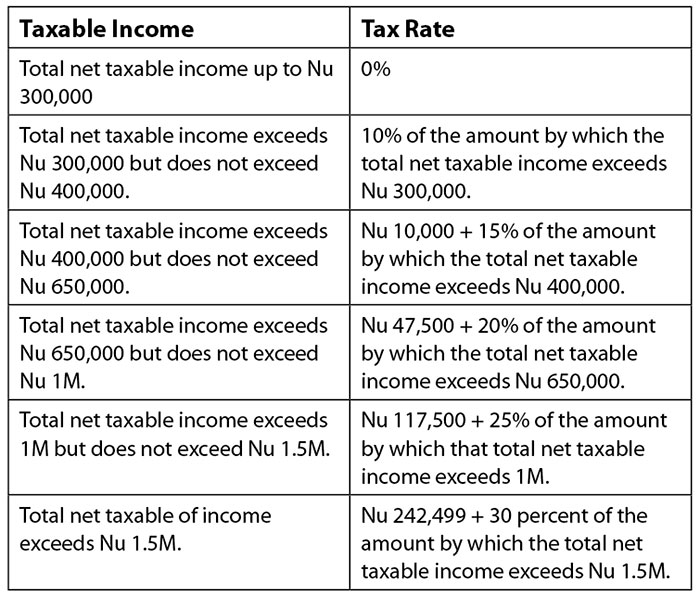

With the new tax Act coming into effect, the PIT ranges from 10 percent on the lowest taxable income to 30 percent on highest taxable income bracket, which is Nu 1.5M and above.

A person earning a monthly income of Nu 25,000 need not pay PIT. As per the revised tax deducted at source (TDS) schedule, the lowest TDS is Nu 10 if the income ranges between Nu 25,000 to 25,100.

The Income Tax (Amendment) Act 2020 has enhanced the allowable deduction for education expenses per child to Nu 350,000. Education expenses are applicable to biological children and those legally adopted or sponsored.

In the absence of supporting documents, the allowable deductions for education expenses shall be Nu 20,000.

If the annual PIT is equal or more than Nu 1 million (M), a surcharge at the rate of 10 percent will be applicable on PIT. The surcharge refers to an additional tax levied on tax payable or paid for an income year.

According to the government, there are about 61,000 registered PIT payers in the country, but only about 43,000 actually filed their PIT last year. With the change in the PIT slab, the number of PIT payers is expected to reduce.

The Corporate Income Taxes (CIT) has been reduced from 30 percent to 25 percent on state-owned corporations.

There are 38 state-owned corporations, of which 19 are held directly by the ministry of finance and as many through the Druk Holding and Investments (DHI).

In 2017, SoEs generated gross revenue of Nu 54,611M, which was 30 percent of GDP and profit after tax of Nu 17,752M.

The cost and benefits of tax reforms

The reduction in tax rates and exemptions have come at a time when the domestic revenue has been hit by the Covid-19.

The government estimated that the overall losses in taxes through the reductions were estimated at Nu 850 million (M) annually. However, it hopes that the amount of taxes and levies that will be collected with the reforms would be much higher than the revenue forgone.

Doing away with the 5 percent voucher tax alone will cost about Nu 190M, according to government’s estimates. The change in the PIT slab is expected to cost Nu 230 to Nu 240M.

The government is expected to lose another Nu 300 to Nu 330M annually through the CIT reduction for state-owned enterprises.

With the fiscal incentives (Amendment) Act 2020 coming into effect, the income tax exemption to small and micro-businesses in rural areas has been extended to 2024. The exemption applies from the income year 2019.

Post Covid-19, Prime Minister Dr Lotay Tshering had said the overall changes in the tax system are aimed at actually increasing the country’s revenue-generating capacity.

The government has already started to levy a 20 percent tax on lottery prizes of Nu 5,000 and more. The lottery tax shall be deducted at source and treated as the final tax.

The government had said that it hoped to collect additional revenue of up to Nu 23M through surcharges and Nu 20M to Nu 25M through taxes on windfall gains on the lottery.

The government had expected the revenue to increase by about 70 to 80 percent and recoup about Nu 850M to Nu 860M from new levies and taxes such as tourism sustainable development fee (SDF).

Post Covid-19, however, the coronavirus pandemic is expected to dig a huge hole in the government’s revenue. The Tourism Council of Bhutan, for instance, is expected to receive tourists only from January next year.