Thukten Zangpo

The finance ministry has projected the country’s tax revenue to grow by 40 percent in the current fiscal year, 2023-24, from fiscal year 2021-22.

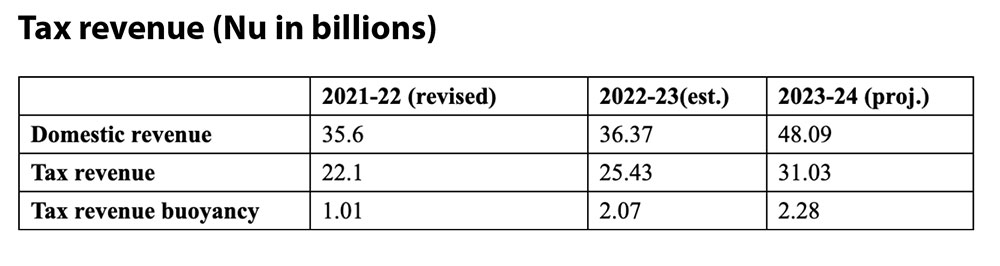

Tax revenue, according to the budget report 2022-23, will grow to Nu 31.03 billion in this fiscal year from Nu 22.1 billion in the previous fiscal year with anticipated improvement in economic conditions. The tax revenue was estimated at Nu 25.43 billion in the last fiscal year 2022-23.

The tax revenue from the land and building tax revision under the Property Tax Act of Bhutan 2022 will churn out millions in the government’s revenue.

The Parliament passed a 0.1 percent tax on the taxable value of land and buildings in the winter session last year.

Suppose a 24-decimal land in E4 (Babesa, Simtokha, Lubding, and Pamtsho) in Thimphu, which was earlier taxed at Nu 2, 623 annually, has to pay Nu 12, 156 annually from this year onwards. This is an increase of 363 percent.

Similarly, a 10 decimal land located in Norzin lam, which falls under the core sub-precinct 1A in Thimphu, will see the tax increase from Nu 1,452 annually to Nu 26, 540, an increase of over 1,500 percent.

Earlier, the commercial land tax rate in Thimphu and Phuentsholing was Nu 217.5 per decimal and residential land tax rate was Nu 108.75 per decimal.

Similarly, a building owner of 10 flats in Olakha, Thimphu, will have to pay Nu 18,000 annually as building tax from this year onwards compared to Nu 1,000 earlier.

Previously, Nu 12 per acre or Nu 0.12 per decimal was taxed for dry land in rural areas, and Nu 24 per acre or Nu 0.24 per decimal for wetland. From this year onwards, a class A Kamzhing land in Paro will have to pay Nu 2,988 per acre or Nu 29.88 per decimal as land tax, Nu 1,318 per acre or Nu 13.18 per decimal in Mongar and Nu 624 per acre or Nu 6.24 per decimal in Gasa.

From this year onwards, a 15 percent vacant land surcharge tax on the amount of land tax for 10 thromdes will also be applied. For example, 13 decimal vacant land in UV medium in Babesa will be taxed Nu 7,000 annually.

Domestic revenue is expected to increase from Nu 36.37 billion to Nu 48.09 billion in fiscal year 2023-24. This was on account of increased domestic demand, government spending and anticipated commissioning of Punatshangchhu-II.

This will improve the country’s domestic revenue buoyancy from 0.8 to 3.34 in the same period. Tax revenue buoyancy was estimated at 1.01, 2.07 and 2.28 in fiscal year 2021-22, 2022-23, and 2023-24 respectively.

Tax buoyancy is an indicator to measure the efficiency of tax revenue mobilisation in response to economic growth.

A percent change in gross domestic product (GDP) should translate to one percent change in domestic revenue.

If it is greater than 1, it indicates a more than proportionate response of the revenue to rise in GDP and if it is less than 1, it shows a less than proportionate response of the revenue to growth in GDP.

In the 2021-22 fiscal year, tax revenue grew by 25 percent to Nu 25.84 billion compared to the previous year. It contributed to 13.4 percent of GDP.

The government estimated foregone tax revenue of Nu 3.31 billion in fiscal year 2021-22 because of implementation of fiscal incentives. The incentive was provided to promote the growth and enhance economic opportunities, livelihood and employment opportunities in rural areas.

Similarly, in the 2020-21 fiscal year, the ratio was 11.7 percent or Nu 20.66 billion. This was mainly because of decrease in collection from corporate income tax, business income tax, and personal income tax, sales tax, excise duty and green tax.

The government estimated a foregone tax revenue of Nu 5.01 billion in the income year 2020. The report stated that 10,732 business entities were exempted from tax or were under tax holiday.

The tax foregone on customs duty, sales tax, and green tax is Nu 2.86 billion, Nu 2.08 billion and Nu 7.75 billion respectively.

According to the Fiscal Incentives (amendment) Act of Bhutan 2020, business income tax exemption for the small and micro-businesses located in the rural areas has been extended till the year 2024.

It was also on the account of refund on payment of taxes and duties for purchase of public transport, exemptions on import of plant and machinery and raw materials to manufacturing sector and exemption on cement.

However, the World Bank emphasizes a tax-to-GDP ratio of 15 percent and countries below this level must strive to enhance their revenue generation in order to meet the essential needs of citizens and businesses.

The budget report stated that the narrow tax base continues to remain a challenge with rising fiscal deficit and increasing developmental activities.